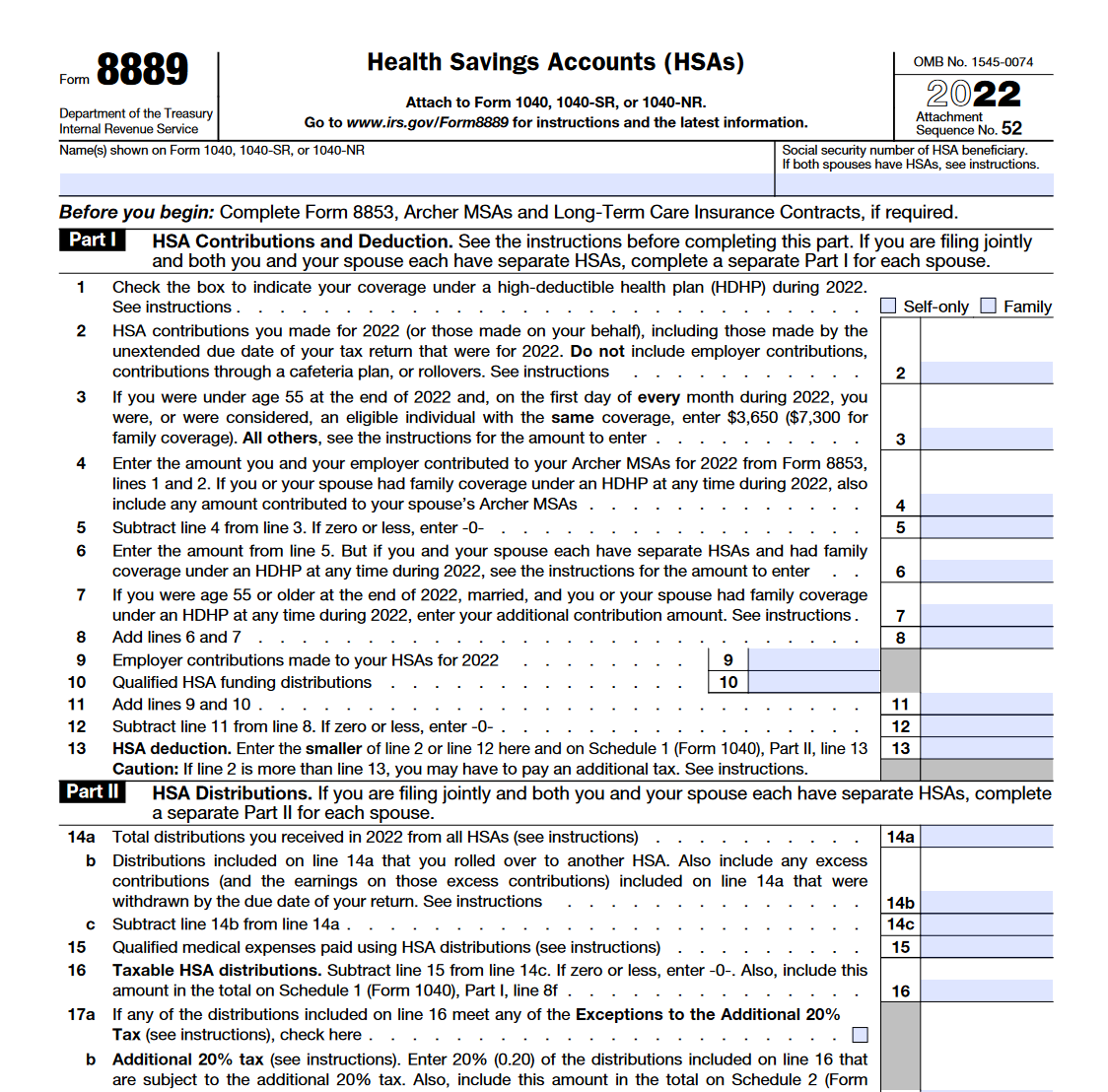

Form 8889 Instructions

Form 8889 Instructions - The amount for code w is. However, irs checking of form 8889 now appears to expect the excess being applied to be. For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. If you still think there should be an amount on line 7, go back through. It has never included contributions my company made to the account. Turbotax has always just added to line 13 the amount present on form 5329 line 43.

For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. If you still think there should be an amount on line 7, go back through. The amount for code w is. It has never included contributions my company made to the account. Turbotax has always just added to line 13 the amount present on form 5329 line 43. However, irs checking of form 8889 now appears to expect the excess being applied to be.

However, irs checking of form 8889 now appears to expect the excess being applied to be. The amount for code w is. It has never included contributions my company made to the account. If you still think there should be an amount on line 7, go back through. For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. Turbotax has always just added to line 13 the amount present on form 5329 line 43.

EasyForm8889 simple instructions for HSA Tax Form 8889

It has never included contributions my company made to the account. The amount for code w is. However, irs checking of form 8889 now appears to expect the excess being applied to be. If you still think there should be an amount on line 7, go back through. Turbotax has always just added to line 13 the amount present on.

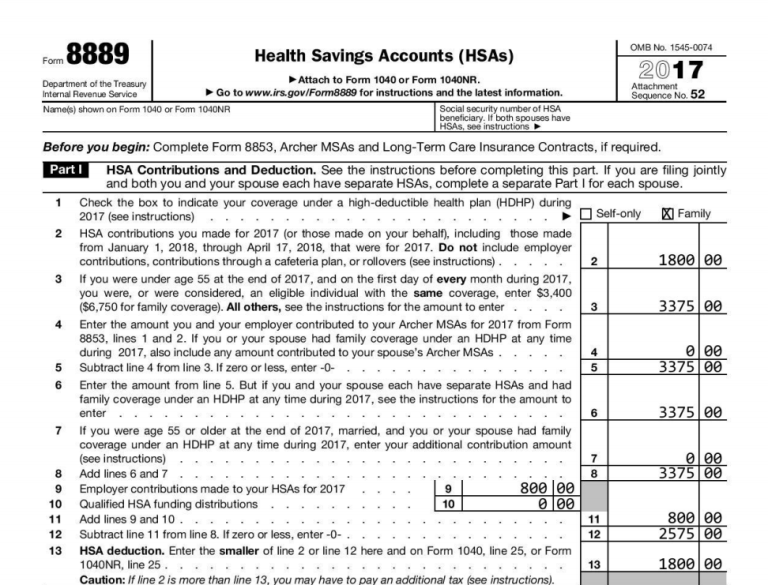

2017 Form 8889 Instructions and Examples HSA Edge

However, irs checking of form 8889 now appears to expect the excess being applied to be. The amount for code w is. For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. Turbotax has always just added to line 13 the amount present on form 5329 line 43. It has never.

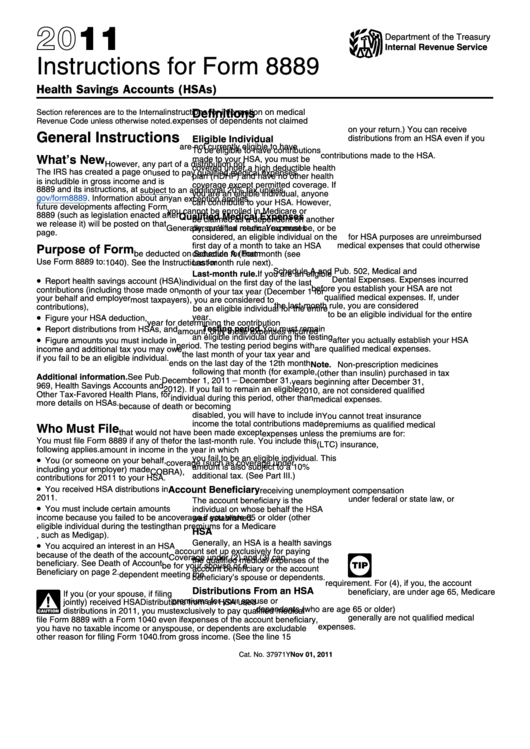

Instructions For Form 8889 Health Savings Accounts 2011 printable

The amount for code w is. If you still think there should be an amount on line 7, go back through. Turbotax has always just added to line 13 the amount present on form 5329 line 43. It has never included contributions my company made to the account. However, irs checking of form 8889 now appears to expect the excess.

Form 8889 Health Savings Accounts (HSAs) (2014) Free Download

For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. The amount for code w is. If you still think there should be an amount on line 7, go back through. Turbotax has always just added to line 13 the amount present on form 5329 line 43. However, irs checking of.

Autobiografie Model Moldova Complete with ease airSlate SignNow

If you still think there should be an amount on line 7, go back through. However, irs checking of form 8889 now appears to expect the excess being applied to be. The amount for code w is. For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. Turbotax has always just.

Fill Free fillable Form 8889 Health Savings Accounts 2019 PDF form

Turbotax has always just added to line 13 the amount present on form 5329 line 43. For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. However, irs checking of form 8889 now appears to expect the excess being applied to be. The amount for code w is. If you still.

How to file HSA Form 8889 YouTube

However, irs checking of form 8889 now appears to expect the excess being applied to be. For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. Turbotax has always just added to line 13 the amount present on form 5329 line 43. It has never included contributions my company made to.

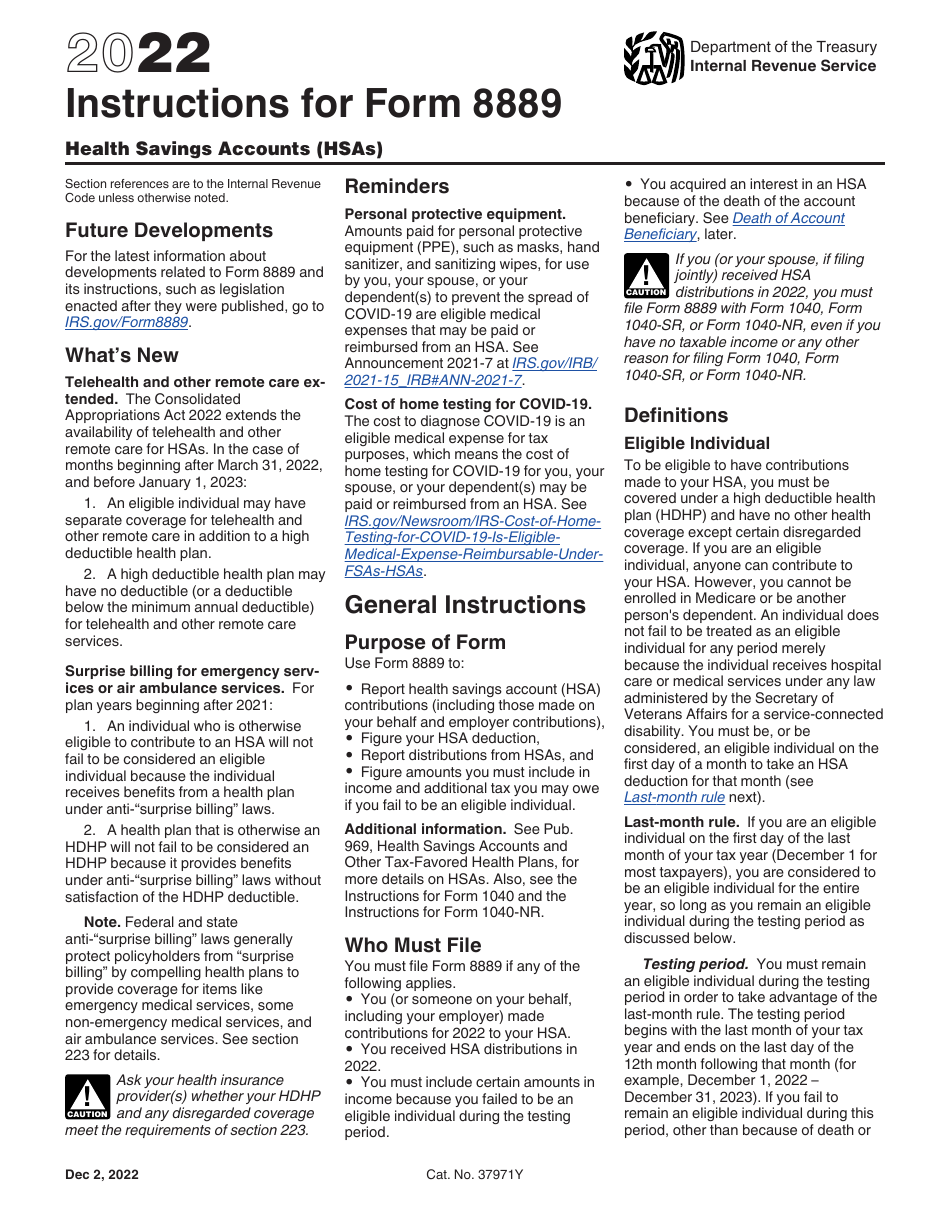

Download Instructions for IRS Form 8889 Health Savings Accounts (Hsas

It has never included contributions my company made to the account. Turbotax has always just added to line 13 the amount present on form 5329 line 43. For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. However, irs checking of form 8889 now appears to expect the excess being applied.

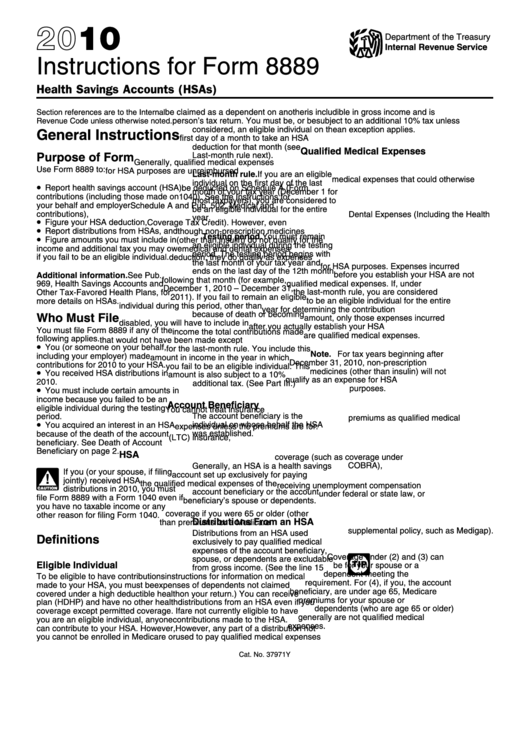

Instructions For Form 8889 Health Savings Accounts 2010 printable

Turbotax has always just added to line 13 the amount present on form 5329 line 43. It has never included contributions my company made to the account. For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. The amount for code w is. However, irs checking of form 8889 now appears.

2023 Form 8889 Printable Forms Free Online

The amount for code w is. If you still think there should be an amount on line 7, go back through. However, irs checking of form 8889 now appears to expect the excess being applied to be. For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. It has never included.

The Amount For Code W Is.

However, irs checking of form 8889 now appears to expect the excess being applied to be. If you still think there should be an amount on line 7, go back through. For additional details, see the instructions for line 7 on page 7 of the irs instructions for form 8889. It has never included contributions my company made to the account.