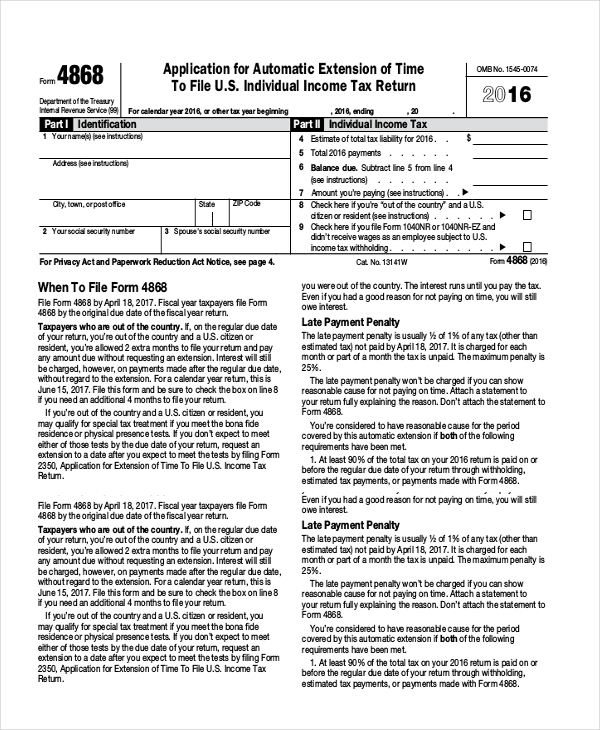

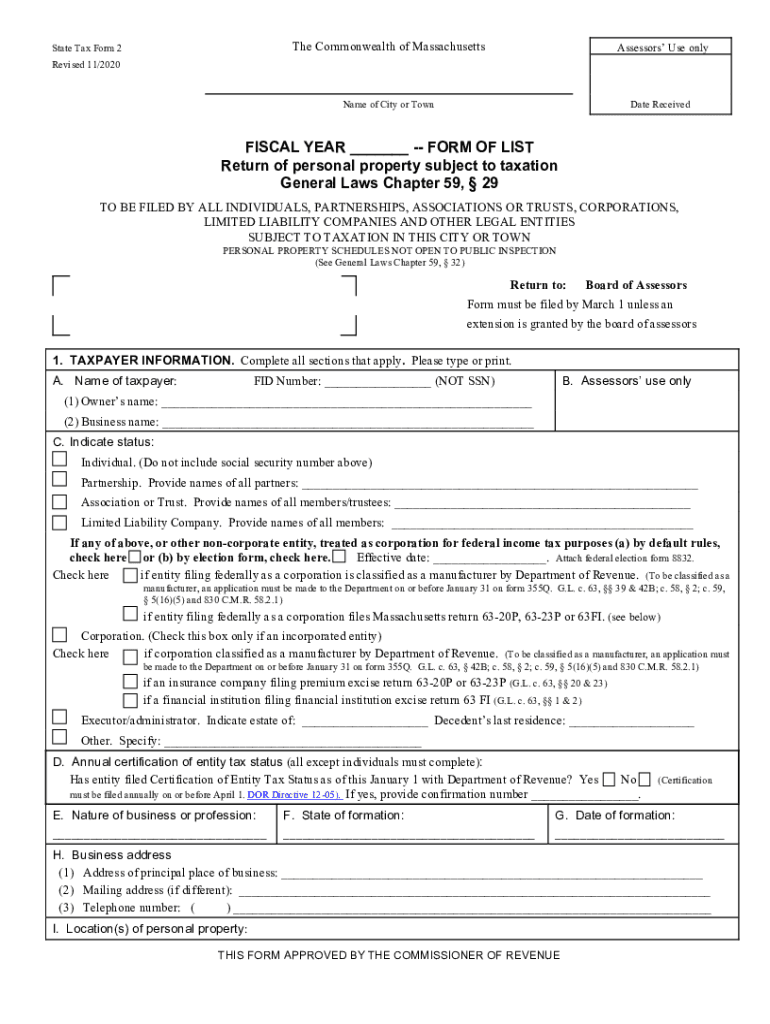

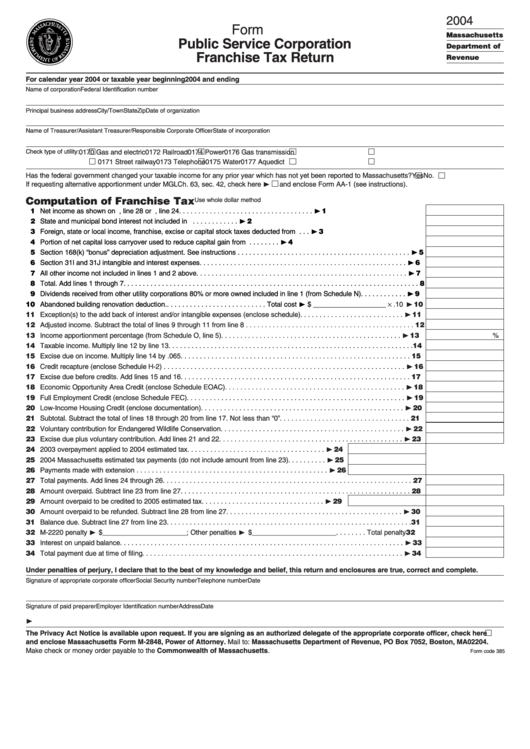

Ma Tax Return Forms

Ma Tax Return Forms - To qualify for the deduction, the following must be true: Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. This page details specific information and instructions that may apply to your state. Dor has released its draft 2024 massachusetts personal income tax forms. Form 1 is the general individual income tax return for massachusetts state residents. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. Dor has released its 2023 ma personal income tax forms. Massachusetts income tax return instructions. These forms are subject to change only by federal or state legislative action. You may file by mail on paper forms or online thorugh efiling.

To qualify for the deduction, the following must be true: This page details specific information and instructions that may apply to your state. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Dor has released its 2023 ma personal income tax forms. Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. Massachusetts income tax return instructions. Dor has released its draft 2024 massachusetts personal income tax forms. Form 1 is the general individual income tax return for massachusetts state residents. These forms are subject to change only by federal or state legislative action. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line.

You may file by mail on paper forms or online thorugh efiling. Dor has released its draft 2024 massachusetts personal income tax forms. To qualify for the deduction, the following must be true: Dor has released its 2023 ma personal income tax forms. These forms are subject to change only by federal or state legislative action. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. This page details specific information and instructions that may apply to your state. Form 1 is the general individual income tax return for massachusetts state residents. Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. Massachusetts income tax return instructions.

Fillable Texas Tax Exempt Form Printable Forms Free Online

Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. Dor has released its 2023 ma personal income tax forms. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. These forms are subject to change only by federal or state legislative action. Form 1.

Massachusetts cities Fill out & sign online DocHub

Dor has released its 2023 ma personal income tax forms. Dor has released its draft 2024 massachusetts personal income tax forms. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. Massachusetts income tax return instructions. You may file by mail on paper forms or online thorugh efiling.

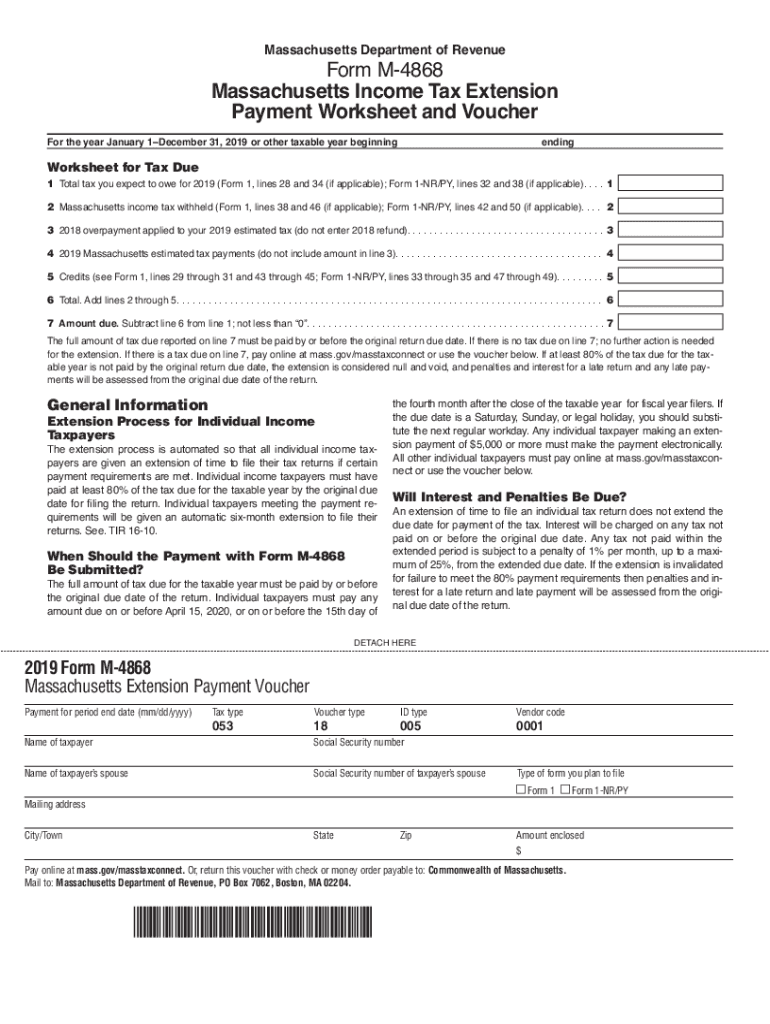

MA PV 20192021 Fill out Tax Template Online US Legal Forms

This page details specific information and instructions that may apply to your state. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. To qualify for the deduction, the following must be true: Massachusetts income tax return instructions. Form 1 is the general individual income tax return for massachusetts state residents.

Printable Ma Tax Forms Printable Forms Free Online

Dor has released its 2023 ma personal income tax forms. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. You may file by mail on paper forms or online thorugh efiling. Form 1 is the general individual income tax return for massachusetts state residents. Here you will find an updated listing of all massachusetts.

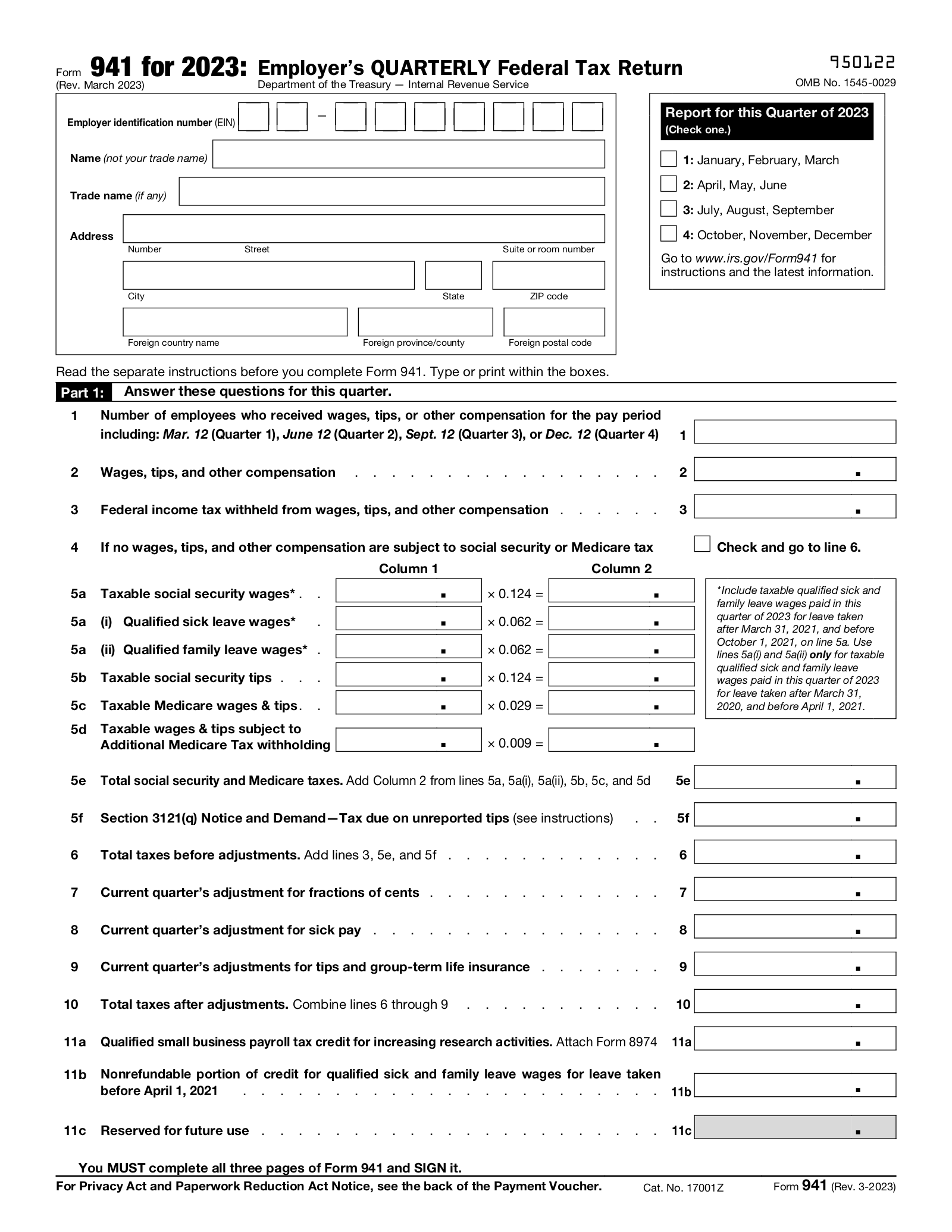

Form 941 Employer’s Quarterly Federal Tax Return eForms

Form 1 is the general individual income tax return for massachusetts state residents. To qualify for the deduction, the following must be true: These forms are subject to change only by federal or state legislative action. This page details specific information and instructions that may apply to your state. Enter the amount of medical savings account deduction included on form.

Massachusetts Extension 20192024 Form Fill Out and Sign Printable

Dor has released its draft 2024 massachusetts personal income tax forms. Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. These forms are subject to change only by federal or state legislative action. To.

Printable Ma Tax Forms Printable Forms Free Online

Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. Massachusetts income tax return instructions. To qualify for the deduction, the following must be true: Dor has released its 2023 ma personal income tax forms.

Detailed instructions for completing your Fringe Benefit Tax Return

Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. To qualify for the deduction, the following must be true: Form 1 is the general individual income tax return for massachusetts state residents. Dor has released its 2023 ma personal income tax forms. Here you will find an updated listing of all massachusetts department of.

Nirmala Sitharaman return forms available early

You may file by mail on paper forms or online thorugh efiling. Dor has released its draft 2024 massachusetts personal income tax forms. This page details specific information and instructions that may apply to your state. Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. Enter the amount of medical savings account.

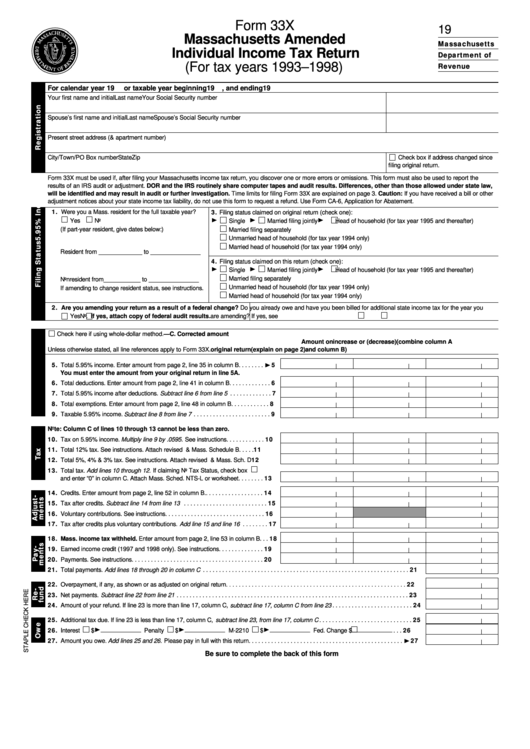

Fillable Form 33x Massachusetts Amended Individual Tax Return

This page details specific information and instructions that may apply to your state. Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. These forms are subject to change only by federal or state legislative action. Massachusetts income.

Complete The Respective Massachusetts Tax Form (S) Then Download, Print, Sign, And Mail Them To The Massachusetts.

This page details specific information and instructions that may apply to your state. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Form 1 is the general individual income tax return for massachusetts state residents.

To Qualify For The Deduction, The Following Must Be True:

Dor has released its draft 2024 massachusetts personal income tax forms. You may file by mail on paper forms or online thorugh efiling. These forms are subject to change only by federal or state legislative action. Massachusetts income tax return instructions.