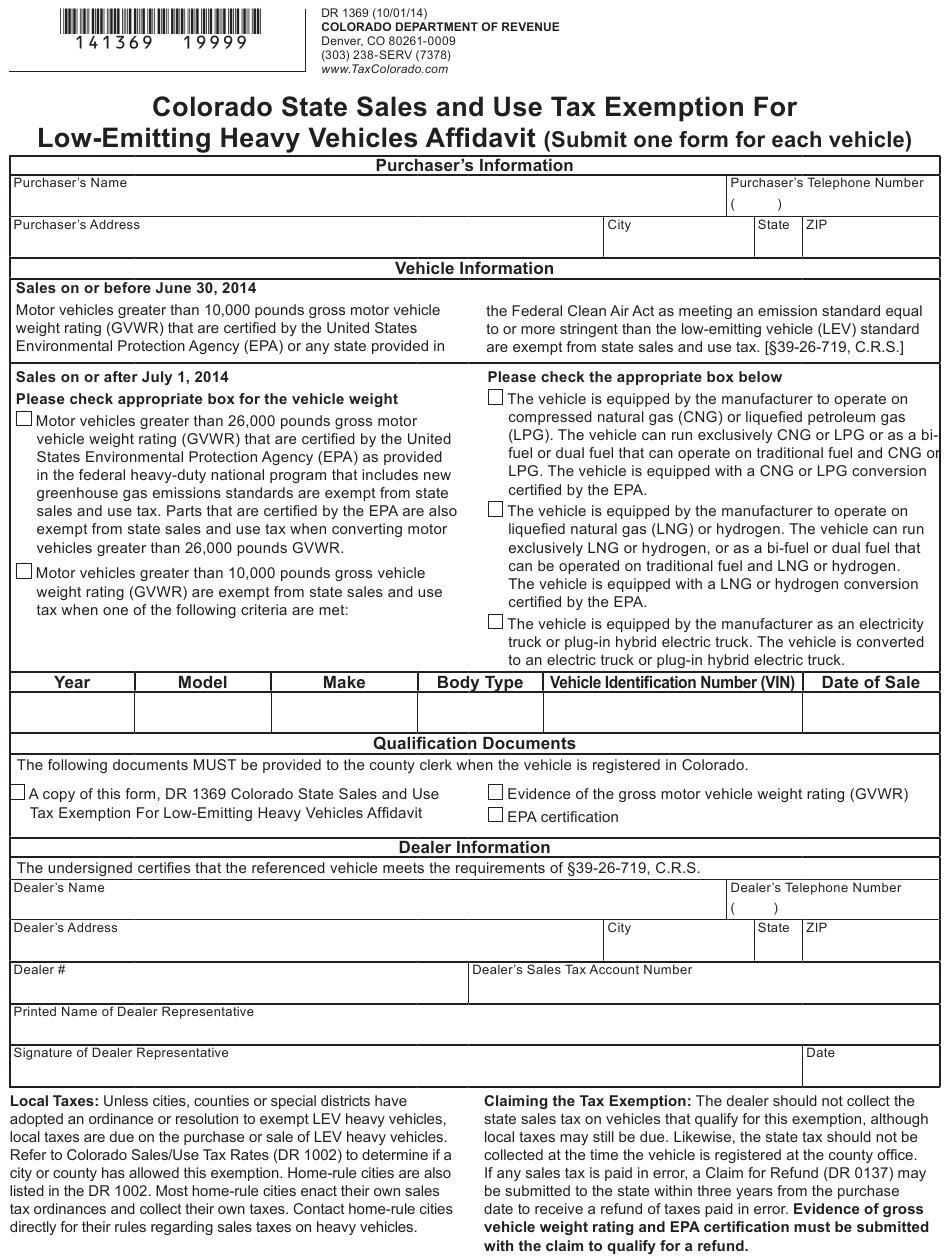

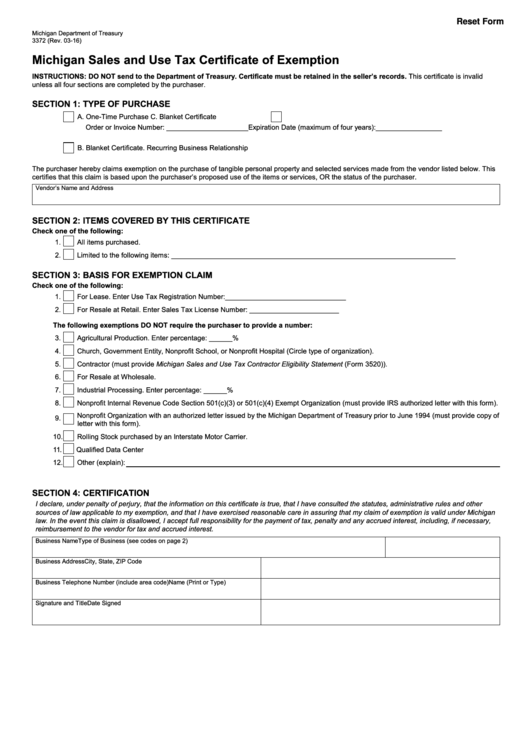

State Of Michigan Sales Tax Exempt Form

State Of Michigan Sales Tax Exempt Form - It is the purchaser’s responsibility. Michigan sales and use tax certificate of exemption instructions: A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Learn how to complete the form,. Do not send to the department of treasury.

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. It is the purchaser’s responsibility. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. Learn how to complete the form,. Do not send to the department of treasury. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Michigan sales and use tax certificate of exemption instructions:

The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Michigan sales and use tax certificate of exemption instructions: Learn how to complete the form,. Do not send to the department of treasury. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. It is the purchaser’s responsibility. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions.

Mi Tax Exempt Form 2023 Printable Forms Free Online

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Do not send to the department of treasury. The.

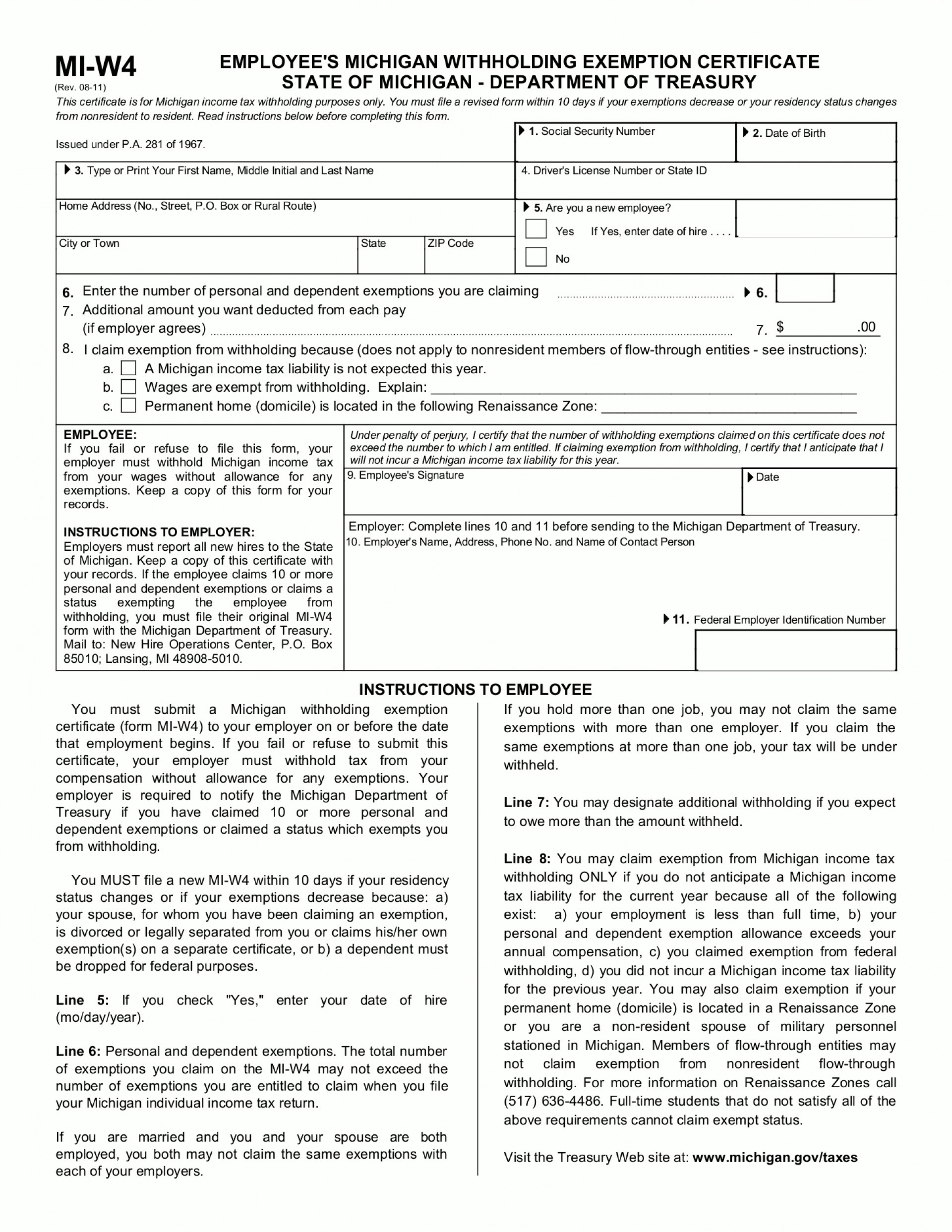

Mi State Tax Exemption Form

Learn how to complete the form,. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility. The purchaser completing this form hereby claims exemption from tax on the purchase of.

Michigan tax exempt form Fill out & sign online DocHub

Learn how to complete the form,. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility. Do not send to the department of treasury. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions.

Arkansas Sales And Use Tax Exemption

Michigan sales and use tax certificate of exemption instructions: Learn how to complete the form,. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. The purchaser completing this form.

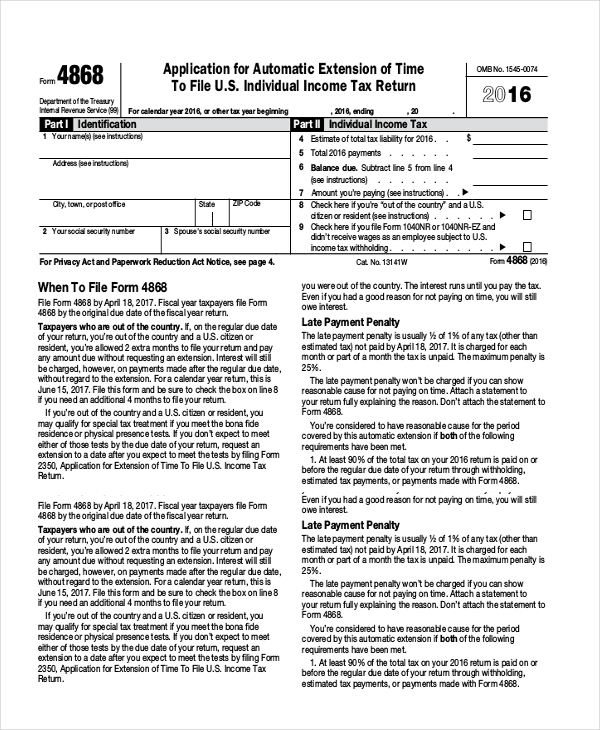

2023 Federal Tax Exemption Form

Do not send to the department of treasury. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. A purchaser who claims exemption for “resale at retail” or “for lease” must.

Michigan Sales Tax Exempt Form Fillable

A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. It.

006 Page1 1200Px State And Local Sales Tax Rates Pdf Michigan Form

A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. Purchasers may use.

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. Learn how to complete the form,. Michigan sales and use tax certificate of exemption instructions: Purchasers may use this form to claim exemption from michigan sales and.

Michigan Sales Tax Exemption Form 2024 Page Tricia

This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Do not send to the department of treasury. Learn how to complete the form,. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. It is the purchaser’s responsibility.

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF

Michigan sales and use tax certificate of exemption instructions: Learn how to complete the form,. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s.

Purchasers May Use This Form To Claim Exemption From Michigan Sales And Use Tax On Qualifi Ed Transactions.

The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions.

Michigan Sales And Use Tax Certificate Of Exemption Instructions:

A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. Do not send to the department of treasury. Learn how to complete the form,.