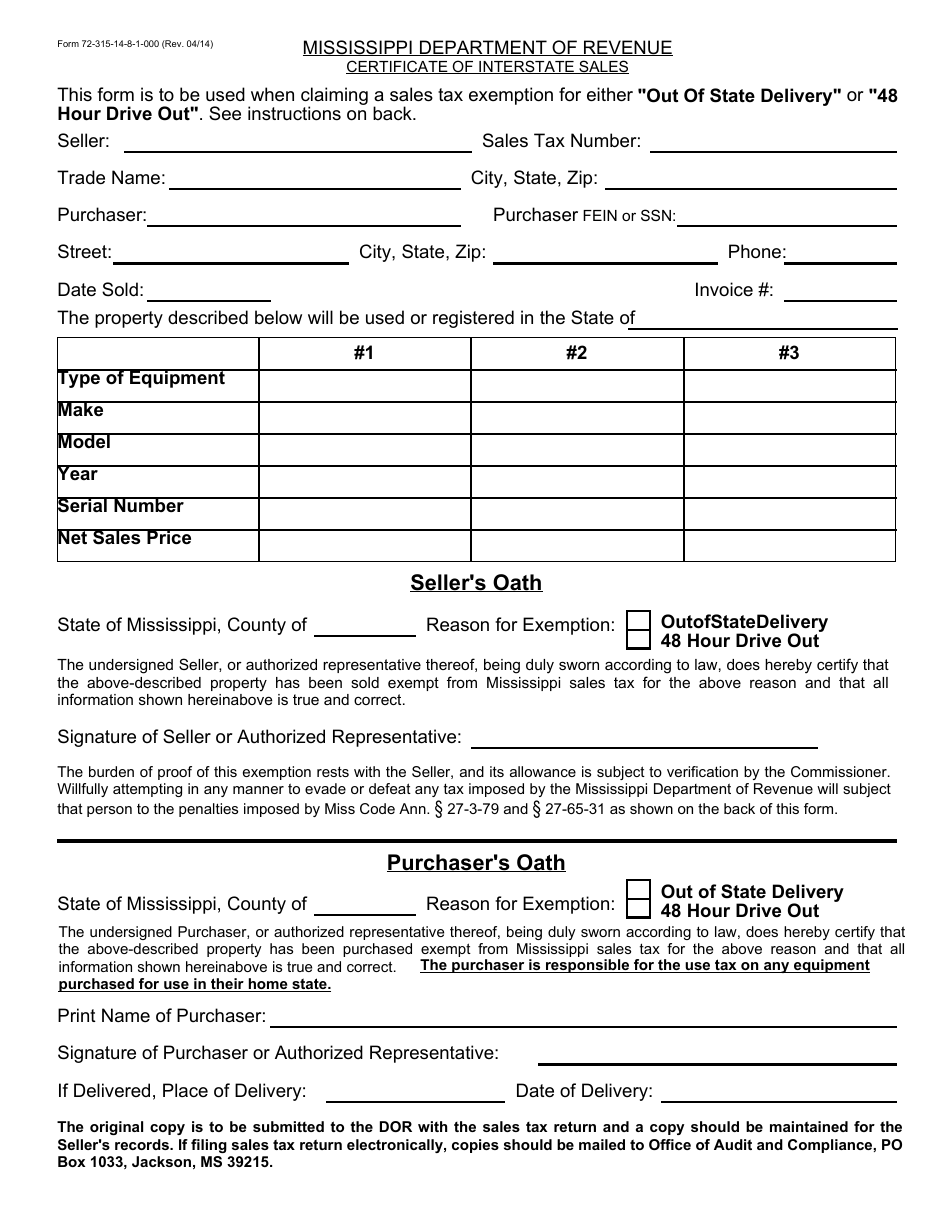

Mississippi Sales Tax Exemption Form

Mississippi Sales Tax Exemption Form - All sales from a business location within the state or by a mississippi dealer are presumed to be taxable mississippi sales unless and until the dealer can substantiate an authorized claim for exemption. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the mississippi sales tax. Exemptions provided in these sections do not apply to taxes levied by miss. Obtaining forms from the dor once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed to the newly approved. You can download a pdf of. An exemption from sales tax must be specifically provided by law.

An exemption from sales tax must be specifically provided by law. All sales from a business location within the state or by a mississippi dealer are presumed to be taxable mississippi sales unless and until the dealer can substantiate an authorized claim for exemption. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the mississippi sales tax. Exemptions provided in these sections do not apply to taxes levied by miss. Obtaining forms from the dor once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed to the newly approved. You can download a pdf of.

An exemption from sales tax must be specifically provided by law. All sales from a business location within the state or by a mississippi dealer are presumed to be taxable mississippi sales unless and until the dealer can substantiate an authorized claim for exemption. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the mississippi sales tax. You can download a pdf of. Obtaining forms from the dor once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed to the newly approved. Exemptions provided in these sections do not apply to taxes levied by miss.

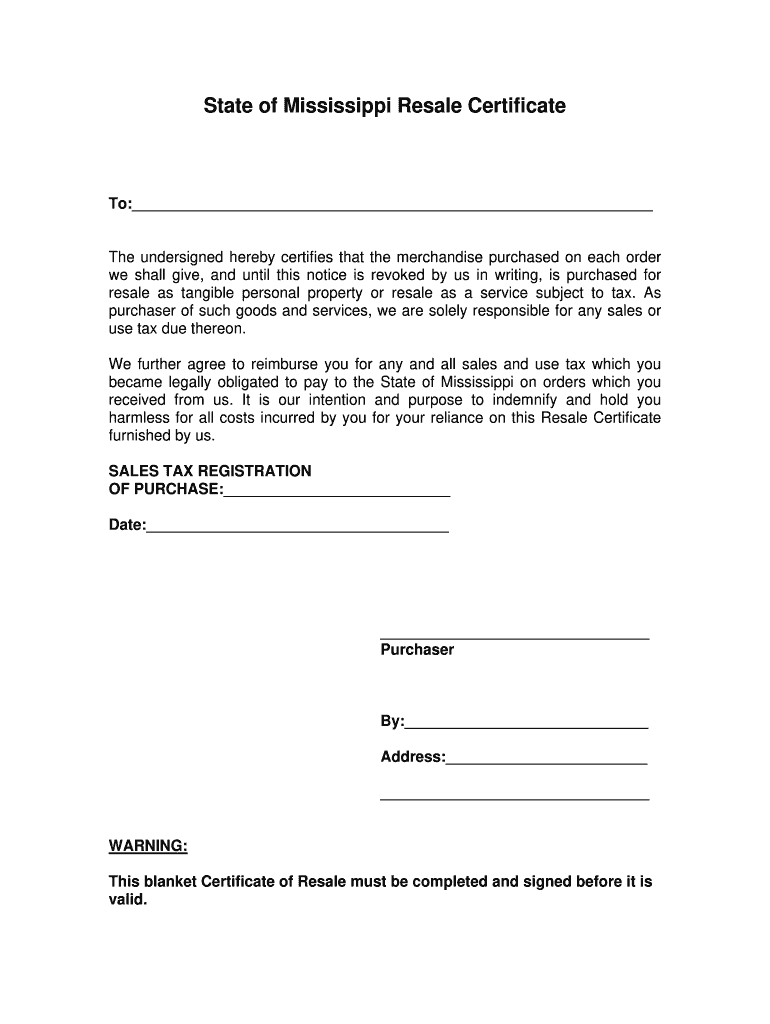

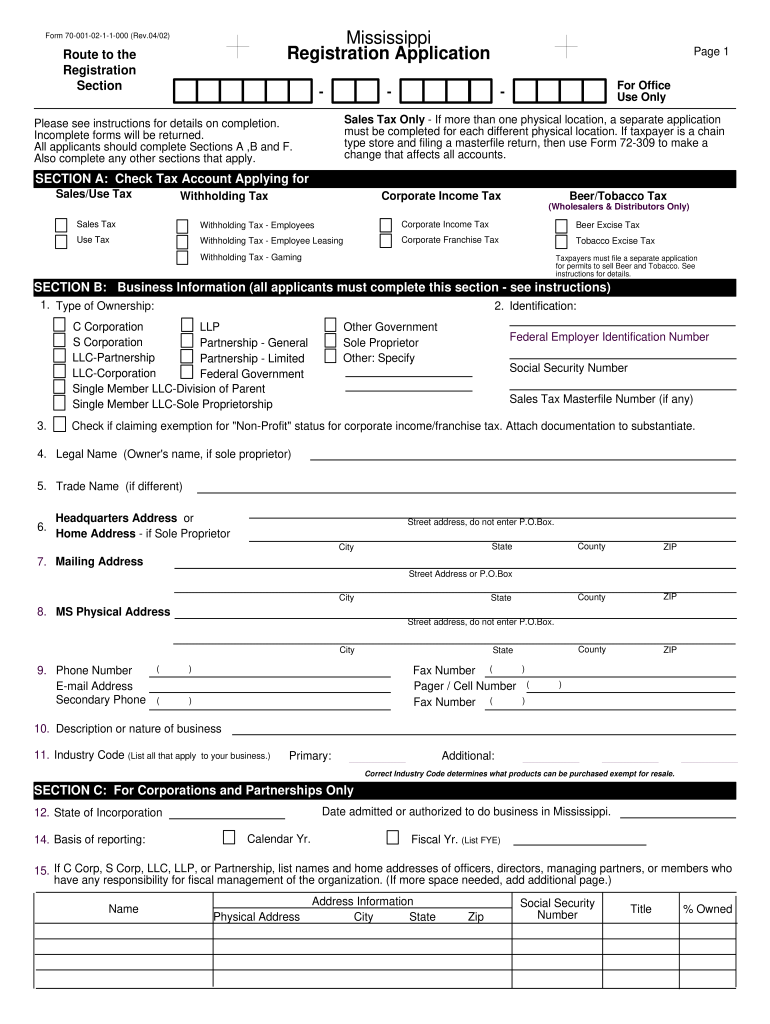

Mississippi Sales Tax Exemption Form For Resale

You can download a pdf of. Exemptions provided in these sections do not apply to taxes levied by miss. An exemption from sales tax must be specifically provided by law. All sales from a business location within the state or by a mississippi dealer are presumed to be taxable mississippi sales unless and until the dealer can substantiate an authorized.

On Tap Where Is Form Sales Tax Exemption Ms

You can download a pdf of. An exemption from sales tax must be specifically provided by law. All sales from a business location within the state or by a mississippi dealer are presumed to be taxable mississippi sales unless and until the dealer can substantiate an authorized claim for exemption. Obtaining forms from the dor once an application for a.

Mississippi Sales And Use Tax Exemption Form

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the mississippi sales tax. All sales from a business location within the state or by a mississippi dealer are presumed to be taxable mississippi sales unless and until the dealer can substantiate an authorized claim for exemption..

Mississippi Sales Tax Exemption Form For Resale

You can download a pdf of. Obtaining forms from the dor once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed to the newly approved. All sales from a business location within the state or by a mississippi dealer are presumed to be taxable.

mississippi tax forms For Lots Profile Image Archive

An exemption from sales tax must be specifically provided by law. Obtaining forms from the dor once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed to the newly approved. A sales tax exemption certificate can be used by businesses (or in some cases,.

Mississippi tax exempt form pdf Fill out & sign online DocHub

Exemptions provided in these sections do not apply to taxes levied by miss. All sales from a business location within the state or by a mississippi dealer are presumed to be taxable mississippi sales unless and until the dealer can substantiate an authorized claim for exemption. You can download a pdf of. Obtaining forms from the dor once an application.

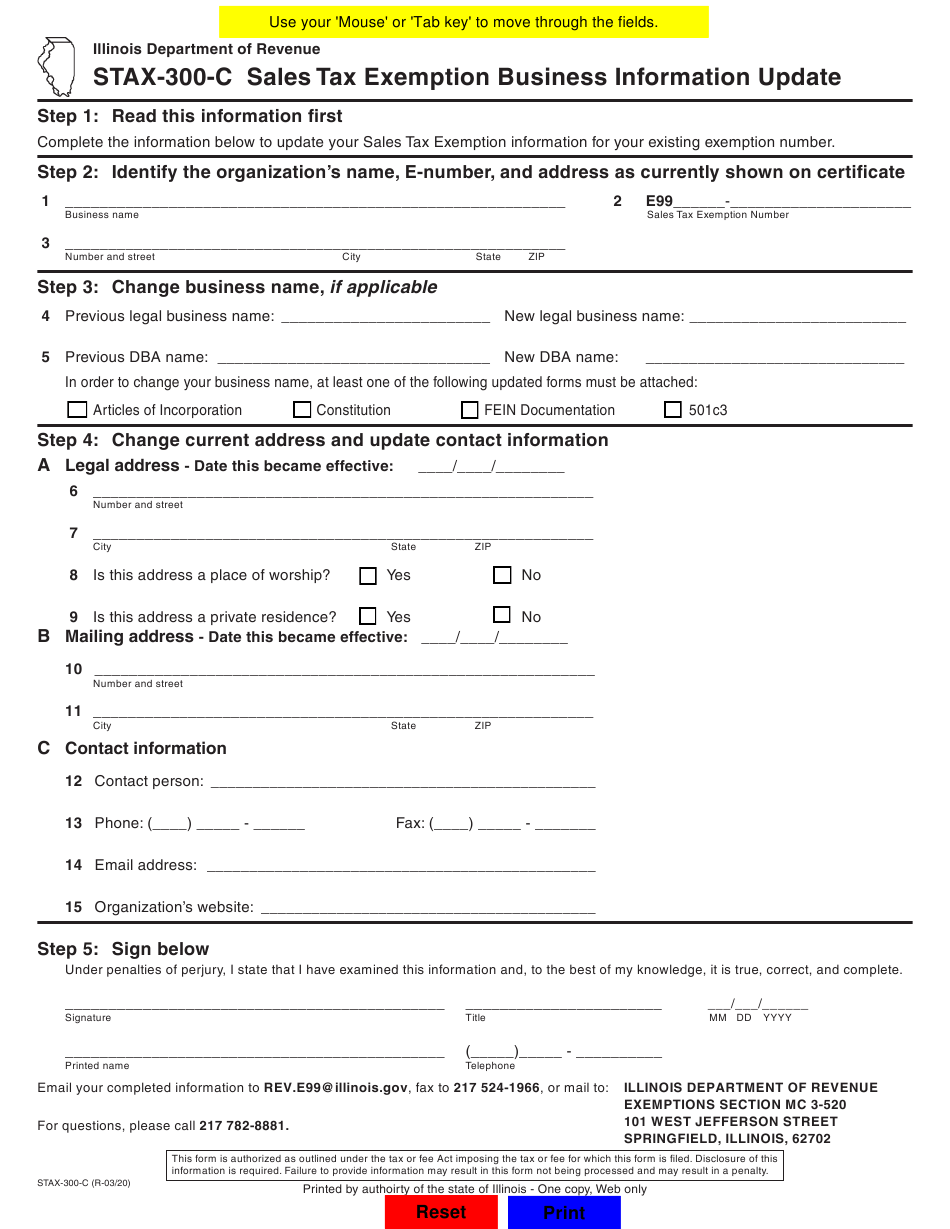

Fillable Online Which sales tax exemption form should be used for each

All sales from a business location within the state or by a mississippi dealer are presumed to be taxable mississippi sales unless and until the dealer can substantiate an authorized claim for exemption. An exemption from sales tax must be specifically provided by law. You can download a pdf of. Exemptions provided in these sections do not apply to taxes.

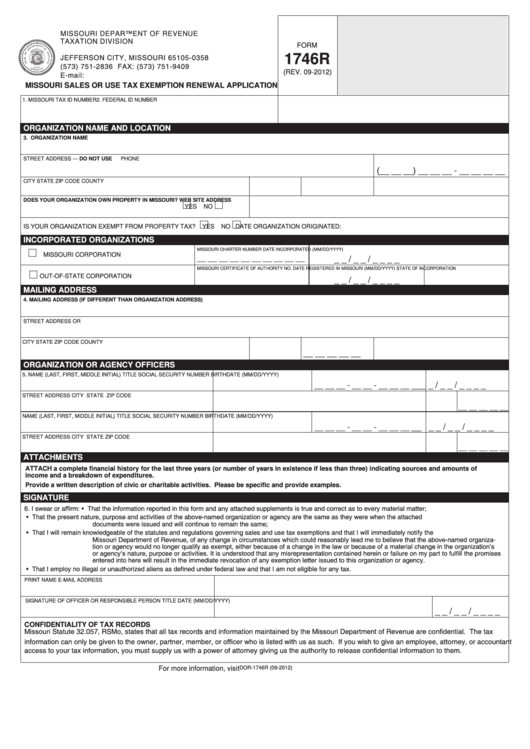

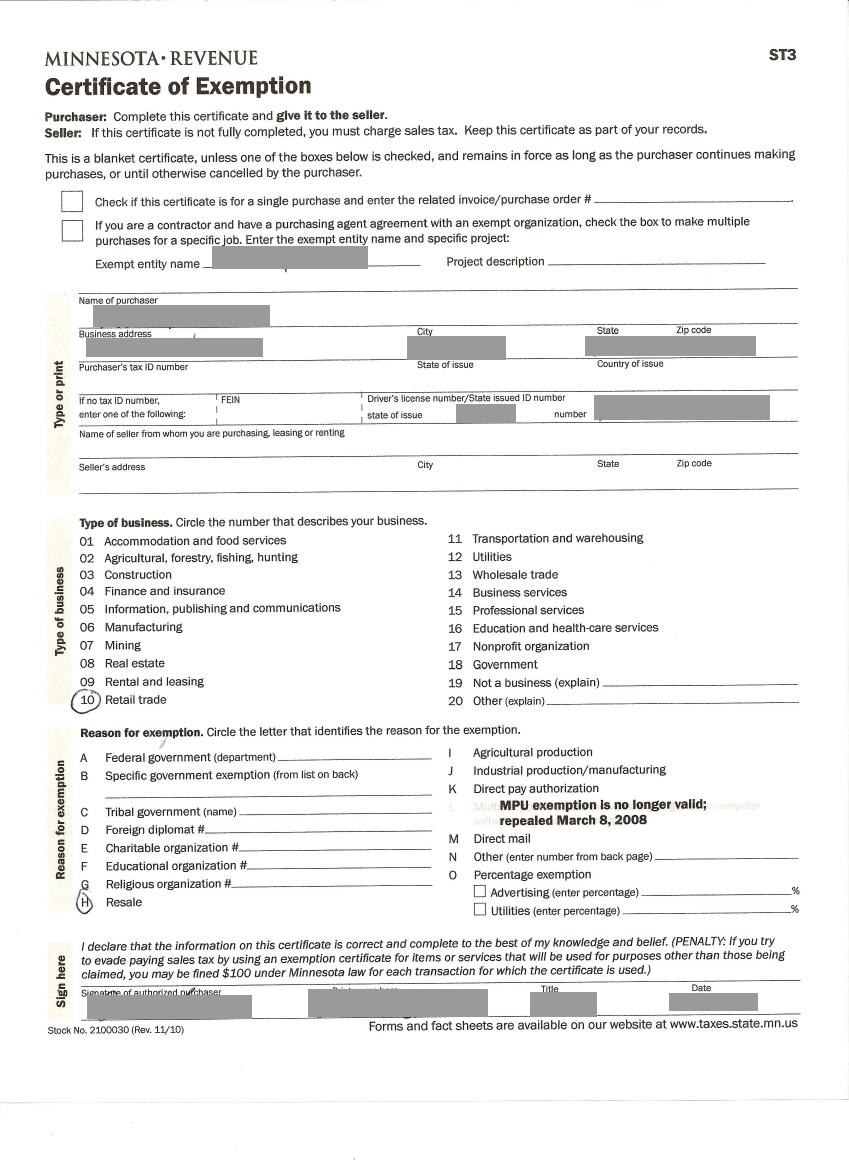

Sales Tax Exemption Forms RJ Matthews Company

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the mississippi sales tax. All sales from a business location within the state or by a mississippi dealer are presumed to be taxable mississippi sales unless and until the dealer can substantiate an authorized claim for exemption..

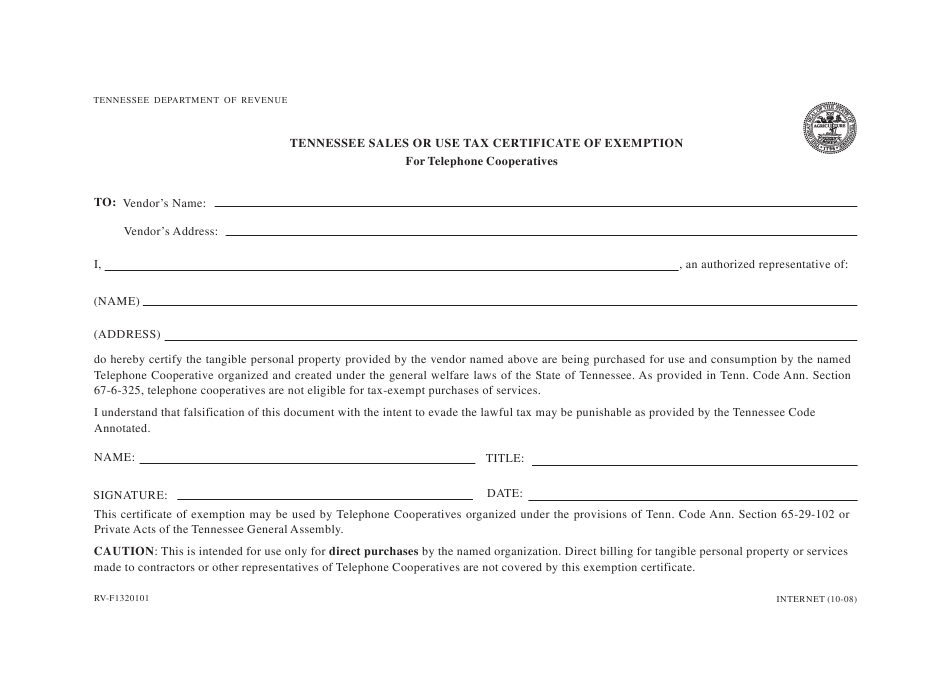

State Sales Tax Exemption Form Tn

All sales from a business location within the state or by a mississippi dealer are presumed to be taxable mississippi sales unless and until the dealer can substantiate an authorized claim for exemption. Obtaining forms from the dor once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two.

Harris County Homestead Exemption Form

You can download a pdf of. Obtaining forms from the dor once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed to the newly approved. An exemption from sales tax must be specifically provided by law. Exemptions provided in these sections do not apply.

All Sales From A Business Location Within The State Or By A Mississippi Dealer Are Presumed To Be Taxable Mississippi Sales Unless And Until The Dealer Can Substantiate An Authorized Claim For Exemption.

Obtaining forms from the dor once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed to the newly approved. You can download a pdf of. An exemption from sales tax must be specifically provided by law. Exemptions provided in these sections do not apply to taxes levied by miss.