Kentucky Form Pte Instructions 2022

Kentucky Form Pte Instructions 2022 - It is retroactive to january 1, 2022, which means it available for returns filed during. Form pte (2022) section a—income (loss) and deductions total amount. 1 kentucky ordinary income (loss) from trade or business activites.

Form pte (2022) section a—income (loss) and deductions total amount. 1 kentucky ordinary income (loss) from trade or business activites. It is retroactive to january 1, 2022, which means it available for returns filed during.

Form pte (2022) section a—income (loss) and deductions total amount. It is retroactive to january 1, 2022, which means it available for returns filed during. 1 kentucky ordinary income (loss) from trade or business activites.

Kentucky Form PTE Instructions (Kentucky PassThrough Entity and

Form pte (2022) section a—income (loss) and deductions total amount. 1 kentucky ordinary income (loss) from trade or business activites. It is retroactive to january 1, 2022, which means it available for returns filed during.

Kentucky enacts passthrough entity tax election Crowe LLP

1 kentucky ordinary income (loss) from trade or business activites. It is retroactive to january 1, 2022, which means it available for returns filed during. Form pte (2022) section a—income (loss) and deductions total amount.

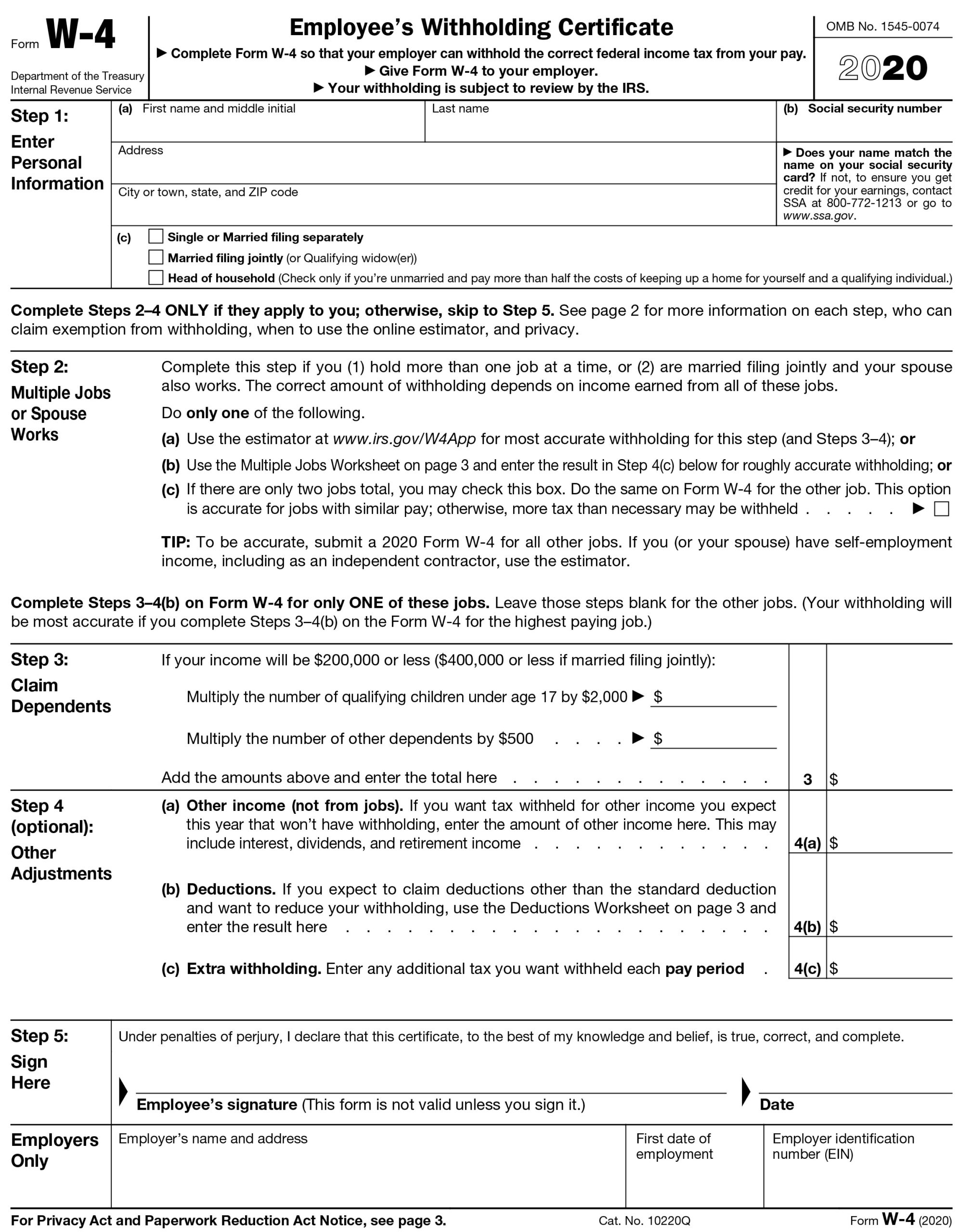

Kentucky Employee Withholding Form 2022

It is retroactive to january 1, 2022, which means it available for returns filed during. Form pte (2022) section a—income (loss) and deductions total amount. 1 kentucky ordinary income (loss) from trade or business activites.

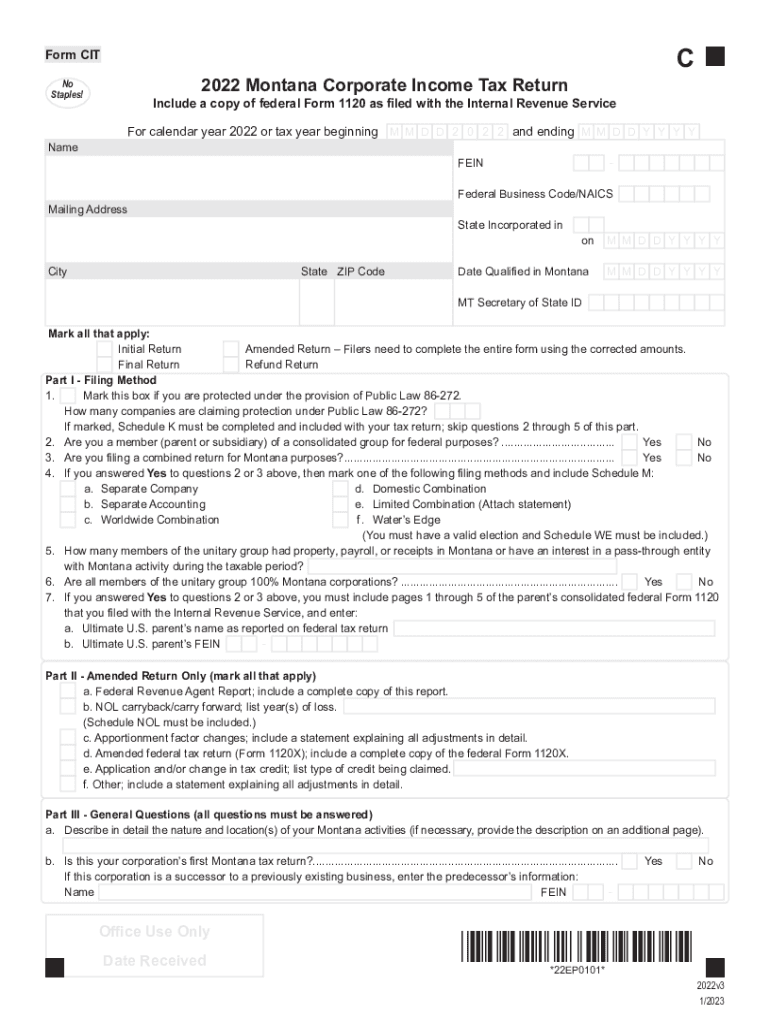

Montana form pte instructions Fill out & sign online DocHub

1 kentucky ordinary income (loss) from trade or business activites. It is retroactive to january 1, 2022, which means it available for returns filed during. Form pte (2022) section a—income (loss) and deductions total amount.

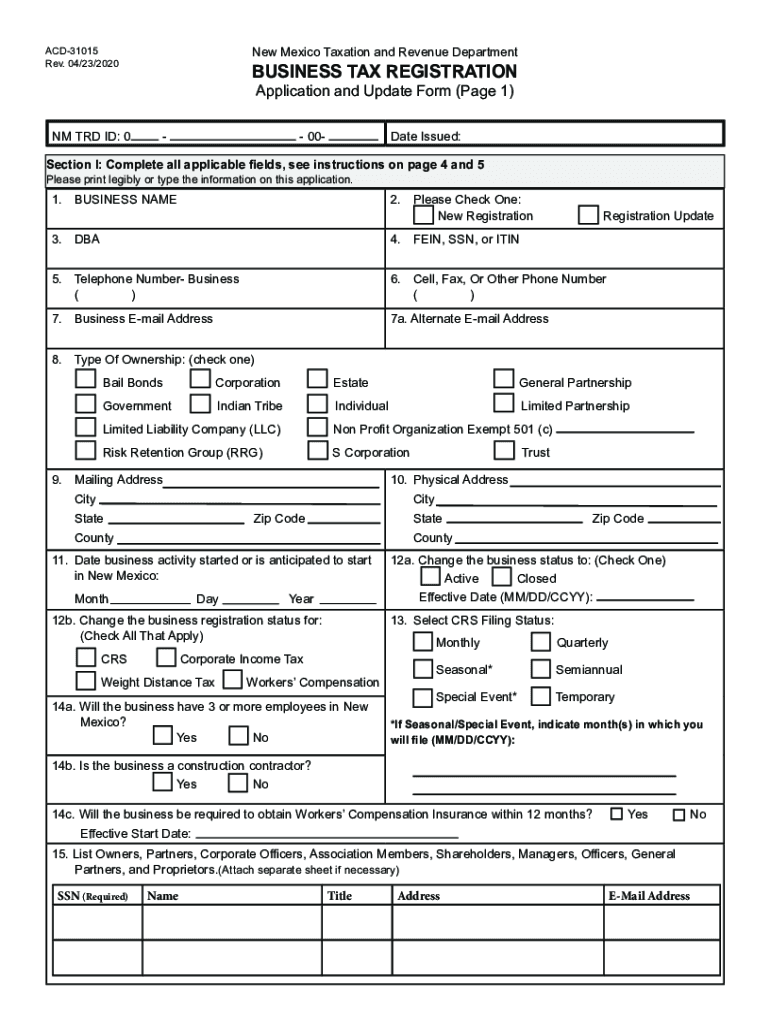

New mexico form pte instructions Fill out & sign online DocHub

It is retroactive to january 1, 2022, which means it available for returns filed during. Form pte (2022) section a—income (loss) and deductions total amount. 1 kentucky ordinary income (loss) from trade or business activites.

Montana Pte Instructions 20222024 Form Fill Out and Sign Printable

Form pte (2022) section a—income (loss) and deductions total amount. It is retroactive to january 1, 2022, which means it available for returns filed during. 1 kentucky ordinary income (loss) from trade or business activites.

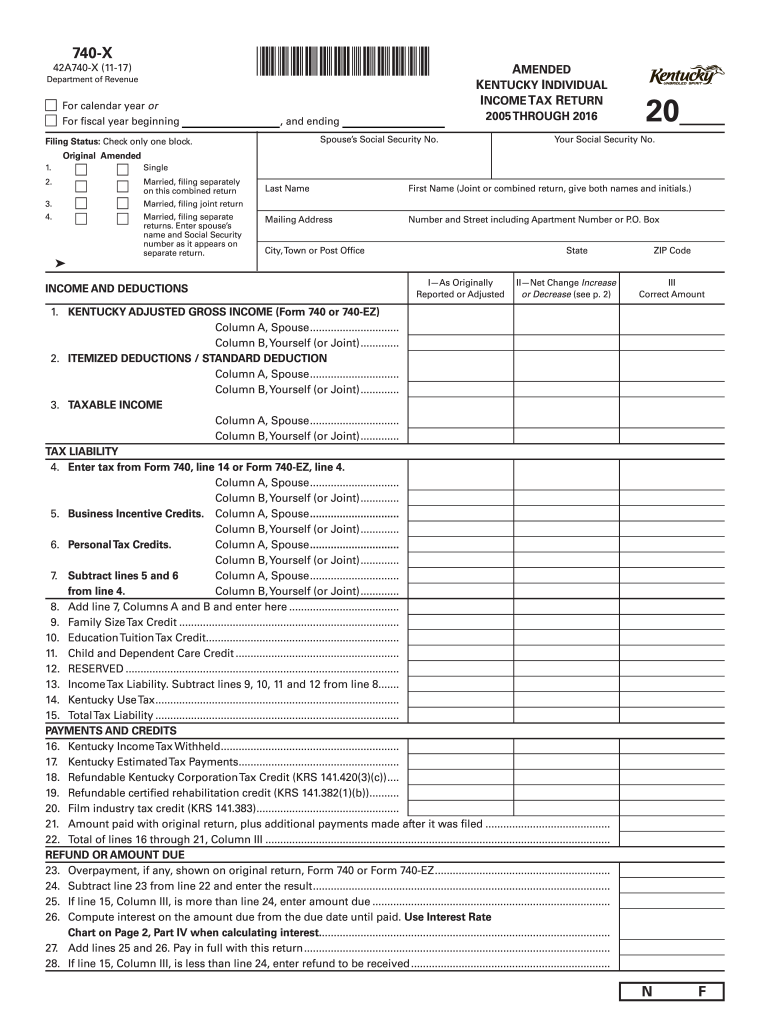

Ky Form 740 Es 2023 Printable Forms Free Online

1 kentucky ordinary income (loss) from trade or business activites. Form pte (2022) section a—income (loss) and deductions total amount. It is retroactive to january 1, 2022, which means it available for returns filed during.

Fillable Online Kentucky Form PTE Instructions (Kentucky PassThrough

Form pte (2022) section a—income (loss) and deductions total amount. It is retroactive to january 1, 2022, which means it available for returns filed during. 1 kentucky ordinary income (loss) from trade or business activites.

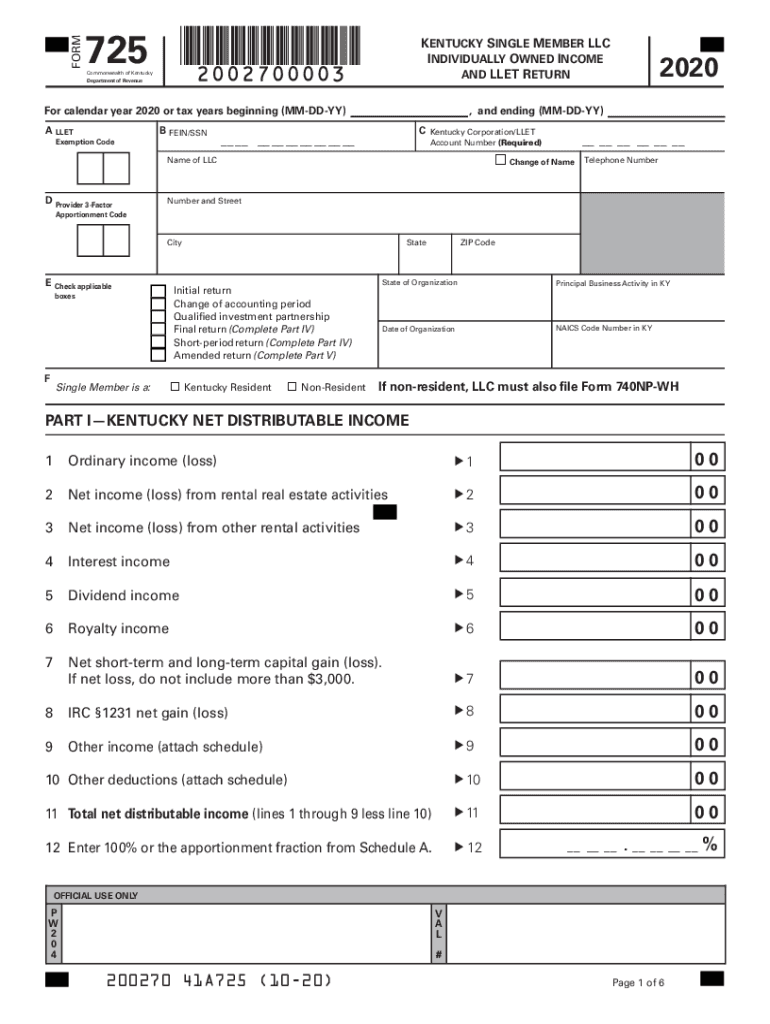

20202022 Form KY DoR 725 (41A725) Fill Online, Printable, Fillable

Form pte (2022) section a—income (loss) and deductions total amount. It is retroactive to january 1, 2022, which means it available for returns filed during. 1 kentucky ordinary income (loss) from trade or business activites.

1 Kentucky Ordinary Income (Loss) From Trade Or Business Activites.

Form pte (2022) section a—income (loss) and deductions total amount. It is retroactive to january 1, 2022, which means it available for returns filed during.