Property Tax Form Mn

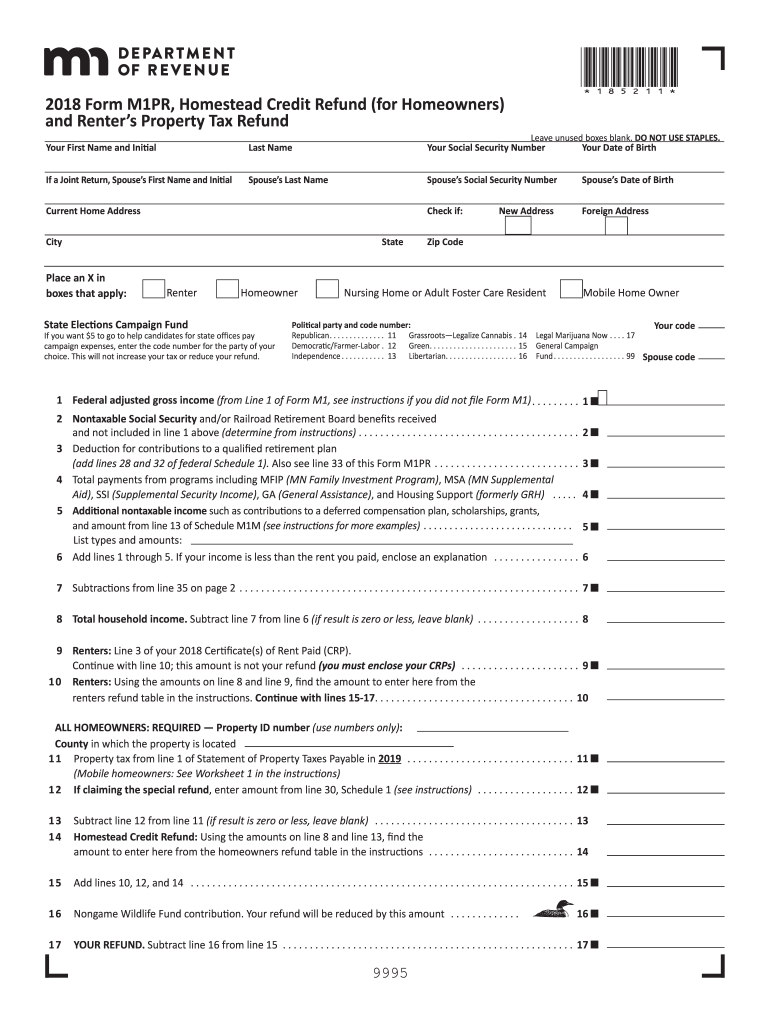

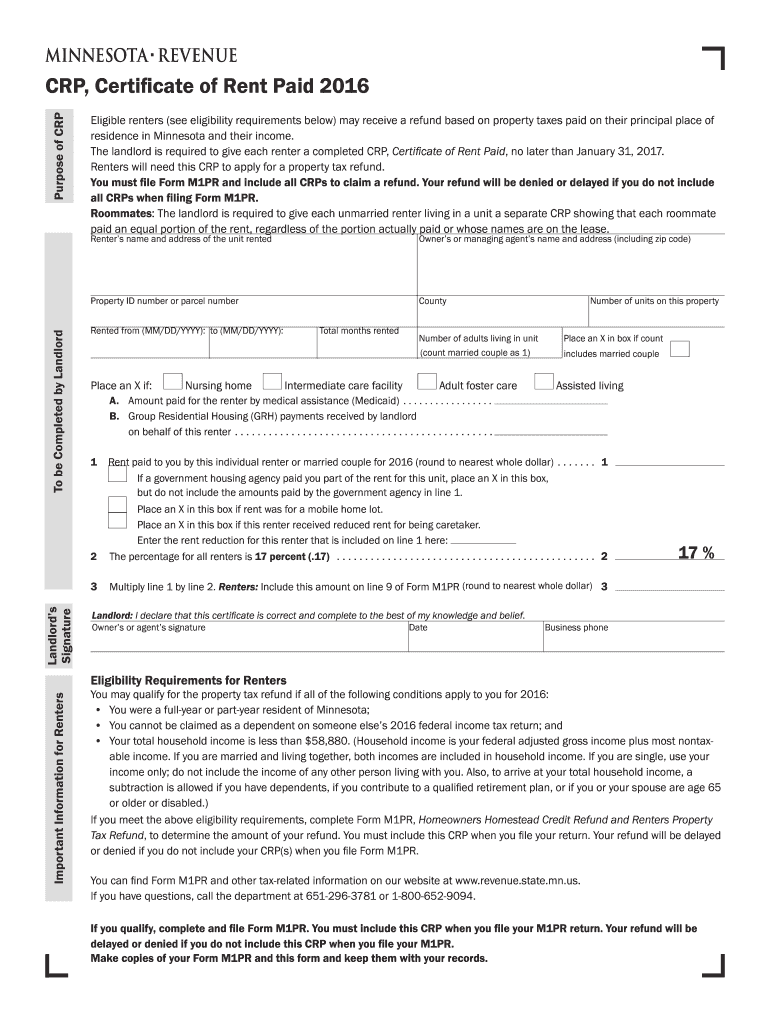

Property Tax Form Mn - I authorize the minnesota department of revenue to discuss this tax return with the preparer. If you are filing as a renter,. • go to www.revenue.state.mn.us to file electronically or download form m1pr, homestead credit refund (for homeowners) and renter’s. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Minnesota property tax refund, mail station. Property taxes or rent paid on your primary residence in minnesota. If you're a minnesota homeowner or renter, you may qualify for a property tax refund. If you are applying with your spouse, you must include both. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary.

If you are applying with your spouse, you must include both. If you are filing as a renter,. If you're a minnesota homeowner or renter, you may qualify for a property tax refund. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. • go to www.revenue.state.mn.us to file electronically or download form m1pr, homestead credit refund (for homeowners) and renter’s. Minnesota property tax refund, mail station. The refund provides property tax relief depending on your. I authorize the minnesota department of revenue to discuss this tax return with the preparer. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary.

Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Property taxes or rent paid on your primary residence in minnesota. Minnesota property tax refund, mail station. I authorize the minnesota department of revenue to discuss this tax return with the preparer. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. If you're a minnesota homeowner or renter, you may qualify for a property tax refund. The refund provides property tax relief depending on your. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. • go to www.revenue.state.mn.us to file electronically or download form m1pr, homestead credit refund (for homeowners) and renter’s. If you are applying with your spouse, you must include both.

Mn Property Tax Refund 20182024 Form Fill Out and Sign Printable PDF

Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. I authorize the minnesota department of revenue to discuss this tax return with the preparer. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. If you are filing as a renter,. The refund provides.

Fillable Online co aitkin mn Frequently Asked Property Tax Questions

If you're a minnesota homeowner or renter, you may qualify for a property tax refund. If you are applying with your spouse, you must include both. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. If you are filing as a renter,..

2021 Form MN DoR M1PR Fill Online, Printable, Fillable, Blank pdfFiller

If you're a minnesota homeowner or renter, you may qualify for a property tax refund. Minnesota property tax refund, mail station. Property taxes or rent paid on your primary residence in minnesota. I authorize the minnesota department of revenue to discuss this tax return with the preparer. To file by paper, complete and file form m1pr, homestead credit refund (for.

14 Form Mn Ten Great 14 Form Mn Ideas That You Can Share With Your

If you are applying with your spouse, you must include both. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. The refund provides property tax relief depending on your. Property taxes or rent paid on your primary residence in minnesota. If you're.

MN DoR MWR 2021 Fill out Tax Template Online US Legal Forms

• go to www.revenue.state.mn.us to file electronically or download form m1pr, homestead credit refund (for homeowners) and renter’s. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. If you are filing as a renter,. If you're a minnesota homeowner or renter, you may qualify for a property tax refund. The refund provides property.

Minnesota Property Tax Refund Fill Out And Sign Printable PDF

Minnesota property tax refund, mail station. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. If you are applying with your spouse, you must include both. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s.

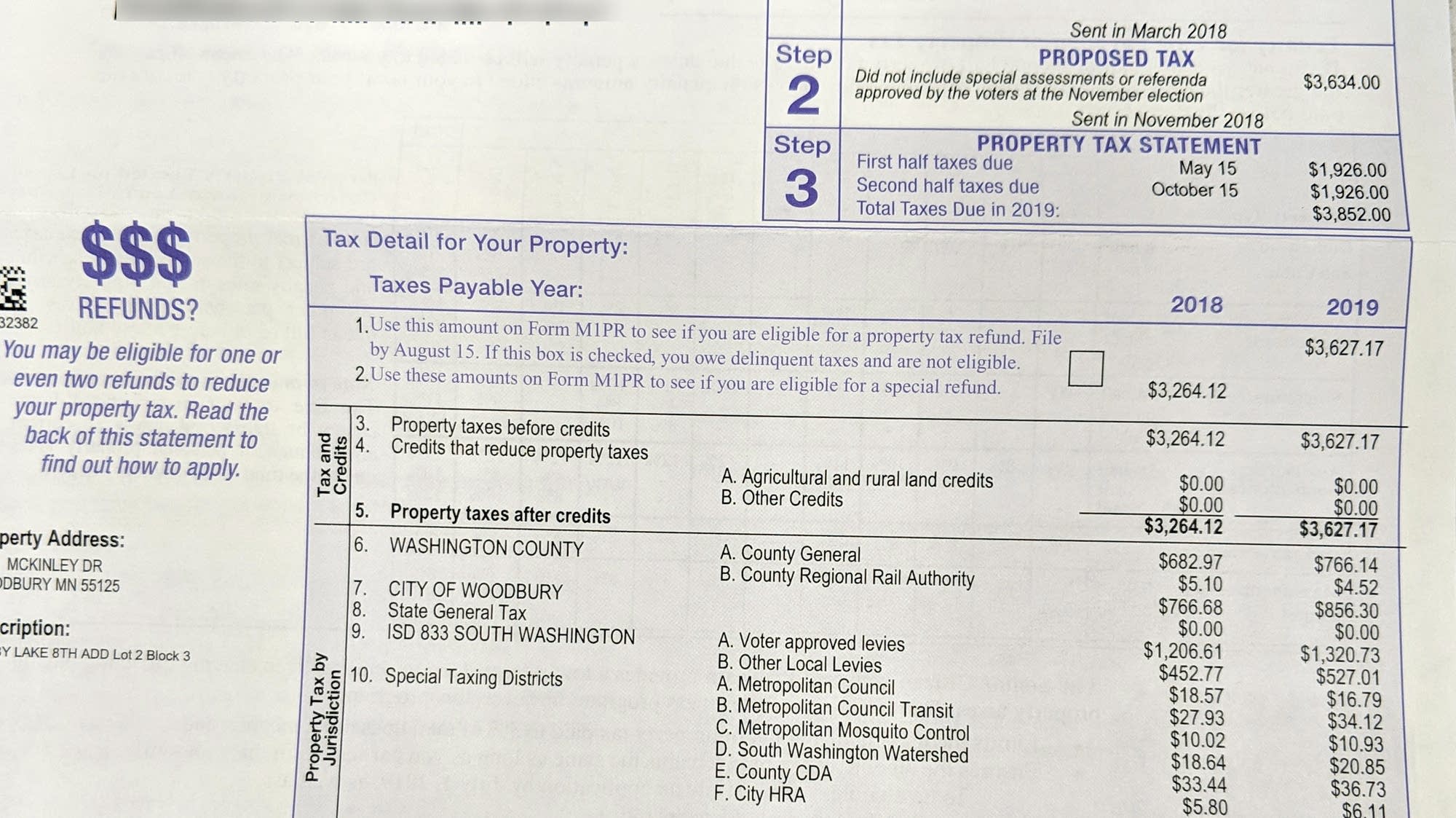

Show us your property tax statement MPR News

Property taxes or rent paid on your primary residence in minnesota. Minnesota property tax refund, mail station. The refund provides property tax relief depending on your. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax.

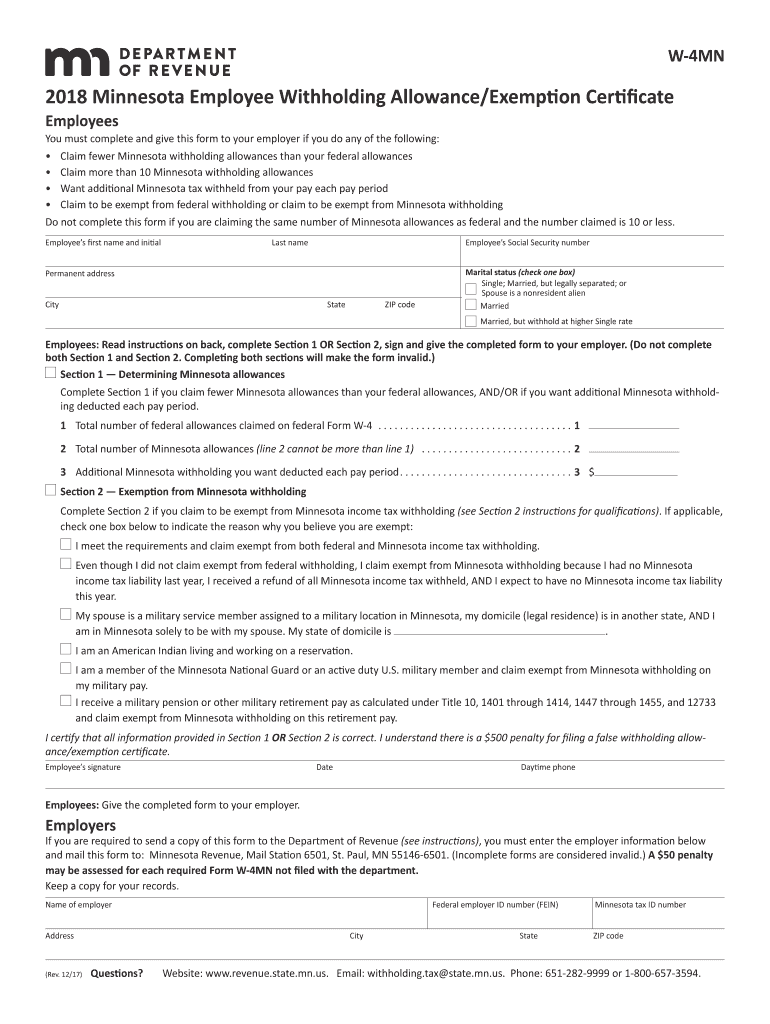

Minnesota State Withholding Form 2025 Daffy Kamillah

• go to www.revenue.state.mn.us to file electronically or download form m1pr, homestead credit refund (for homeowners) and renter’s. Minnesota property tax refund, mail station. Property taxes or rent paid on your primary residence in minnesota. If you're a minnesota homeowner or renter, you may qualify for a property tax refund. If you are filing as a renter,.

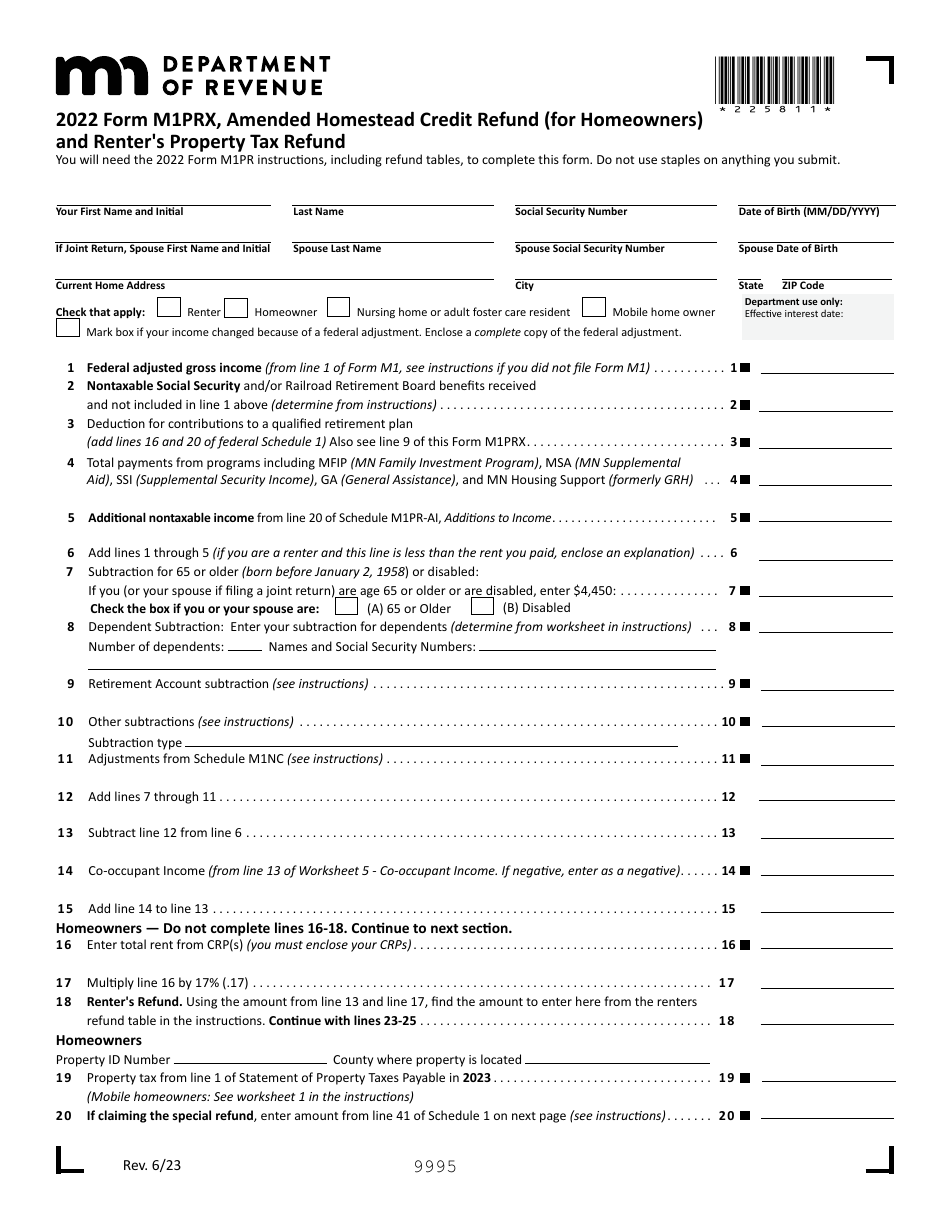

Form M1PRX 2022 Fill Out, Sign Online and Download Fillable PDF

I authorize the minnesota department of revenue to discuss this tax return with the preparer. Property taxes or rent paid on your primary residence in minnesota. If you are applying with your spouse, you must include both. If you are filing as a renter,. • go to www.revenue.state.mn.us to file electronically or download form m1pr, homestead credit refund (for homeowners).

2018 Form MN DoR M1 Fill Online, Printable, Fillable, Blank PDFfiller

To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. If you are filing as a renter,. • go to www.revenue.state.mn.us to file electronically or download form m1pr, homestead credit refund (for homeowners) and renter’s. If you are applying with your spouse, you must include both. If you're a minnesota homeowner.

If You Are Applying With Your Spouse, You Must Include Both.

If you're a minnesota homeowner or renter, you may qualify for a property tax refund. If you are filing as a renter,. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Minnesota property tax refund, mail station.

I Authorize The Minnesota Department Of Revenue To Discuss This Tax Return With The Preparer.

To file by paper, complete and file form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Property taxes or rent paid on your primary residence in minnesota. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. The refund provides property tax relief depending on your.