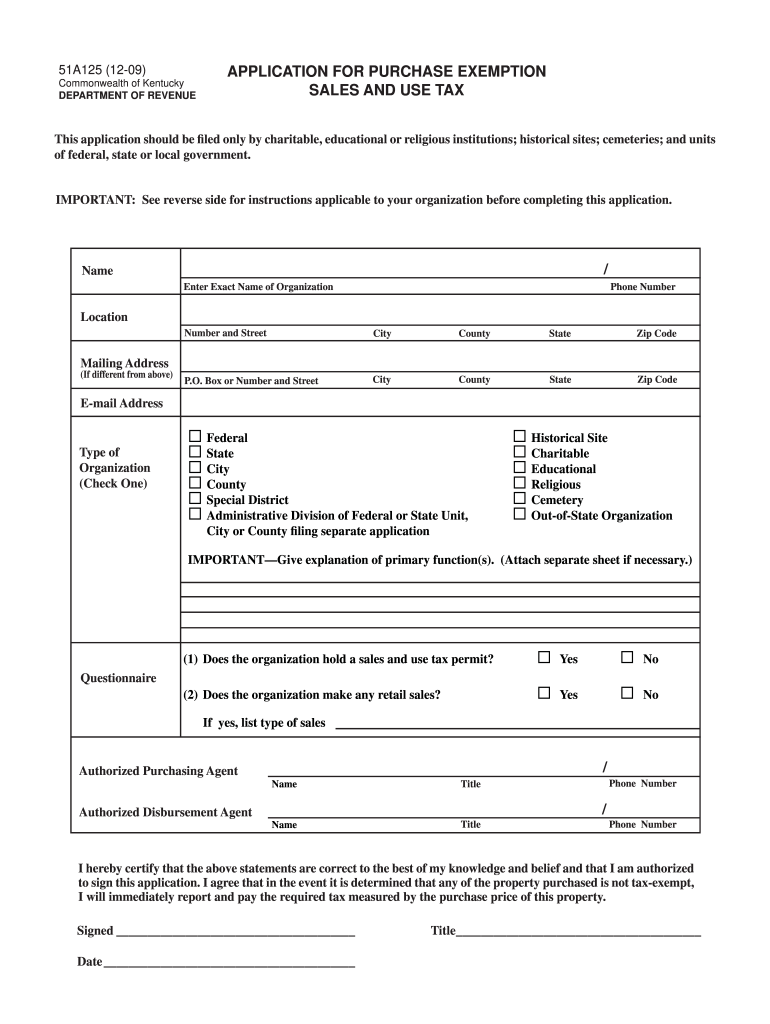

Kentucky Sales Tax Exemption Form

Kentucky Sales Tax Exemption Form - Provide the id number to claim exemption from sales tax that is required by the taxing state. Hb 487, effective july 1, 2018, requires remote retailers with 200 or more sales into the state or $100,000 or more in gross receipts from sales into the state to register. Download or print the 2023 kentucky form 51a126 (sales tax purchase exemption certificate) for free from the kentucky department of revenue. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now. Check with that state to determine your exemption requirements and status.

Download or print the 2023 kentucky form 51a126 (sales tax purchase exemption certificate) for free from the kentucky department of revenue. Hb 487, effective july 1, 2018, requires remote retailers with 200 or more sales into the state or $100,000 or more in gross receipts from sales into the state to register. Provide the id number to claim exemption from sales tax that is required by the taxing state. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now. Check with that state to determine your exemption requirements and status.

Download or print the 2023 kentucky form 51a126 (sales tax purchase exemption certificate) for free from the kentucky department of revenue. Check with that state to determine your exemption requirements and status. Provide the id number to claim exemption from sales tax that is required by the taxing state. Hb 487, effective july 1, 2018, requires remote retailers with 200 or more sales into the state or $100,000 or more in gross receipts from sales into the state to register. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now.

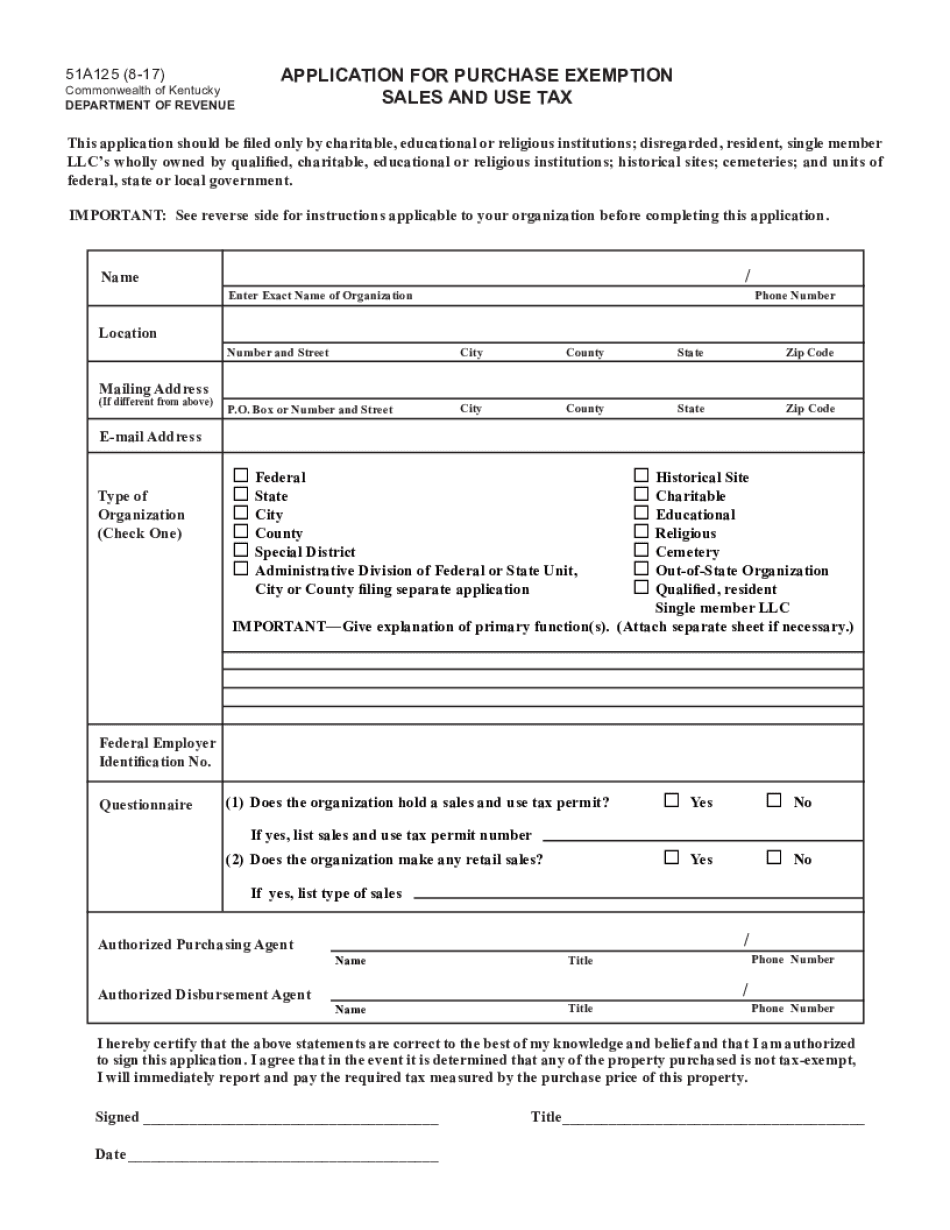

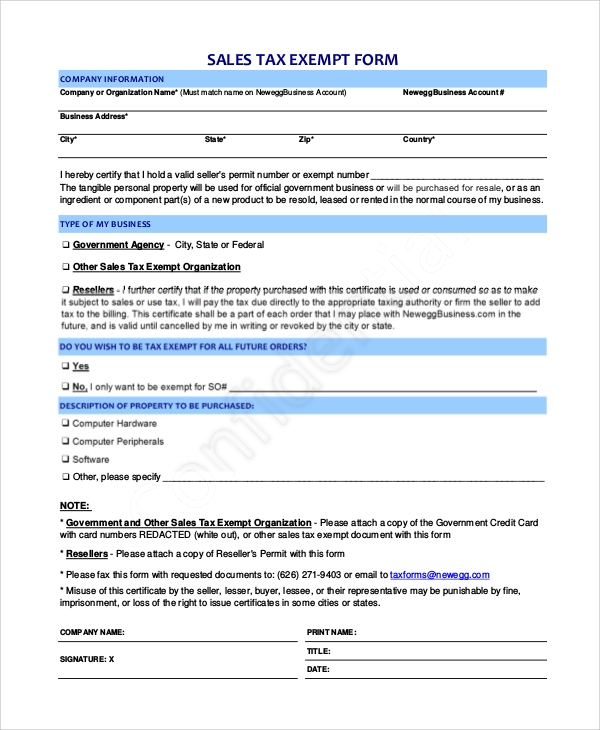

16 H Form For Tax Exemption

Download or print the 2023 kentucky form 51a126 (sales tax purchase exemption certificate) for free from the kentucky department of revenue. Provide the id number to claim exemption from sales tax that is required by the taxing state. Hb 487, effective july 1, 2018, requires remote retailers with 200 or more sales into the state or $100,000 or more in.

kansas sales and use tax exemption form Virulent Ejournal Photo Galery

Check with that state to determine your exemption requirements and status. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now. Hb 487, effective july 1, 2018, requires remote retailers with 200 or more sales into the state or $100,000 or more in.

What Does Tax Exempt Foreign Mean at Estelle Hammock blog

Check with that state to determine your exemption requirements and status. Download or print the 2023 kentucky form 51a126 (sales tax purchase exemption certificate) for free from the kentucky department of revenue. Hb 487, effective july 1, 2018, requires remote retailers with 200 or more sales into the state or $100,000 or more in gross receipts from sales into the.

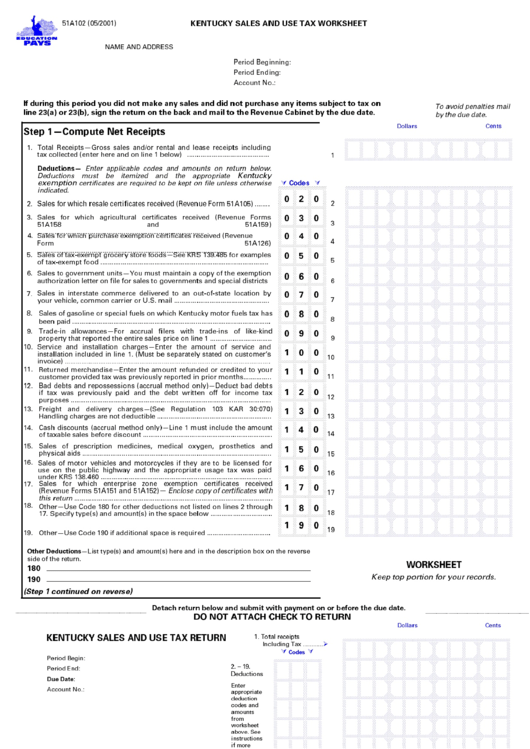

Form 51a102 Kentucky Sales And Use Tax Worksheet printable pdf download

(july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now. Hb 487, effective july 1, 2018, requires remote retailers with 200 or more sales into the state or $100,000 or more in gross receipts from sales into the state to register. Check with.

Kentucky Exemption Sales Tax PDF 20172024 Form Fill Out and Sign

Provide the id number to claim exemption from sales tax that is required by the taxing state. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now. Check with that state to determine your exemption requirements and status. Download or print the 2023.

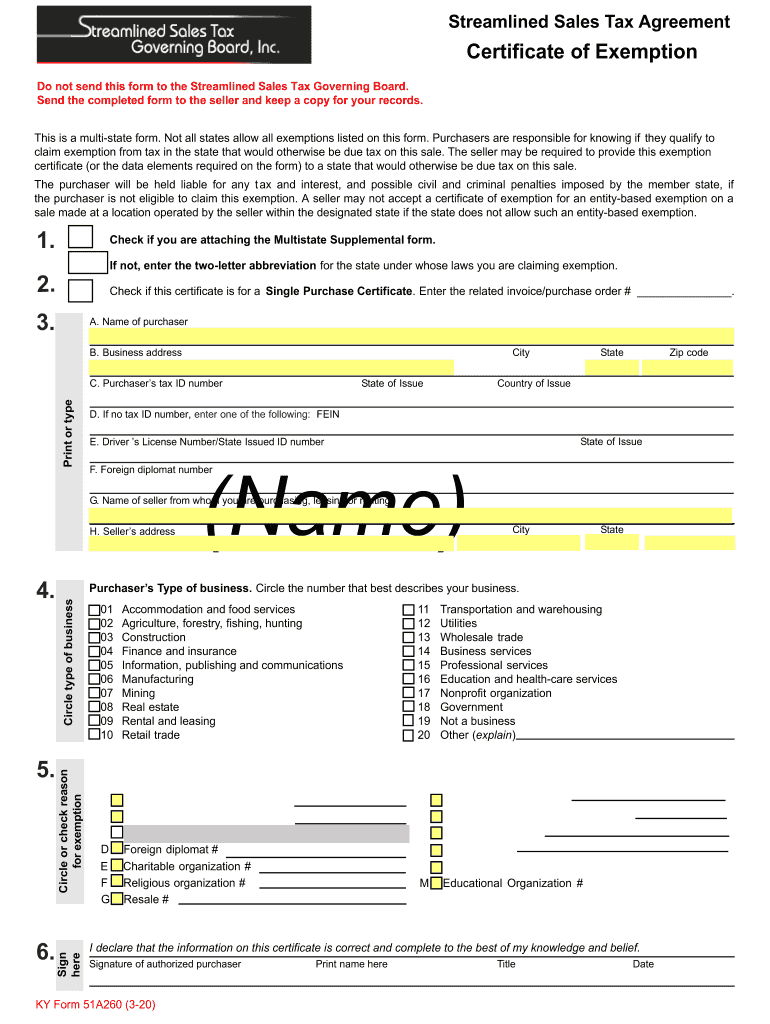

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller

Check with that state to determine your exemption requirements and status. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now. Download or print the 2023 kentucky form 51a126 (sales tax purchase exemption certificate) for free from the kentucky department of revenue. Hb.

Ky State Sales Tax 2024 Gigi Persis

Hb 487, effective july 1, 2018, requires remote retailers with 200 or more sales into the state or $100,000 or more in gross receipts from sales into the state to register. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now. Download or.

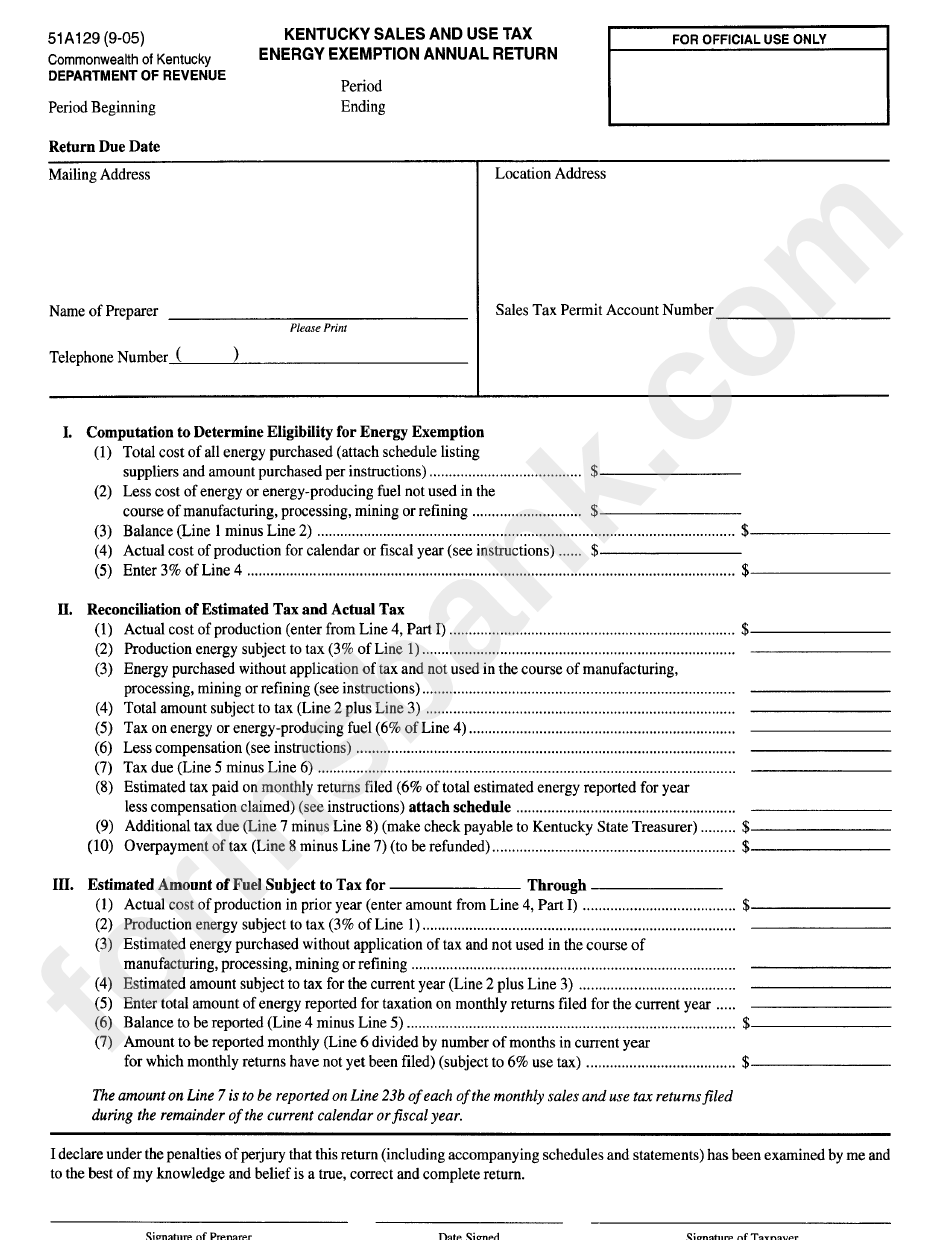

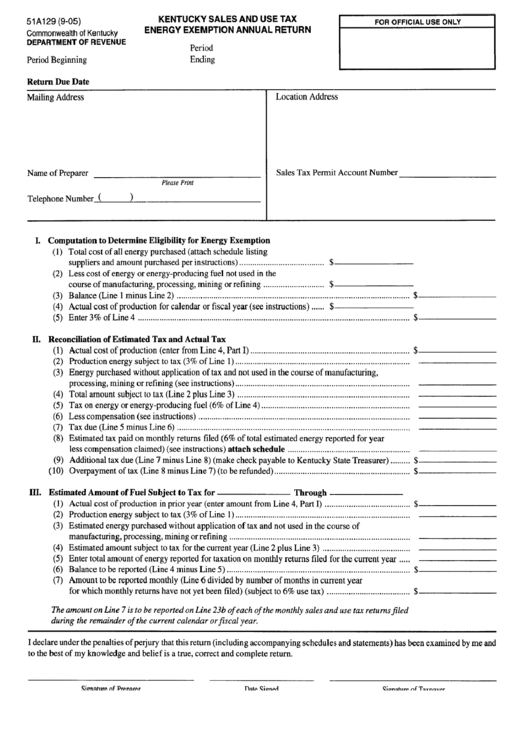

Kentucky Sales And Use Tax Energy Exemption Annual Return Form

(july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now. Download or print the 2023 kentucky form 51a126 (sales tax purchase exemption certificate) for free from the kentucky department of revenue. Check with that state to determine your exemption requirements and status. Provide.

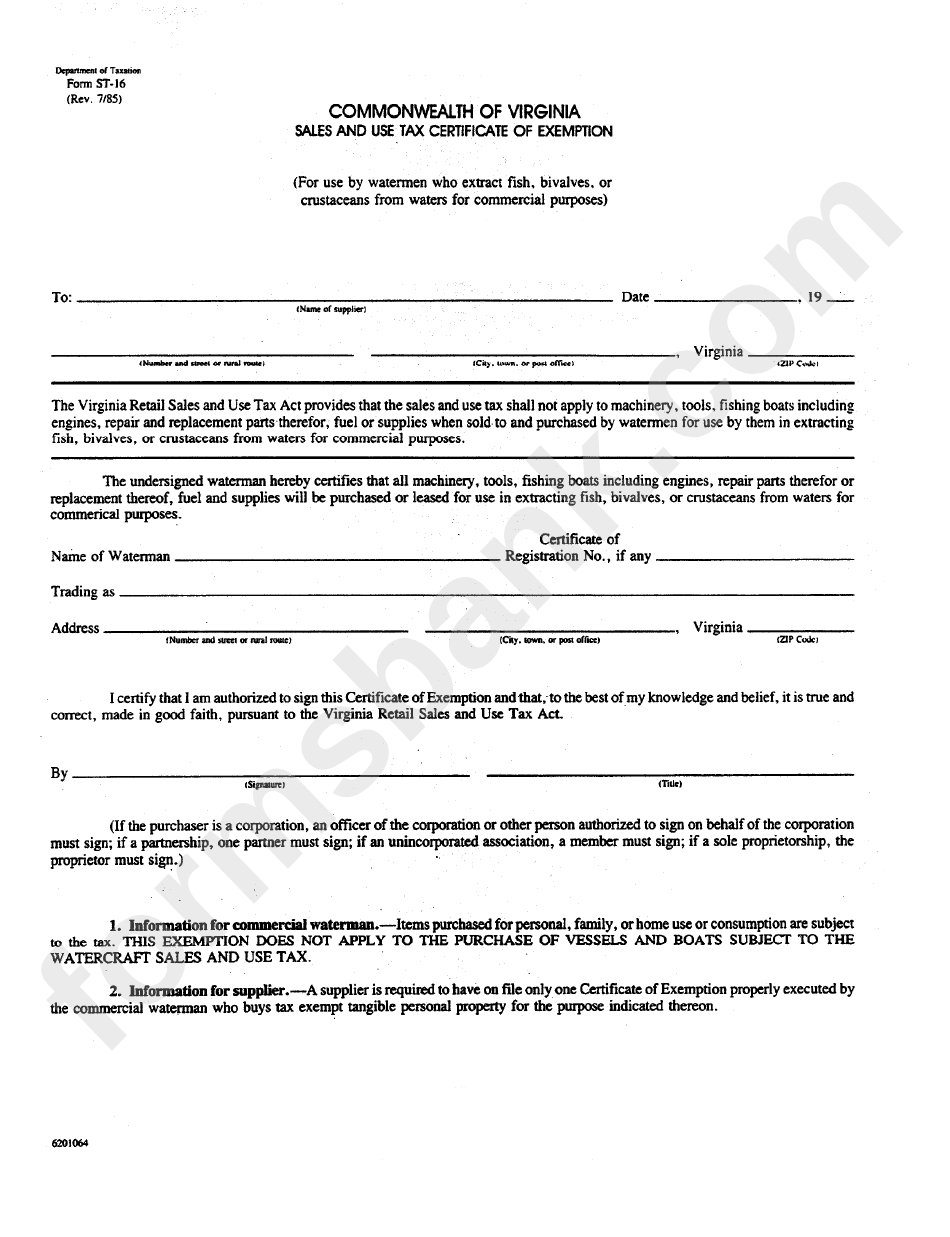

Va Tax Exempt Form 2024

Hb 487, effective july 1, 2018, requires remote retailers with 200 or more sales into the state or $100,000 or more in gross receipts from sales into the state to register. Check with that state to determine your exemption requirements and status. Download or print the 2023 kentucky form 51a126 (sales tax purchase exemption certificate) for free from the kentucky.

Kentucky Sales Tax Farm Exemption Form Fill Online, Printable

Download or print the 2023 kentucky form 51a126 (sales tax purchase exemption certificate) for free from the kentucky department of revenue. Check with that state to determine your exemption requirements and status. Provide the id number to claim exemption from sales tax that is required by the taxing state. Hb 487, effective july 1, 2018, requires remote retailers with 200.

Hb 487, Effective July 1, 2018, Requires Remote Retailers With 200 Or More Sales Into The State Or $100,000 Or More In Gross Receipts From Sales Into The State To Register.

(july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105) to include the services that are now. Download or print the 2023 kentucky form 51a126 (sales tax purchase exemption certificate) for free from the kentucky department of revenue. Check with that state to determine your exemption requirements and status. Provide the id number to claim exemption from sales tax that is required by the taxing state.