Where Do I Send Form 843

Where Do I Send Form 843 - A refund of tax, other than a tax for which a different form must be used. According to this irs webpage, california residents should mail returns without payments to: Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. This includes most forms 843. Use form 843 to claim or request the following. Page provides taxpayers and tax professionals the mailing address for submitting form 843 Where do i mail form 843? Mail the form to the address indicted in the instructions.

Use form 843 to claim or request the following. This includes most forms 843. A refund of tax, other than a tax for which a different form must be used. Mail the form to the address indicted in the instructions. Page provides taxpayers and tax professionals the mailing address for submitting form 843 Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Where do i mail form 843? According to this irs webpage, california residents should mail returns without payments to:

Mail the form to the address indicted in the instructions. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. A refund of tax, other than a tax for which a different form must be used. This includes most forms 843. According to this irs webpage, california residents should mail returns without payments to: Where do i mail form 843? Page provides taxpayers and tax professionals the mailing address for submitting form 843 Use form 843 to claim or request the following.

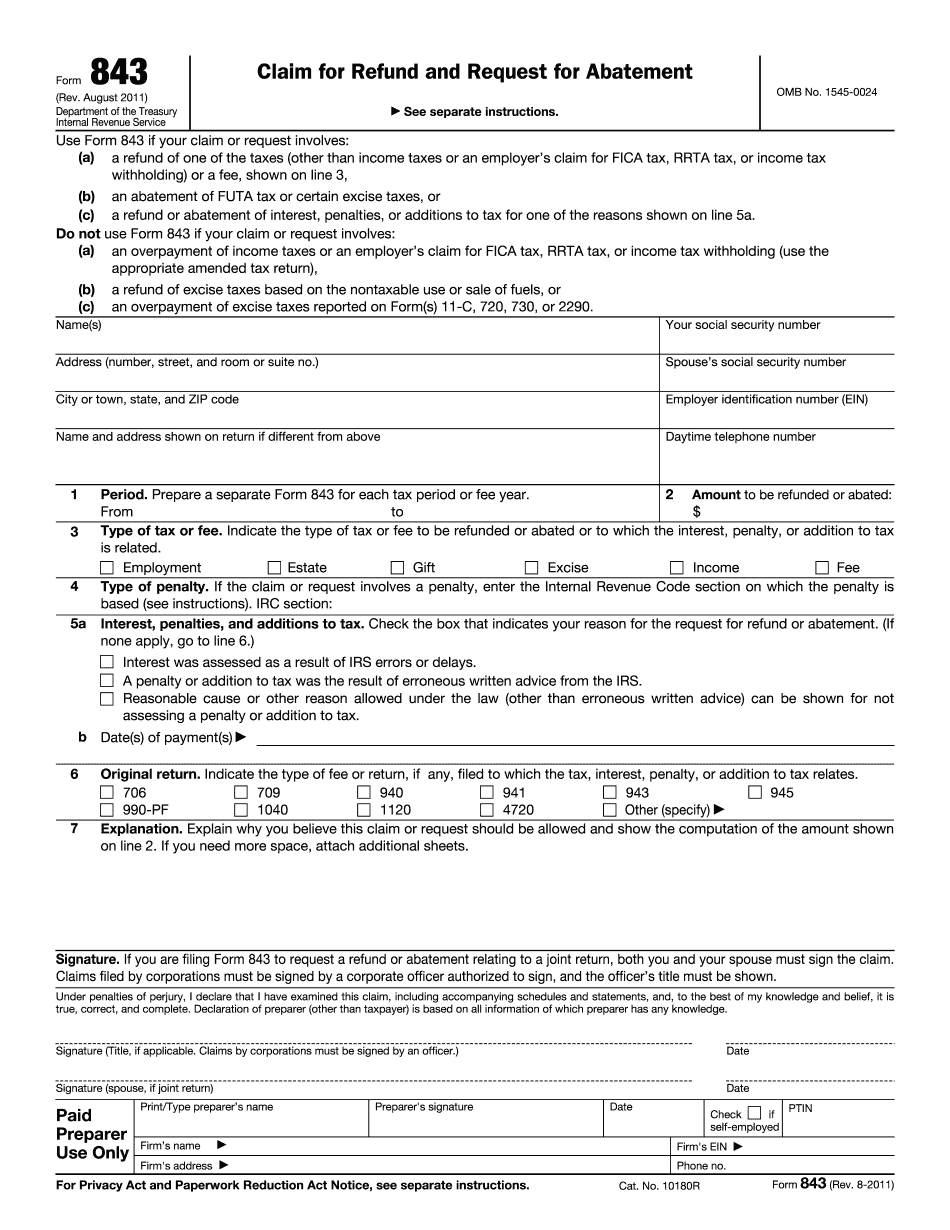

Form 843 IRS Penalty Abatement Form Request Wiztax

Use form 843 to claim or request the following. Page provides taxpayers and tax professionals the mailing address for submitting form 843 Where do i mail form 843? This includes most forms 843. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to.

Where To File Form 843?

Page provides taxpayers and tax professionals the mailing address for submitting form 843 According to this irs webpage, california residents should mail returns without payments to: Mail the form to the address indicted in the instructions. Where do i mail form 843? Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions.

IRS Form 843 Instructions

A refund of tax, other than a tax for which a different form must be used. According to this irs webpage, california residents should mail returns without payments to: Use form 843 to claim or request the following. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Mail.

Manage Documents Using Our Editable Form For IRS Form 843

According to this irs webpage, california residents should mail returns without payments to: This includes most forms 843. A refund of tax, other than a tax for which a different form must be used. Where do i mail form 843? Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how.

IRS Form 843. Claim for Refund and Request for Abatement Forms Docs

Where do i mail form 843? Mail the form to the address indicted in the instructions. This includes most forms 843. A refund of tax, other than a tax for which a different form must be used. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to.

I have “his masters voice gramaphone”since whats its value do you know

Mail the form to the address indicted in the instructions. Page provides taxpayers and tax professionals the mailing address for submitting form 843 According to this irs webpage, california residents should mail returns without payments to: Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. A refund of.

Do send in your enquiries and requests via email

Use form 843 to claim or request the following. This includes most forms 843. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Where do i mail form 843? According to this irs webpage, california residents should mail returns without payments to:

Form 843 Request for Penalty Abatement YouTube

This includes most forms 843. Mail the form to the address indicted in the instructions. Page provides taxpayers and tax professionals the mailing address for submitting form 843 Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Where do i mail form 843?

Where To Mail Form 843 To The IRS?

A refund of tax, other than a tax for which a different form must be used. Use form 843 to claim or request the following. Where do i mail form 843? Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. This includes most forms 843.

DD Form 843 Requisition For

Use form 843 to claim or request the following. A refund of tax, other than a tax for which a different form must be used. Page provides taxpayers and tax professionals the mailing address for submitting form 843 This includes most forms 843. According to this irs webpage, california residents should mail returns without payments to:

Page Provides Taxpayers And Tax Professionals The Mailing Address For Submitting Form 843

Where do i mail form 843? Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. A refund of tax, other than a tax for which a different form must be used. This includes most forms 843.

Mail The Form To The Address Indicted In The Instructions.

Use form 843 to claim or request the following. According to this irs webpage, california residents should mail returns without payments to: