New Tax Form For Llc 2024

New Tax Form For Llc 2024 - For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. You have until have until january 1, 2025, to file your initial report. Review information about a limited liability company (llc) and the federal tax classification process. The beneficial ownership information (boi) report. New federal reporting requirements for llcs, corporations and business entities. Congress has passed the corporate. There's a new form for companies to know about and file in 2024: Although the exact nature of. For llcs formed before january 1, 2024: Companies newly created on or after january 1, 2024 will need to register within 30 days after creation.

You have until have until january 1, 2025, to file your initial report. The beneficial ownership information (boi) report. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. New federal reporting requirements for llcs, corporations and business entities. For llcs formed before january 1, 2024: Congress has passed the corporate. There's a new form for companies to know about and file in 2024: Although the exact nature of. Review information about a limited liability company (llc) and the federal tax classification process. For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations.

Congress has passed the corporate. There's a new form for companies to know about and file in 2024: Although the exact nature of. For llcs formed before january 1, 2024: New federal reporting requirements for llcs, corporations and business entities. For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. You have until have until january 1, 2025, to file your initial report. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. Review information about a limited liability company (llc) and the federal tax classification process. The beneficial ownership information (boi) report.

2016 minnesota tax forms Fill out & sign online DocHub

There's a new form for companies to know about and file in 2024: New federal reporting requirements for llcs, corporations and business entities. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. The beneficial ownership information (boi) report. For llcs formed before january 1, 2024:

Taxes 2023 When does tax season start and what documents do I need

Although the exact nature of. For llcs formed before january 1, 2024: There's a new form for companies to know about and file in 2024: Review information about a limited liability company (llc) and the federal tax classification process. The beneficial ownership information (boi) report.

Tax Calculator New Regime 2024 25 Image to u

There's a new form for companies to know about and file in 2024: For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. Although the exact nature of. New federal reporting requirements for llcs, corporations and business entities. For llcs formed before january 1, 2024:

Tax Books & Forms Available!

For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. Congress has passed the corporate. Review information about a limited liability company (llc) and the federal tax classification process. Although the exact nature of. For llcs formed before january 1, 2024:

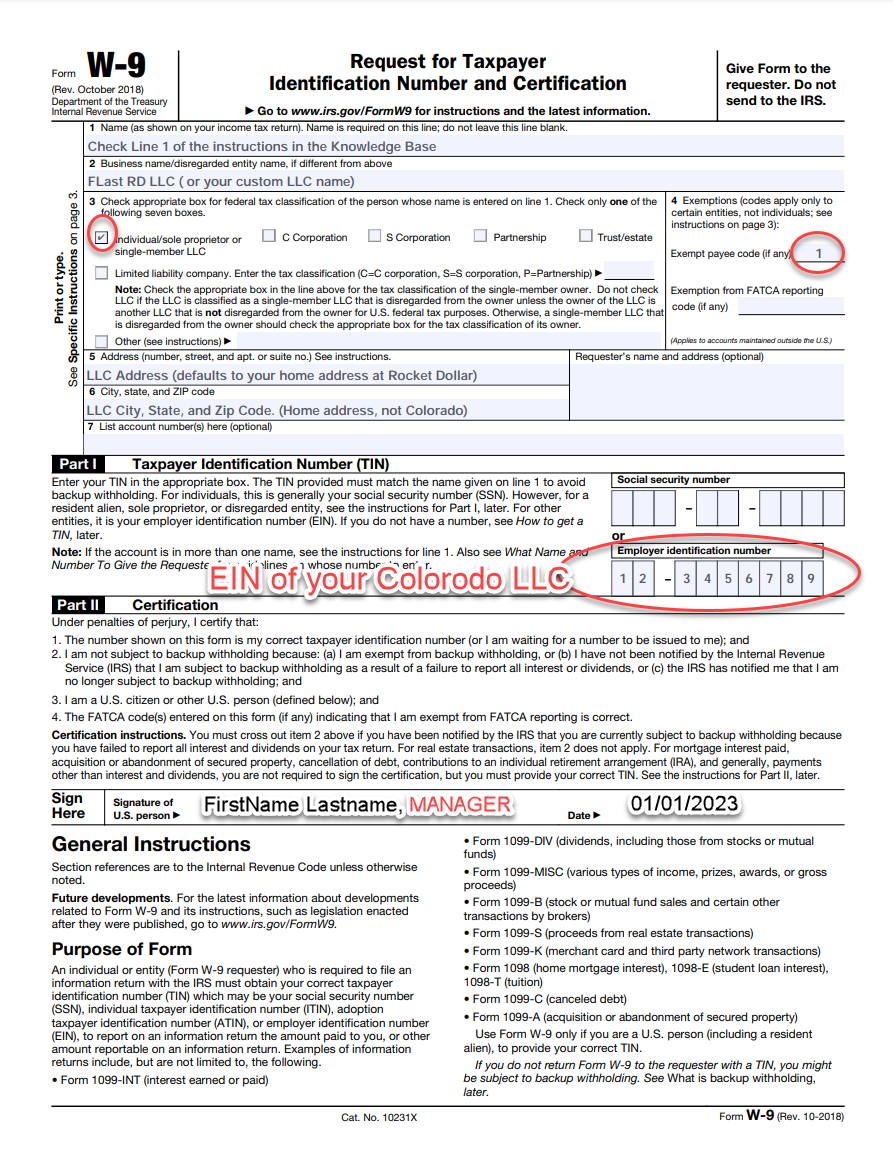

2024 W9 Form Irs Laina Justine

Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. Congress has passed the corporate. New federal reporting requirements for llcs, corporations and business entities. Although the exact nature of. You have until have until january 1, 2025, to file your initial report.

What Form To Use For Llc Tax Return Ethel Hernandez's Templates

You have until have until january 1, 2025, to file your initial report. New federal reporting requirements for llcs, corporations and business entities. Review information about a limited liability company (llc) and the federal tax classification process. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. The beneficial ownership information (boi).

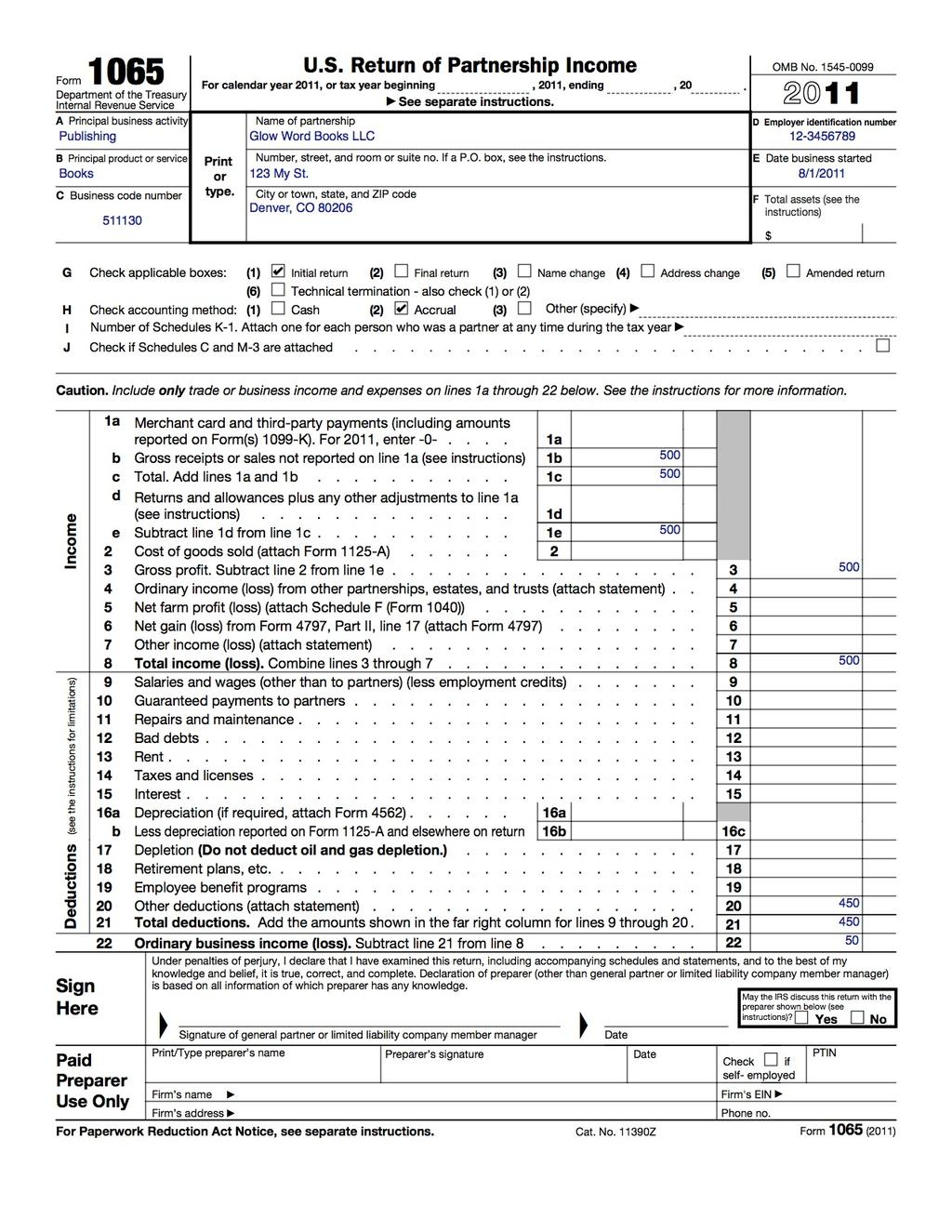

Llc Capital Account Spreadsheet Within How To Fill Out An Llc 1065 Irs

The beneficial ownership information (boi) report. Congress has passed the corporate. New federal reporting requirements for llcs, corporations and business entities. There's a new form for companies to know about and file in 2024: For llcs formed before january 1, 2024:

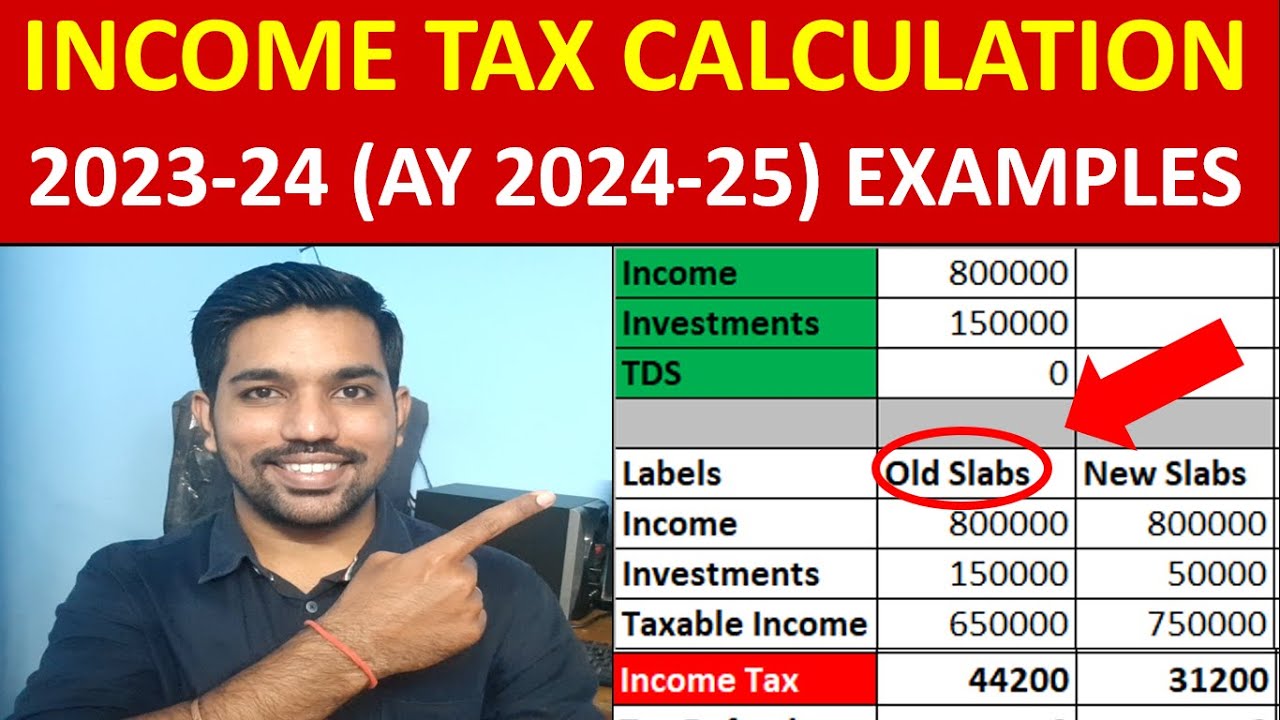

Tax Calculation for FY 202324 [Examples] FinCalC Blog

There's a new form for companies to know about and file in 2024: For llcs formed before january 1, 2024: Although the exact nature of. Congress has passed the corporate. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation.

Tax rates for the 2024 year of assessment Just One Lap

For llcs formed before january 1, 2024: For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. Congress has passed the corporate. Review information about a limited liability company (llc) and the federal tax classification process. New federal reporting requirements for llcs, corporations and business entities.

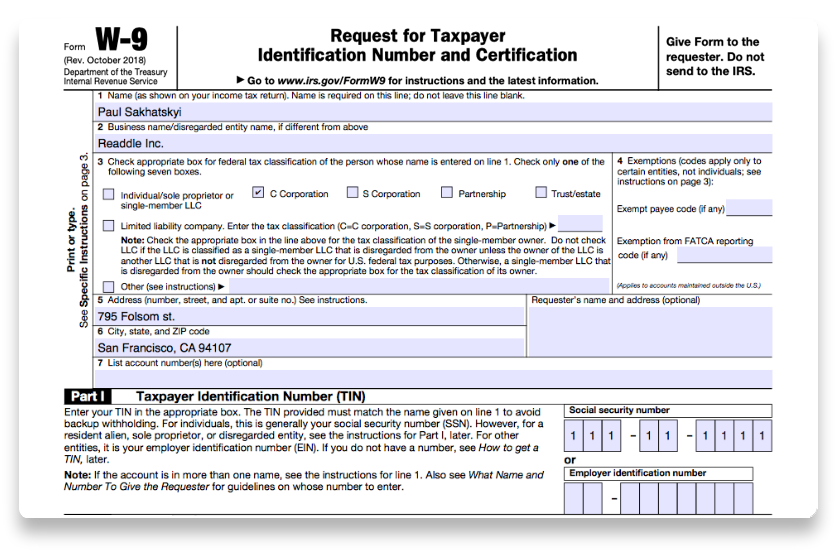

W9 Form 2024 Massachusetts Wally Jordanna

There's a new form for companies to know about and file in 2024: For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. Review information about a limited liability company (llc) and the federal tax classification process. Congress has passed the corporate. You have until have until january 1, 2025, to.

You Have Until Have Until January 1, 2025, To File Your Initial Report.

For llcs formed before january 1, 2024: Although the exact nature of. Companies newly created on or after january 1, 2024 will need to register within 30 days after creation. The beneficial ownership information (boi) report.

Review Information About A Limited Liability Company (Llc) And The Federal Tax Classification Process.

New federal reporting requirements for llcs, corporations and business entities. There's a new form for companies to know about and file in 2024: For limited liability companies (llcs), the year 2024 could potentially bring a new set of tax forms and regulations. Congress has passed the corporate.

![Tax Calculation for FY 202324 [Examples] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2023/03/income-tax-calculation-examples-FY-2023-24-AY-2024-25-video-1024x576.webp)