New Employment Credit Form 3554

New Employment Credit Form 3554 - Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. (do not include any assigned credit claimed on form. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. Enter the amount of the credit claimed on the current year tax return. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023.

Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. Enter the amount of the credit claimed on the current year tax return. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. (do not include any assigned credit claimed on form. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full.

We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. Enter the amount of the credit claimed on the current year tax return. (do not include any assigned credit claimed on form.

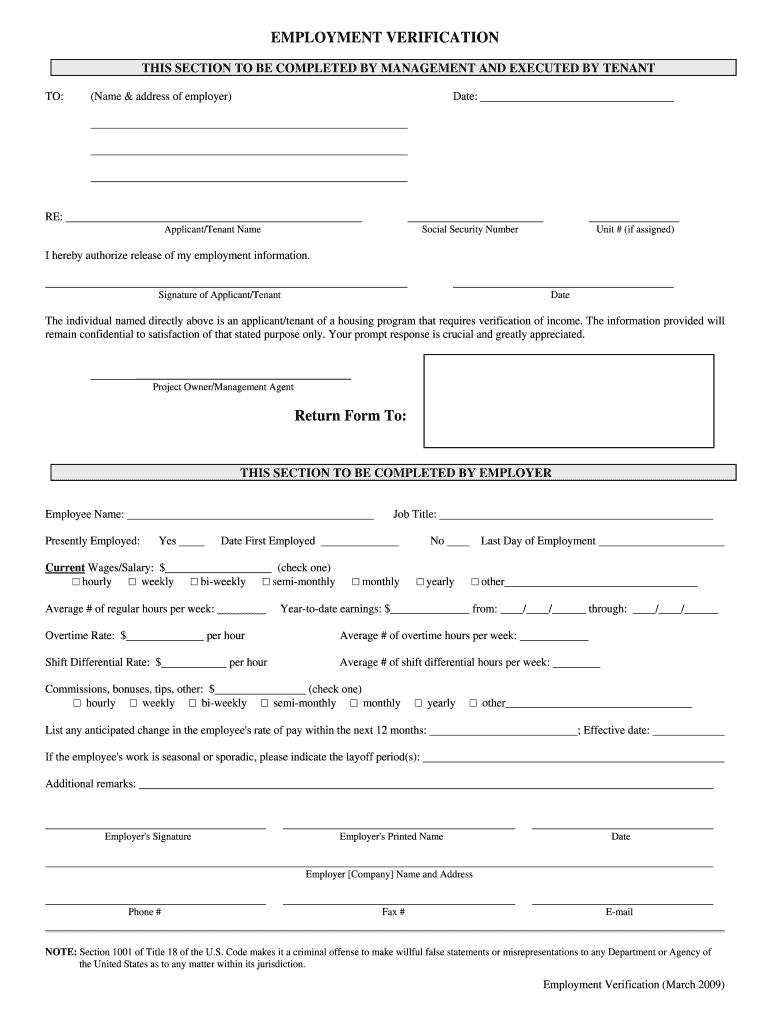

Pdf Printable Employment Verification Form Printable Form 2023 Free

Enter the amount of the credit claimed on the current year tax return. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. (do not include any assigned credit claimed on form. Download or print the 2023 california (new employment credit) (2023) and other income.

NEW Employment Authorization Card PSD Template RH Editography

(do not include any assigned credit claimed on form. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. Enter the amount of the credit claimed on the.

IRS Form 5695 Residential Energy Tax Credits StepbyStep Guide

(do not include any assigned credit claimed on form. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Enter the amount of the credit claimed on the current year tax return. Download or print the 2023 california (new employment credit) (2023) and other income.

Fillable Online 2020 FORM 3554 New Employment Credit. 2020 FORM 3554

Enter the amount of the credit claimed on the current year tax return. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. (do.

New Employment Plan Ppt PowerPoint Presentation Complete Deck With Slides

Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. Enter the amount of the credit claimed on the current year tax return. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. We last updated the new.

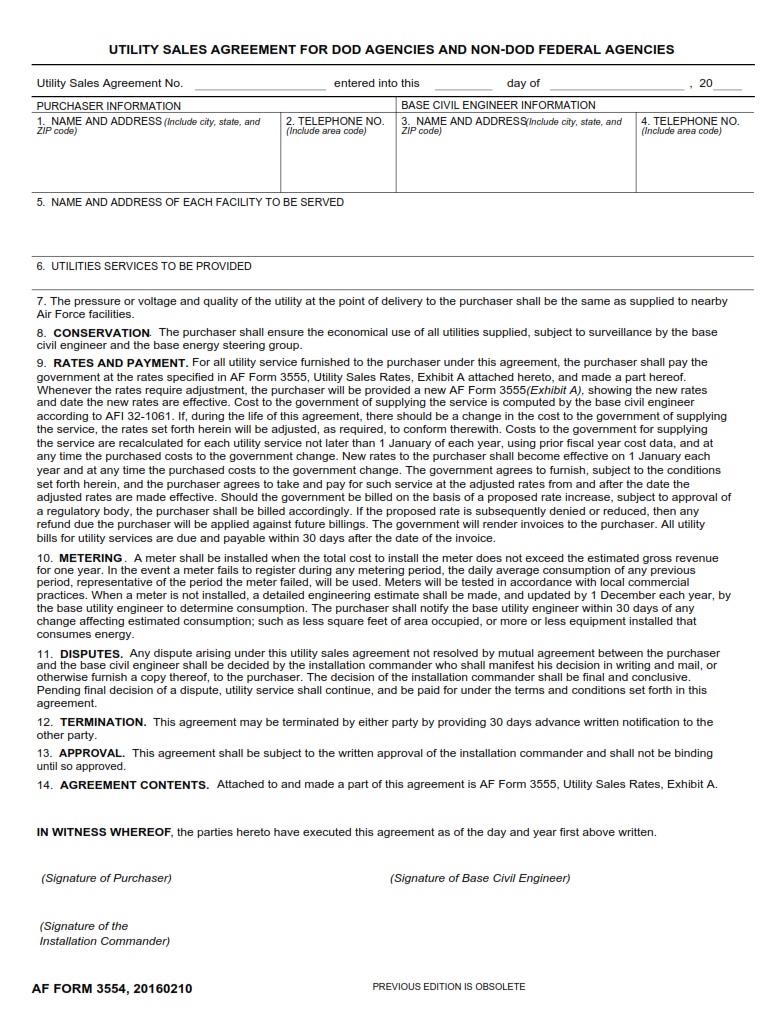

AF Form 3554 Utility Sales Agreement For DoD Agencies And NonFederal

We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Enter the amount of the credit claimed on the current year tax return. (do not include any assigned credit claimed on form. Download or print the 2023 california (new employment credit) (2023) and other income.

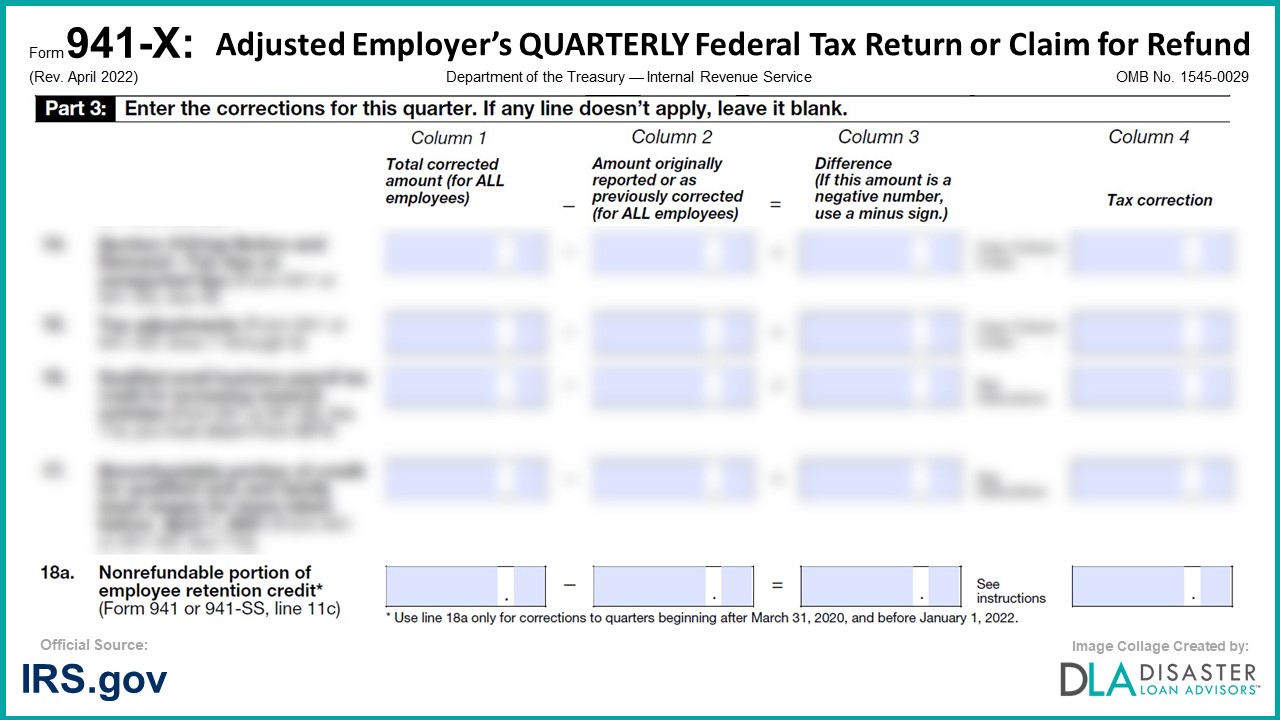

941X 18a. Nonrefundable Portion of Employee Retention Credit, Form

(do not include any assigned credit claimed on form. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. We last updated the new employment credit in february.

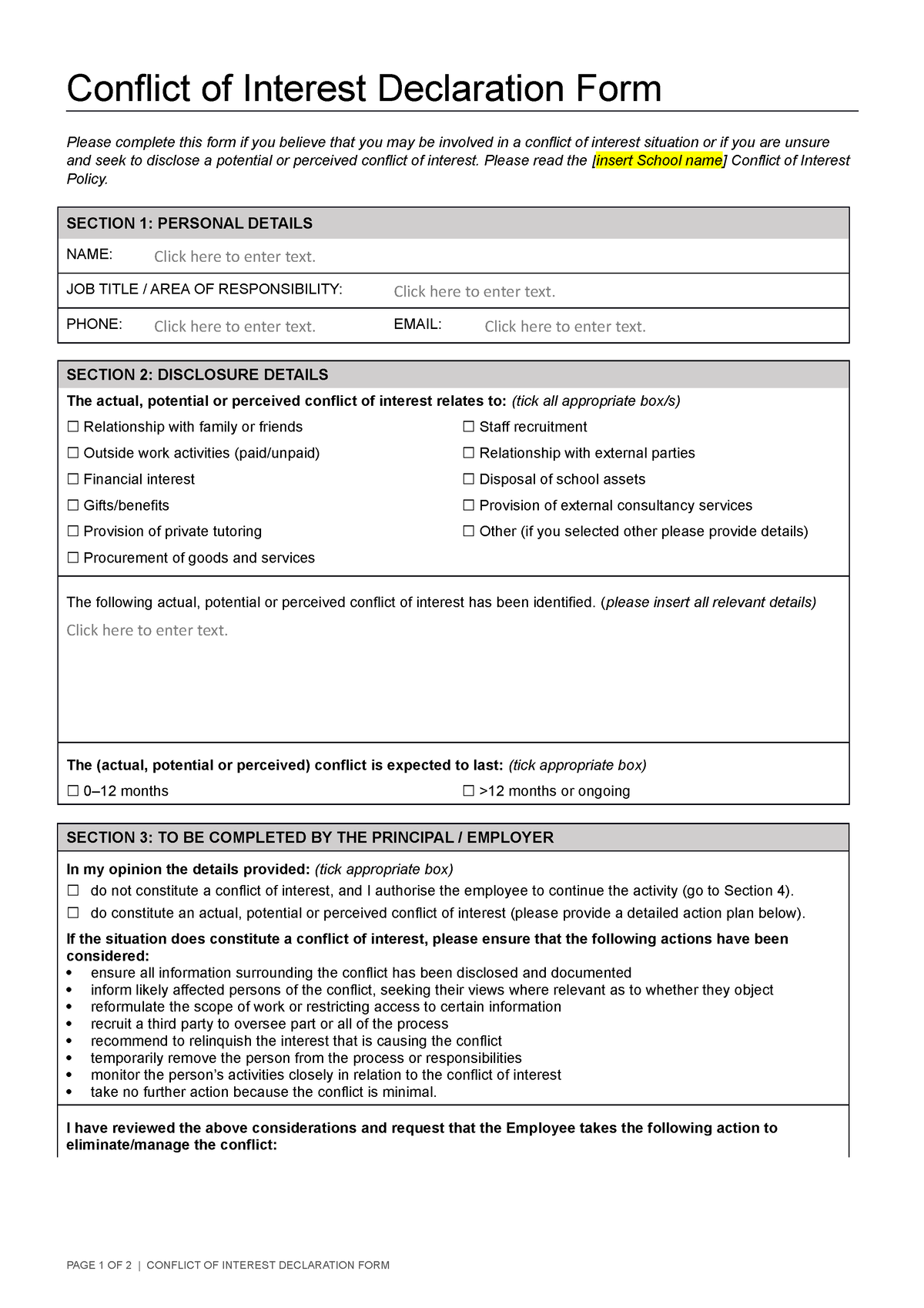

Conflict of Interest Template Declaration Form Conflict of Interest

Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. Enter the amount of the credit claimed on the current year tax return. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Download.

Fillable Online 2021 Instructions for Form FTB 3554 New Employment

Download or print the 2023 california (new employment credit) (2023) and other income tax forms from the california franchise tax board. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. (do not include any assigned credit claimed on form. Enter the amount of the credit claimed on the.

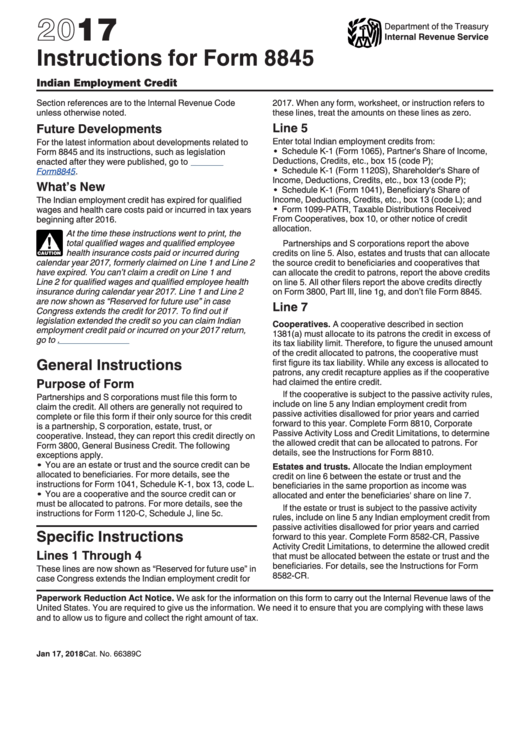

Instructions For Form 8845 Indian Employment Credit 2017 printable

(do not include any assigned credit claimed on form. Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023. Enter the amount of the.

Download Or Print The 2023 California (New Employment Credit) (2023) And Other Income Tax Forms From The California Franchise Tax Board.

Taxpayers use form ftb 3554, new employment credit, to figure a credit for a qualified taxpayer that hires a qualified full. Enter the amount of the credit claimed on the current year tax return. (do not include any assigned credit claimed on form. We last updated the new employment credit in february 2024, so this is the latest version of form 3554, fully updated for tax year 2023.