Liquor Liability Insurance For Event

Liquor Liability Insurance For Event - Liquor liability insurance can help protect you if you serve or distribute alcohol at your event. This type of liability coverage can help cover claims of bodily injury or property. Liability limits start at $500,000 and liquor liability can be excluded if there is no. Our venue preferred special event liability insurance protects event holders and vendors from lawsuits involving injuries and damage to property with 24/7 claims reporting. Thimble includes this coverage in many special. Liquor liability insurance provides protection from the financial consequences of damages incurred because of alcohol consumption at an event. Perfect for bartenders, caterers, wedding host venues, and more! Event insurance can range from $75 to $235, depending on coverage limits and coverage options chosen.

Perfect for bartenders, caterers, wedding host venues, and more! Our venue preferred special event liability insurance protects event holders and vendors from lawsuits involving injuries and damage to property with 24/7 claims reporting. Liquor liability insurance can help protect you if you serve or distribute alcohol at your event. Liability limits start at $500,000 and liquor liability can be excluded if there is no. Event insurance can range from $75 to $235, depending on coverage limits and coverage options chosen. This type of liability coverage can help cover claims of bodily injury or property. Thimble includes this coverage in many special. Liquor liability insurance provides protection from the financial consequences of damages incurred because of alcohol consumption at an event.

Liability limits start at $500,000 and liquor liability can be excluded if there is no. Thimble includes this coverage in many special. This type of liability coverage can help cover claims of bodily injury or property. Liquor liability insurance can help protect you if you serve or distribute alcohol at your event. Event insurance can range from $75 to $235, depending on coverage limits and coverage options chosen. Liquor liability insurance provides protection from the financial consequences of damages incurred because of alcohol consumption at an event. Perfect for bartenders, caterers, wedding host venues, and more! Our venue preferred special event liability insurance protects event holders and vendors from lawsuits involving injuries and damage to property with 24/7 claims reporting.

Liquor Liability is not just for Restaurants and Bars Trutela Insurance

Liability limits start at $500,000 and liquor liability can be excluded if there is no. This type of liability coverage can help cover claims of bodily injury or property. Liquor liability insurance can help protect you if you serve or distribute alcohol at your event. Thimble includes this coverage in many special. Event insurance can range from $75 to $235,.

Event Insurance Exploring Host Liquor Liability vs. Liquor Liability

Event insurance can range from $75 to $235, depending on coverage limits and coverage options chosen. Liability limits start at $500,000 and liquor liability can be excluded if there is no. Liquor liability insurance can help protect you if you serve or distribute alcohol at your event. Our venue preferred special event liability insurance protects event holders and vendors from.

Certificate Of Insurance / Liquor Liability — Rent At God'S regarding

Liability limits start at $500,000 and liquor liability can be excluded if there is no. Liquor liability insurance provides protection from the financial consequences of damages incurred because of alcohol consumption at an event. Liquor liability insurance can help protect you if you serve or distribute alcohol at your event. Thimble includes this coverage in many special. Event insurance can.

Event Insurance, Liability, Cancellation, Liquor Liability Wedding

Our venue preferred special event liability insurance protects event holders and vendors from lawsuits involving injuries and damage to property with 24/7 claims reporting. Liability limits start at $500,000 and liquor liability can be excluded if there is no. This type of liability coverage can help cover claims of bodily injury or property. Liquor liability insurance provides protection from the.

Liquor Liability Southern General Agency

Liability limits start at $500,000 and liquor liability can be excluded if there is no. Liquor liability insurance provides protection from the financial consequences of damages incurred because of alcohol consumption at an event. This type of liability coverage can help cover claims of bodily injury or property. Liquor liability insurance can help protect you if you serve or distribute.

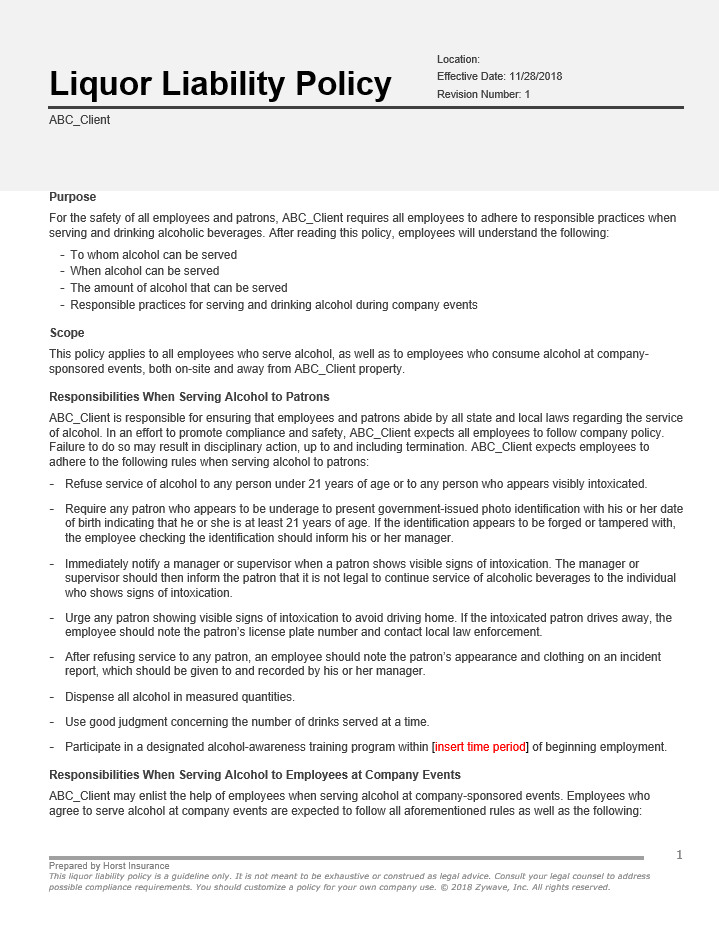

Liquor Liability Policy Horst Insurance

Thimble includes this coverage in many special. Liquor liability insurance can help protect you if you serve or distribute alcohol at your event. Liquor liability insurance provides protection from the financial consequences of damages incurred because of alcohol consumption at an event. Our venue preferred special event liability insurance protects event holders and vendors from lawsuits involving injuries and damage.

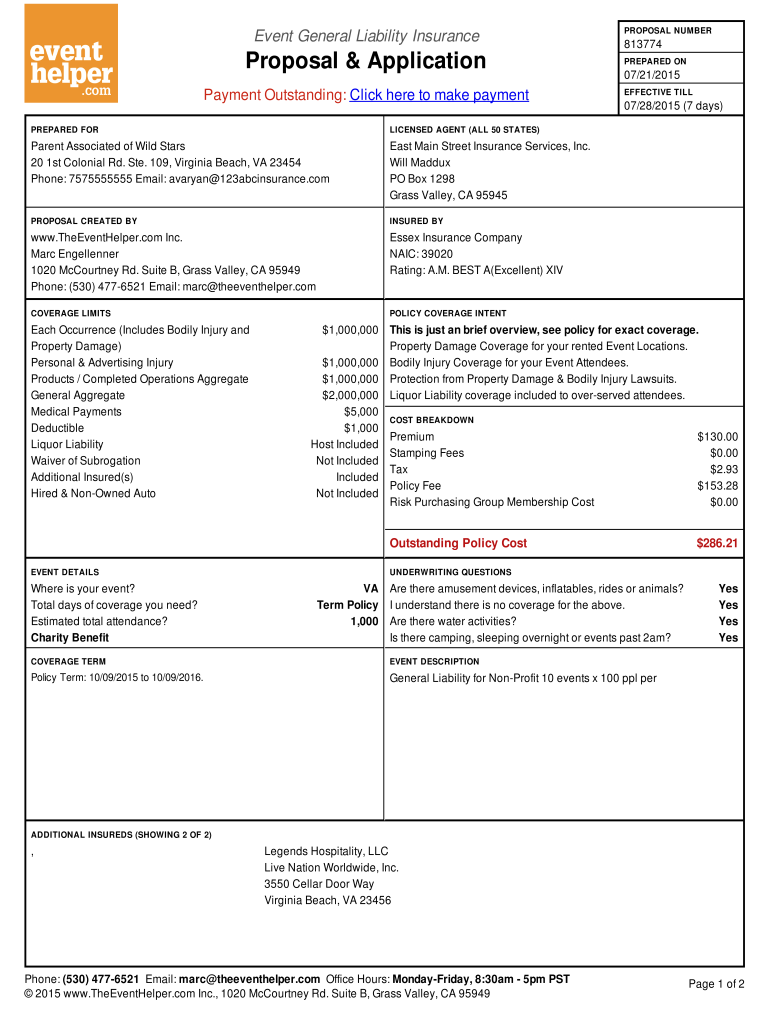

Cheapest one day event insurance Fill out & sign online DocHub

Perfect for bartenders, caterers, wedding host venues, and more! Our venue preferred special event liability insurance protects event holders and vendors from lawsuits involving injuries and damage to property with 24/7 claims reporting. Liability limits start at $500,000 and liquor liability can be excluded if there is no. Thimble includes this coverage in many special. Liquor liability insurance can help.

Liquor Liability Insurance Providence Risk Group New Jersey

Our venue preferred special event liability insurance protects event holders and vendors from lawsuits involving injuries and damage to property with 24/7 claims reporting. Liability limits start at $500,000 and liquor liability can be excluded if there is no. This type of liability coverage can help cover claims of bodily injury or property. Liquor liability insurance provides protection from the.

Liquor Liability Is Your Event Covered? McGowan Allied Specialty

This type of liability coverage can help cover claims of bodily injury or property. Our venue preferred special event liability insurance protects event holders and vendors from lawsuits involving injuries and damage to property with 24/7 claims reporting. Liability limits start at $500,000 and liquor liability can be excluded if there is no. Liquor liability insurance can help protect you.

Liquor Liability Insurance Newfoundland Crosbie Job Insurance

Thimble includes this coverage in many special. This type of liability coverage can help cover claims of bodily injury or property. Liquor liability insurance provides protection from the financial consequences of damages incurred because of alcohol consumption at an event. Event insurance can range from $75 to $235, depending on coverage limits and coverage options chosen. Our venue preferred special.

Liability Limits Start At $500,000 And Liquor Liability Can Be Excluded If There Is No.

Thimble includes this coverage in many special. This type of liability coverage can help cover claims of bodily injury or property. Perfect for bartenders, caterers, wedding host venues, and more! Liquor liability insurance can help protect you if you serve or distribute alcohol at your event.

Event Insurance Can Range From $75 To $235, Depending On Coverage Limits And Coverage Options Chosen.

Our venue preferred special event liability insurance protects event holders and vendors from lawsuits involving injuries and damage to property with 24/7 claims reporting. Liquor liability insurance provides protection from the financial consequences of damages incurred because of alcohol consumption at an event.