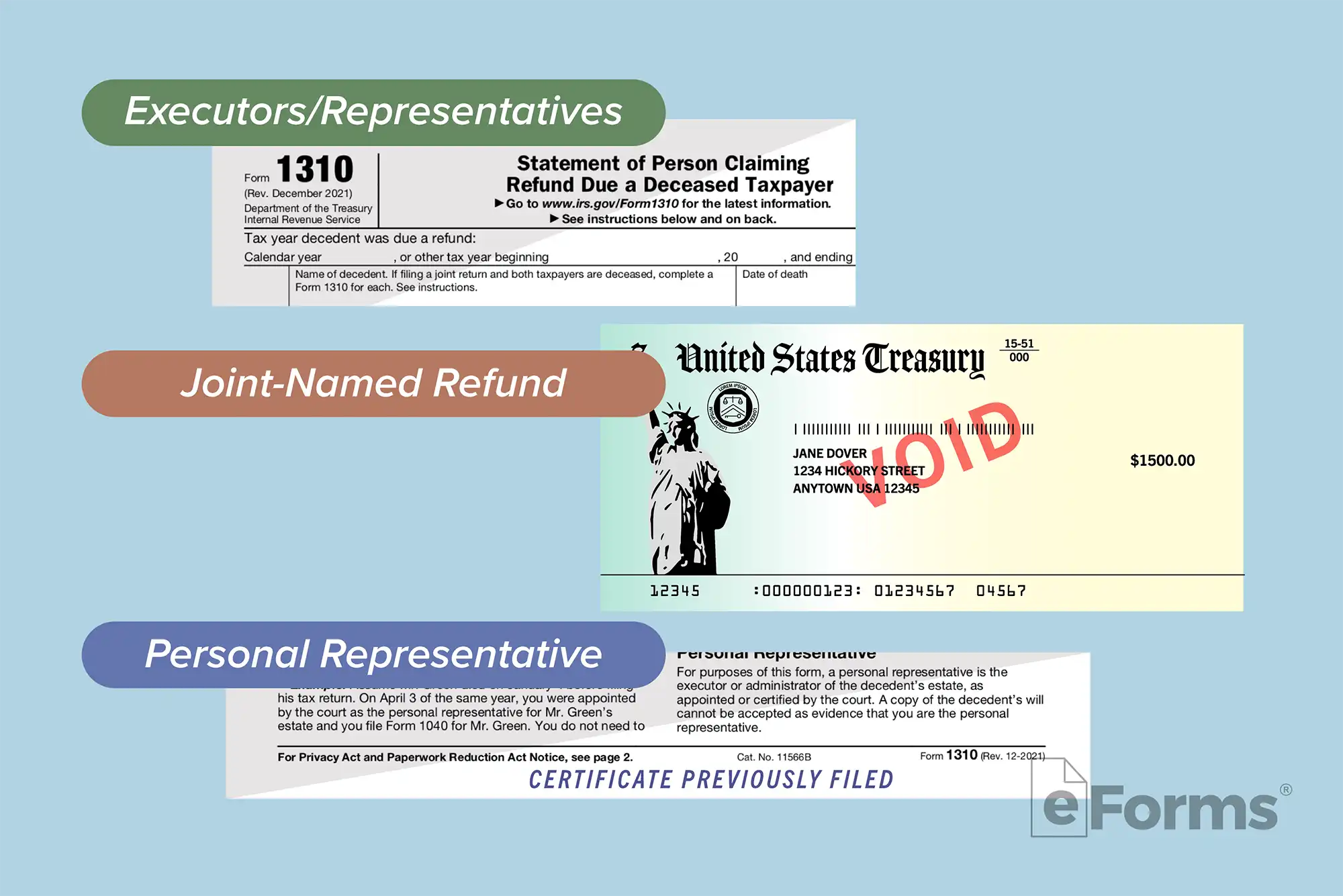

Who Files Form 1310

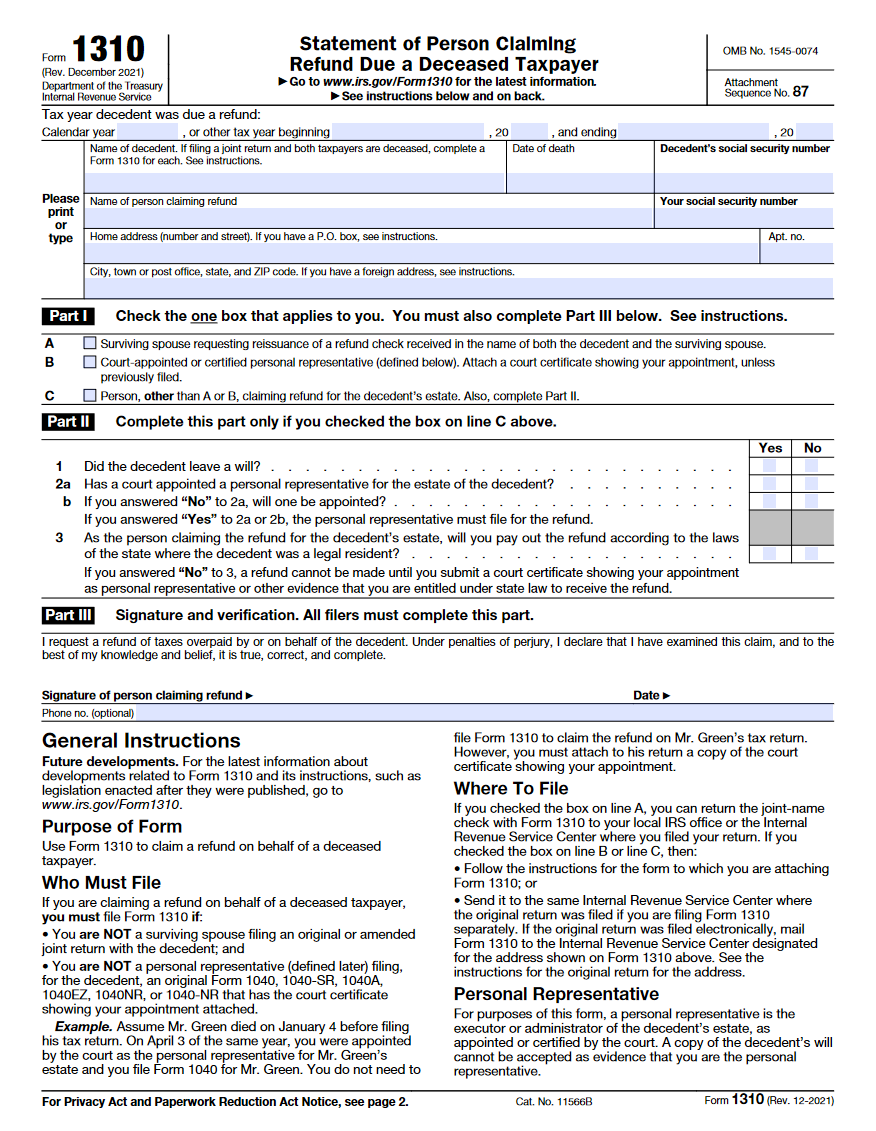

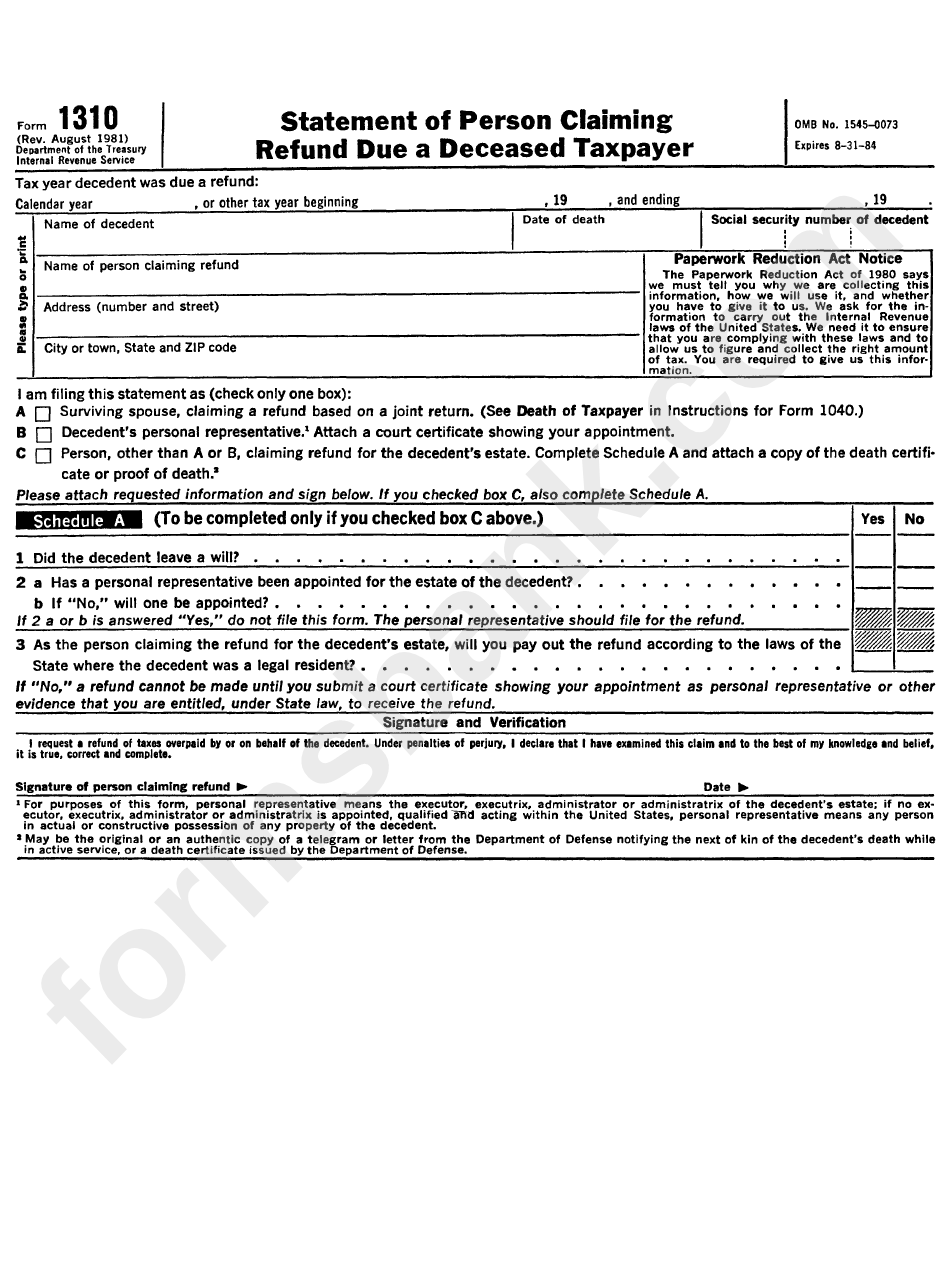

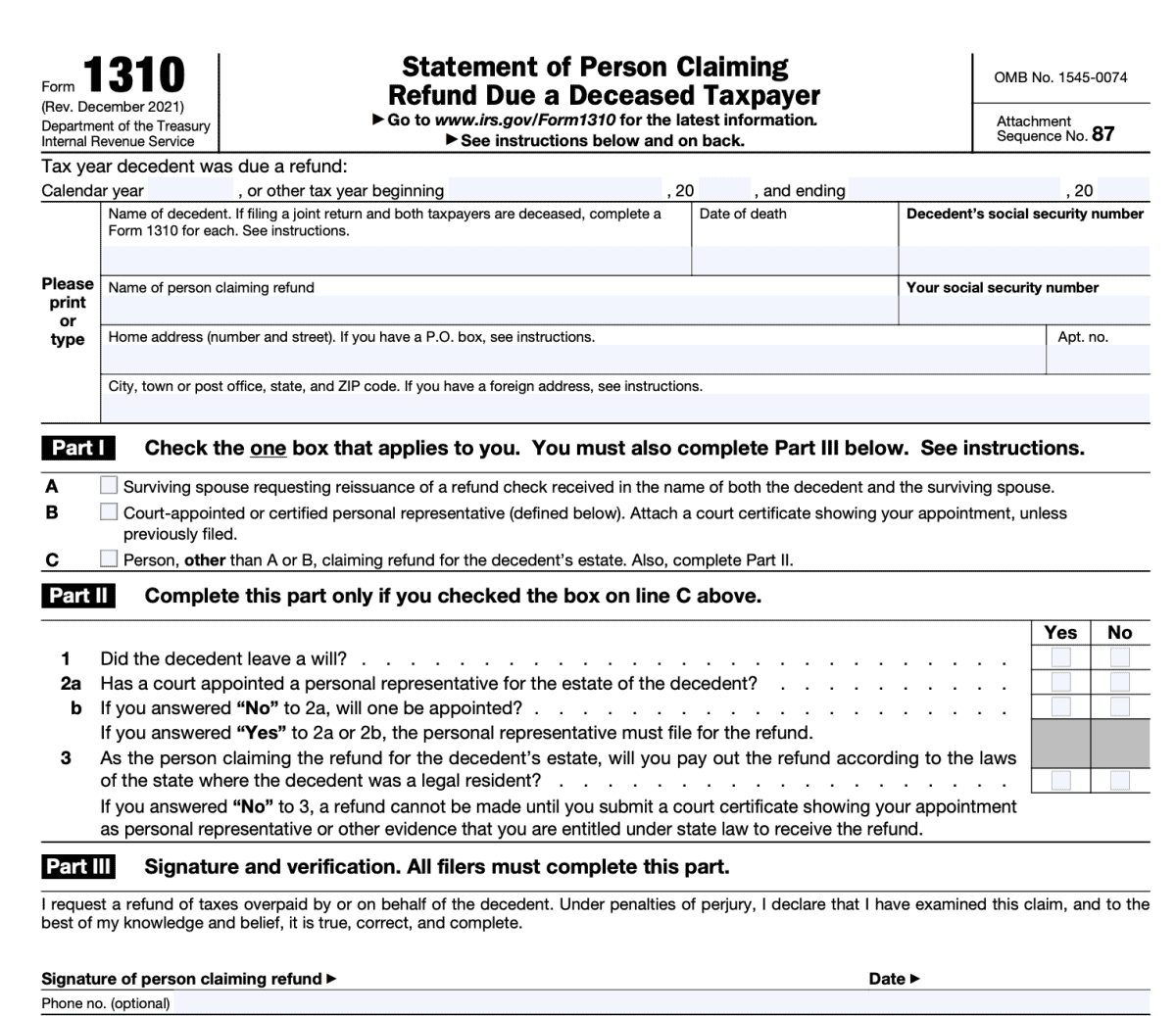

Who Files Form 1310 - You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,.

You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. When a taxpayer dies, the taxpayer’s personal. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

When a taxpayer dies, the taxpayer’s personal. Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,.

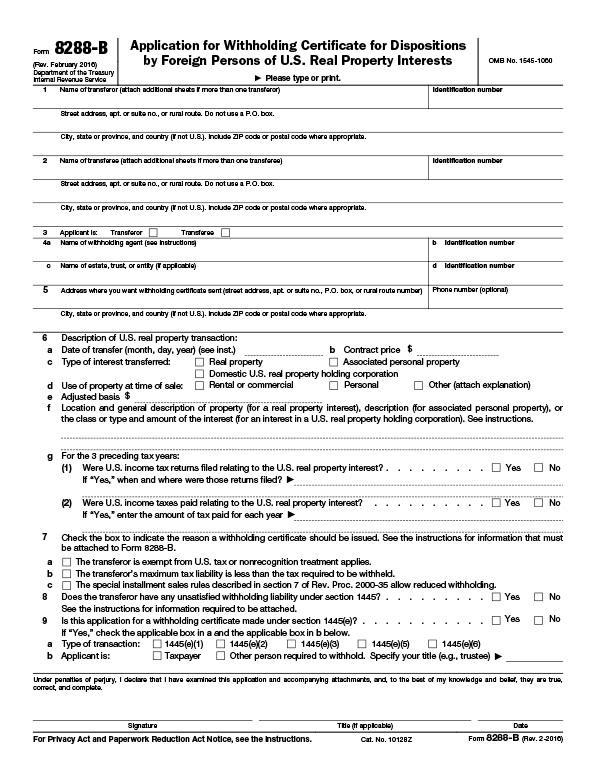

The Foreign Investment in Real Property Tax Act (FIRPTA)

Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed to claim a refund on behalf of.

Free IRS Form 1310 PDF eForms

Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. When a taxpayer dies, the taxpayer’s personal. Use form 1310.

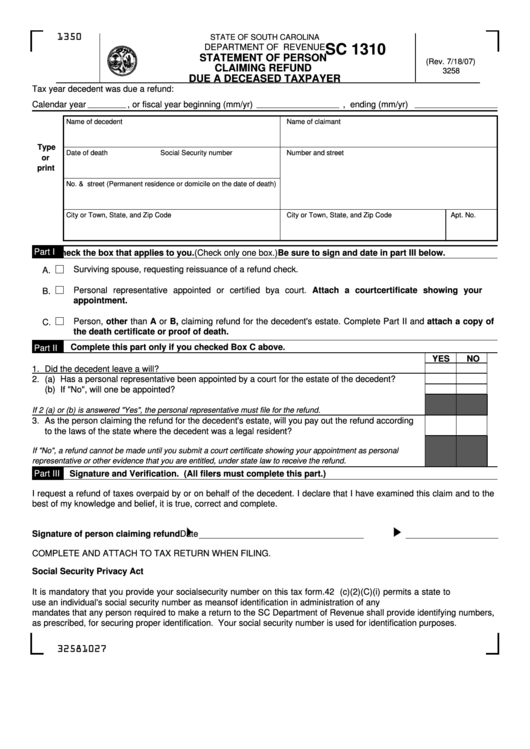

Form Sc 1310 Statement Of Person Claiming Refund Due A Deceased

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in.

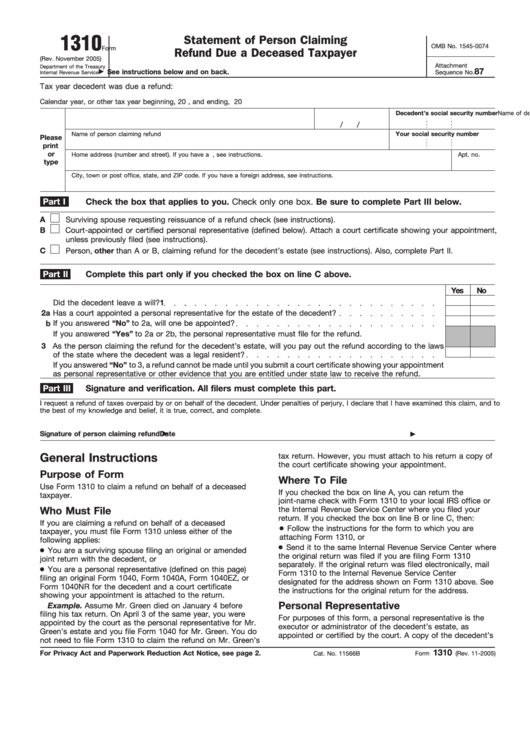

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You must file form 1310 if the description in line a, line b, or line c on the form. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. Use form 1310.

IRS Form 1310. Statement of Person Claiming Refund Due a Deceased

Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You must file form 1310 if the description in.

Irs Form 1310 Printable Printable Forms Free Online

Use form 1310 to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed.

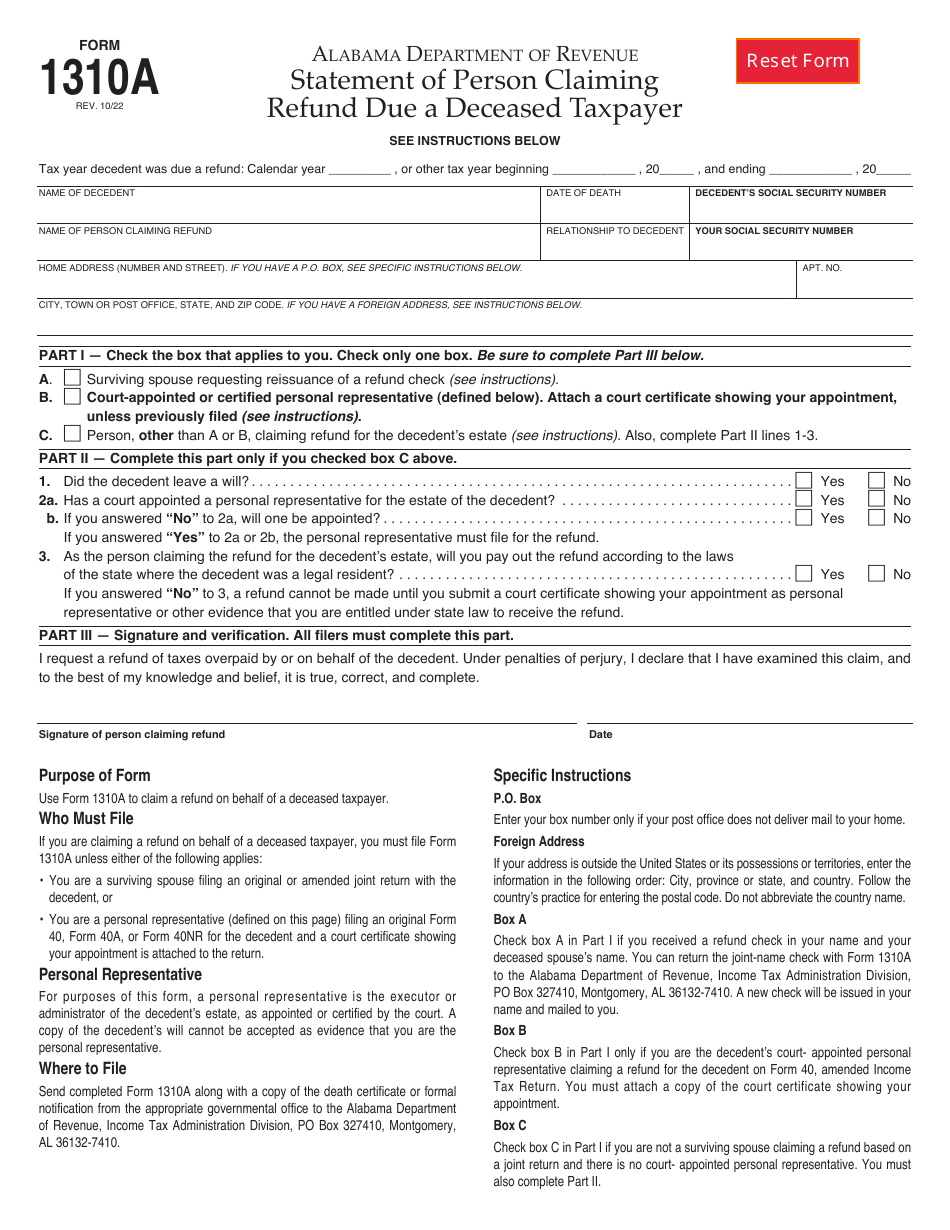

Form 1310A Fill Out, Sign Online and Download Fillable PDF, Alabama

Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. Information about form 1310, statement of.

Fillable Form R 1310 Certificate Of Sales Tax Exemption Exclusion For

Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed to claim a refund on behalf of.

Irs Form 1310 Printable

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c.

Irs 1310 Fill out & sign online DocHub

When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Irs form 1310 is filed.

Irs Form 1310 Is Filed To Claim A Refund On Behalf Of A Deceased Taxpayer.

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. When a taxpayer dies, the taxpayer’s personal.