Wealthfront Tax Forms

Wealthfront Tax Forms - Our support team has your back. For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. We’ve partnered with green dot bank, member fdic, to bring you. For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. If you’re a wealthfront client and you earned more than $10 of interest (or $600 in awards) during the previous year, we’ll send. You can just access your account and click your profile | documents. What is a series 480 tax form? Wealthfront will send you a form to report your interest.

We’ve partnered with green dot bank, member fdic, to bring you. Wealthfront will send you a form to report your interest. For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. You can just access your account and click your profile | documents. For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. If you’re a wealthfront client and you earned more than $10 of interest (or $600 in awards) during the previous year, we’ll send. Our support team has your back. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. What is a series 480 tax form?

What is a series 480 tax form? For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. Wealthfront will send you a form to report your interest. Our support team has your back. You can just access your account and click your profile | documents. If you’re a wealthfront client and you earned more than $10 of interest (or $600 in awards) during the previous year, we’ll send. For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. We’ve partnered with green dot bank, member fdic, to bring you.

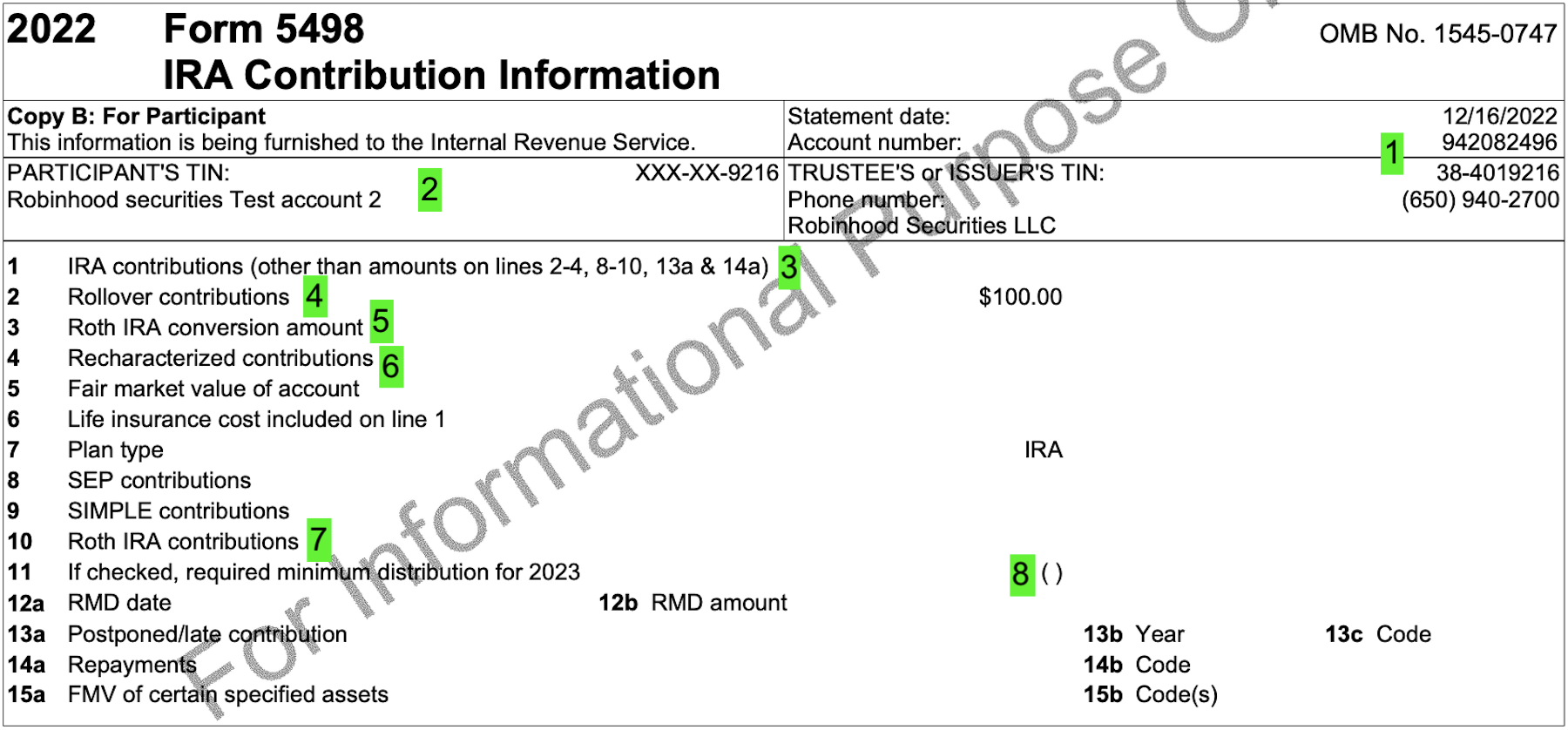

5498 Tax Forms for IRA Contributions, Participant Copy B

You can just access your account and click your profile | documents. What is a series 480 tax form? For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. We’ve partnered with green dot bank, member fdic, to bring you. For individual, joint, and.

Wealthfront Review

For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. You can just access your account and click your profile | documents. What is a series 480 tax form? For cash accounts that generated more than $10 of interest or received $600 or more.

Wealthfront Eliminates 100k Minimum For TaxLoss Harvesting Wealth

For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. Wealthfront will send you a form to report your interest. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest.

Beginner's guide to filing tax in Canada MoneyTalk

What is a series 480 tax form? For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. You can just access your account and click your profile | documents. Wealthfront will send you a form to report your interest. If you’re a wealthfront client and you earned more than $10 of interest.

Wealthfront TaxLoss Harvesting Explained Is It Worth It? YouTube

Our support team has your back. For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. Wealthfront will send you a form to report your interest. We’ve partnered with green dot bank, member fdic, to bring you. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if.

Top 9 Reviews and Complaints about Wealthfront

Wealthfront will send you a form to report your interest. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. If you’re a wealthfront client and you earned more than $10 of interest (or $600 in awards) during the previous year, we’ll send. We’ve.

How to read your 1099R and 5498 Robinhood

What is a series 480 tax form? Our support team has your back. We’ve partnered with green dot bank, member fdic, to bring you. For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. For individual, joint, and trust automated and stock investing accounts,.

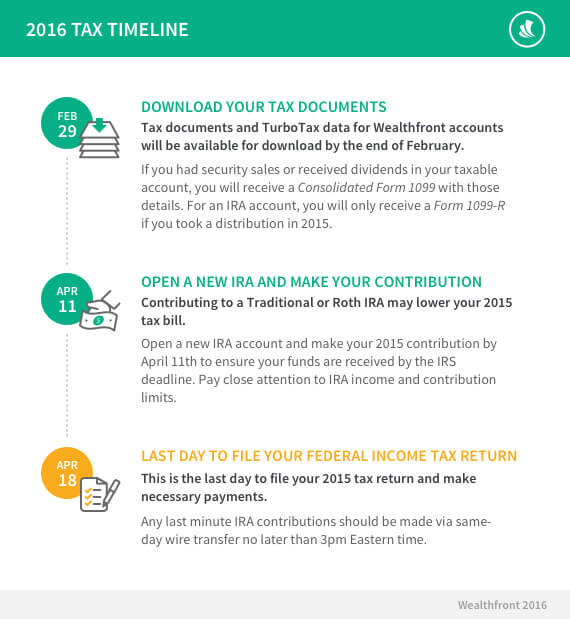

Wealthfront's TurboTax Integration Makes Tax Time Easy

If you’re a wealthfront client and you earned more than $10 of interest (or $600 in awards) during the previous year, we’ll send. Wealthfront will send you a form to report your interest. Our support team has your back. For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. We’ve partnered with.

How to Read Your Brokerage 1099 Form YouTube

Our support team has your back. If you’re a wealthfront client and you earned more than $10 of interest (or $600 in awards) during the previous year, we’ll send. Wealthfront will send you a form to report your interest. For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. We’ve partnered with.

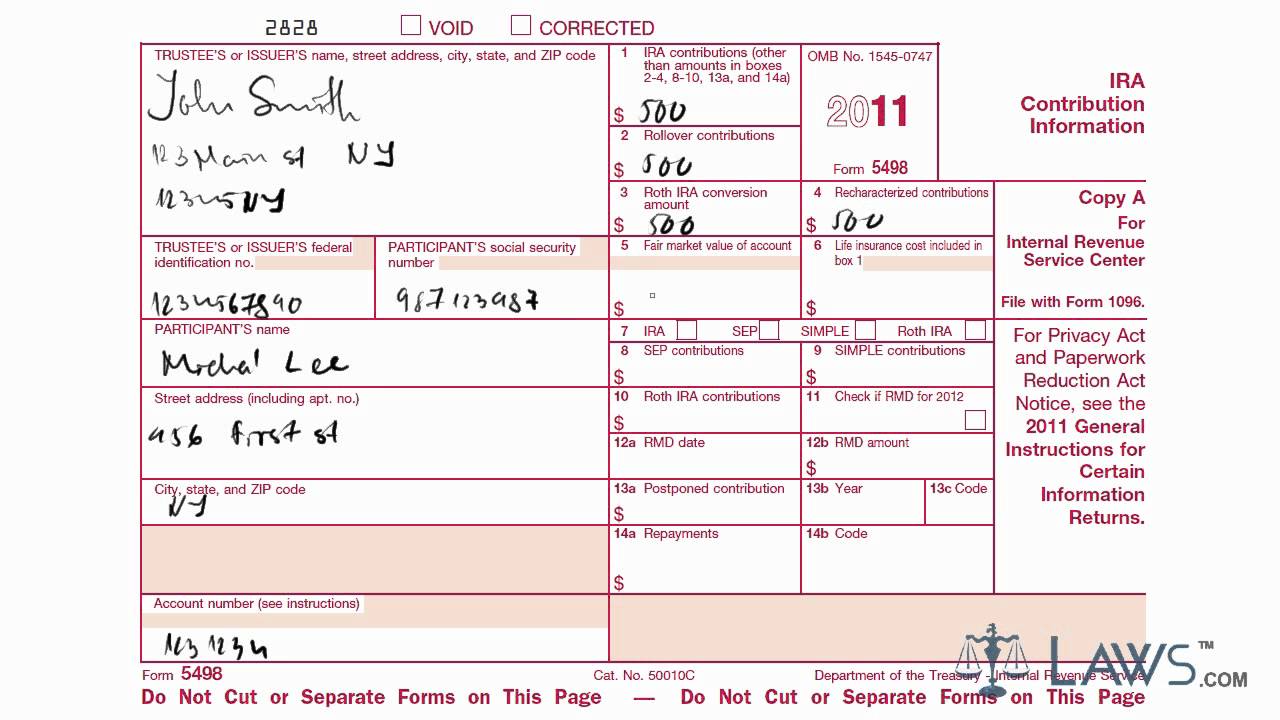

Learn How to Fill the Form 5498 Individual Retirement Account

For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. You can just access your account and click your profile | documents. What is a series 480 tax form? Wealthfront will send you a form to report your interest. If you’re a wealthfront client.

For Individual, Joint, And Trust Automated And Stock Investing Accounts, You Will Receive A Consolidated Form 1099 Including.

You can just access your account and click your profile | documents. We’ve partnered with green dot bank, member fdic, to bring you. What is a series 480 tax form? Our support team has your back.

If You’re A Wealthfront Client And You Earned More Than $10 Of Interest (Or $600 In Awards) During The Previous Year, We’ll Send.

For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. Wealthfront will send you a form to report your interest.