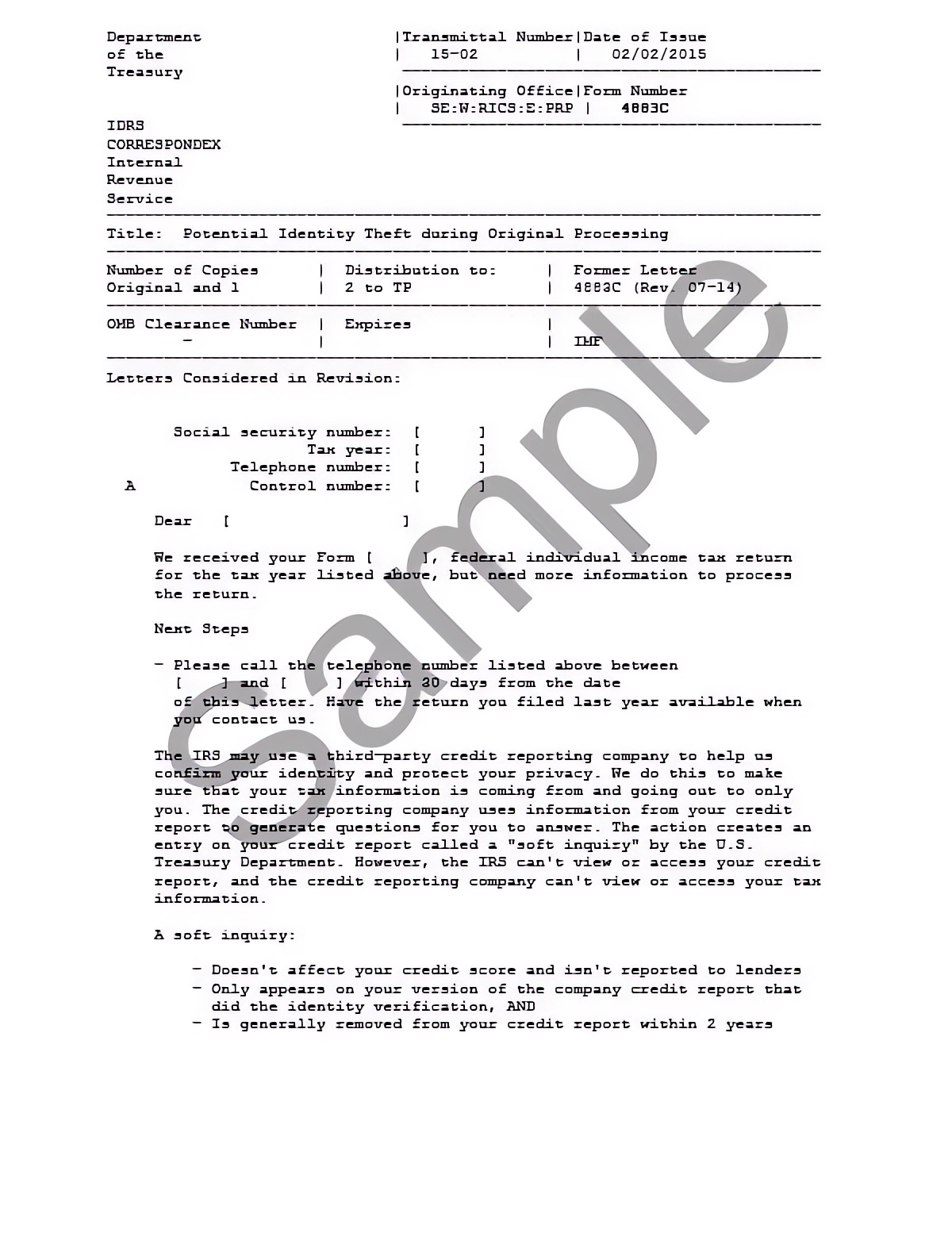

Irs Form 4883C

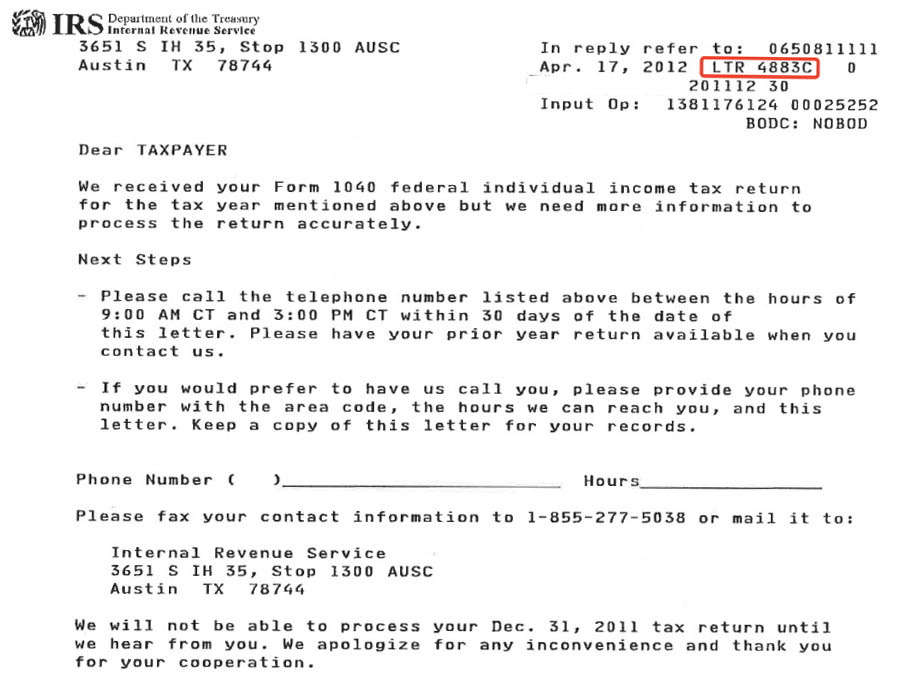

Irs Form 4883C - The irs sends letter 4883c when they have received your return but they need more information to process it. If you received letter 4883c, you need to call the taxpayer protection program hotline to verify your identity and the tax return. It is usually sent out when the irs. Irs letter 4883c is a written correspondence from the irs requesting identity verification. I must call within 30 days or. Why you received irs letter 4883c. I received letter 4883c which instructions to call [phone number removed] to verify my identity. The irs fraud detection system flagged your tax return as a potential identity theft case.

I received letter 4883c which instructions to call [phone number removed] to verify my identity. If you received letter 4883c, you need to call the taxpayer protection program hotline to verify your identity and the tax return. The irs sends letter 4883c when they have received your return but they need more information to process it. The irs fraud detection system flagged your tax return as a potential identity theft case. Why you received irs letter 4883c. I must call within 30 days or. It is usually sent out when the irs. Irs letter 4883c is a written correspondence from the irs requesting identity verification.

I received letter 4883c which instructions to call [phone number removed] to verify my identity. Irs letter 4883c is a written correspondence from the irs requesting identity verification. Why you received irs letter 4883c. The irs fraud detection system flagged your tax return as a potential identity theft case. I must call within 30 days or. It is usually sent out when the irs. If you received letter 4883c, you need to call the taxpayer protection program hotline to verify your identity and the tax return. The irs sends letter 4883c when they have received your return but they need more information to process it.

Impuestos en Estados Unidos Todo lo que necesitas saber Página 4 de

If you received letter 4883c, you need to call the taxpayer protection program hotline to verify your identity and the tax return. The irs sends letter 4883c when they have received your return but they need more information to process it. I received letter 4883c which instructions to call [phone number removed] to verify my identity. I must call within.

4883c/5071c Letter Recipients—How fast did the IRS process your tax

Why you received irs letter 4883c. I received letter 4883c which instructions to call [phone number removed] to verify my identity. If you received letter 4883c, you need to call the taxpayer protection program hotline to verify your identity and the tax return. I must call within 30 days or. The irs sends letter 4883c when they have received your.

IRS Letter 4883C. Potential Identity Theft During Original Processing

I received letter 4883c which instructions to call [phone number removed] to verify my identity. Why you received irs letter 4883c. It is usually sent out when the irs. The irs sends letter 4883c when they have received your return but they need more information to process it. Irs letter 4883c is a written correspondence from the irs requesting identity.

IRS 4883C Letter Possible Tax Identity Theft Wiztax

Irs letter 4883c is a written correspondence from the irs requesting identity verification. Why you received irs letter 4883c. It is usually sent out when the irs. I must call within 30 days or. I received letter 4883c which instructions to call [phone number removed] to verify my identity.

IRS LTR 4883C, Potential Identify Theft

The irs sends letter 4883c when they have received your return but they need more information to process it. If you received letter 4883c, you need to call the taxpayer protection program hotline to verify your identity and the tax return. Why you received irs letter 4883c. I must call within 30 days or. I received letter 4883c which instructions.

Irs Letter 4883c Verify Online Letter Resume Template Collections

The irs sends letter 4883c when they have received your return but they need more information to process it. I must call within 30 days or. Why you received irs letter 4883c. If you received letter 4883c, you need to call the taxpayer protection program hotline to verify your identity and the tax return. I received letter 4883c which instructions.

IRS Identity Fraud Filters Working Overtime Center for Agricultural

I must call within 30 days or. If you received letter 4883c, you need to call the taxpayer protection program hotline to verify your identity and the tax return. The irs fraud detection system flagged your tax return as a potential identity theft case. Why you received irs letter 4883c. The irs sends letter 4883c when they have received your.

What to Do if You Receive the 4883c Letter from the IRS Read this

The irs fraud detection system flagged your tax return as a potential identity theft case. If you received letter 4883c, you need to call the taxpayer protection program hotline to verify your identity and the tax return. I must call within 30 days or. Why you received irs letter 4883c. Irs letter 4883c is a written correspondence from the irs.

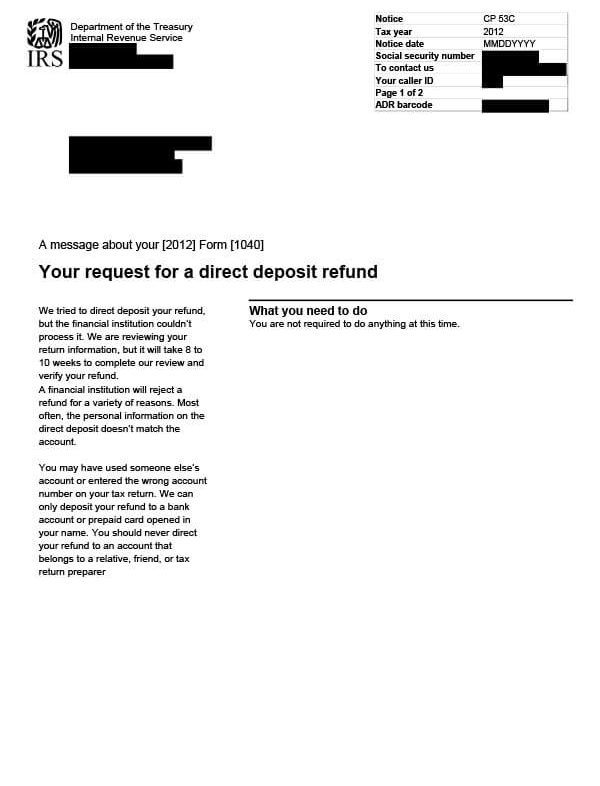

IRS Notice CP53C Tax Defense Network

The irs sends letter 4883c when they have received your return but they need more information to process it. I received letter 4883c which instructions to call [phone number removed] to verify my identity. It is usually sent out when the irs. The irs fraud detection system flagged your tax return as a potential identity theft case. Irs letter 4883c.

Irs Letter 4883C Thankyou Letter

I must call within 30 days or. If you received letter 4883c, you need to call the taxpayer protection program hotline to verify your identity and the tax return. The irs fraud detection system flagged your tax return as a potential identity theft case. Why you received irs letter 4883c. Irs letter 4883c is a written correspondence from the irs.

The Irs Fraud Detection System Flagged Your Tax Return As A Potential Identity Theft Case.

Why you received irs letter 4883c. I must call within 30 days or. I received letter 4883c which instructions to call [phone number removed] to verify my identity. Irs letter 4883c is a written correspondence from the irs requesting identity verification.

If You Received Letter 4883C, You Need To Call The Taxpayer Protection Program Hotline To Verify Your Identity And The Tax Return.

The irs sends letter 4883c when they have received your return but they need more information to process it. It is usually sent out when the irs.