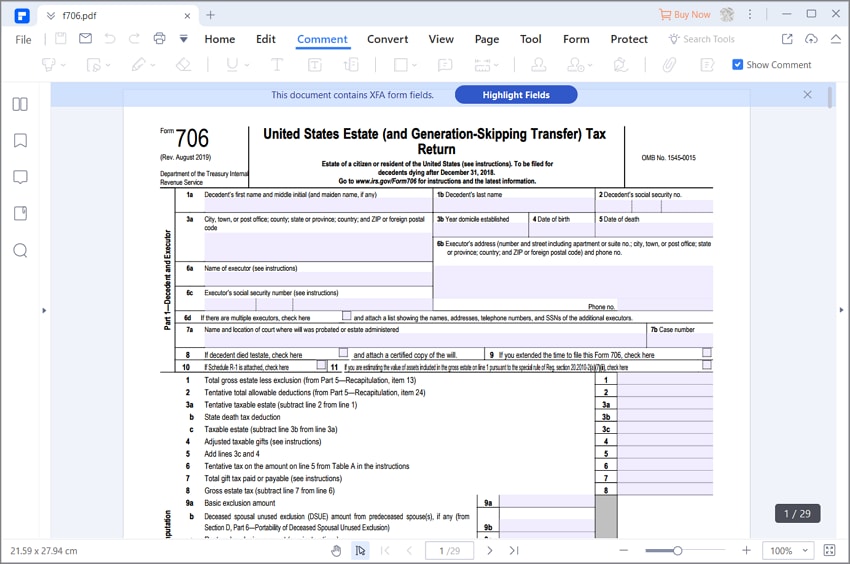

Form 706 Filing Requirements

Form 706 Filing Requirements - Form 706 must be filed by the executor of the estate of every u.s. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Information about form 706, united states estate (and generation. Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. If you are unable to file form 706 by the due date, you may receive. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Tax form 706 is required for the decedent’s estate of u.s. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue).

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Form 706 must be filed by the executor of the estate of every u.s. Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue). Tax form 706 is required for the decedent’s estate of u.s. Information about form 706, united states estate (and generation. If you are unable to file form 706 by the due date, you may receive. Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal.

Tax form 706 is required for the decedent’s estate of u.s. Information about form 706, united states estate (and generation. Form 706 must be filed by the executor of the estate of every u.s. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue). An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. If you are unable to file form 706 by the due date, you may receive.

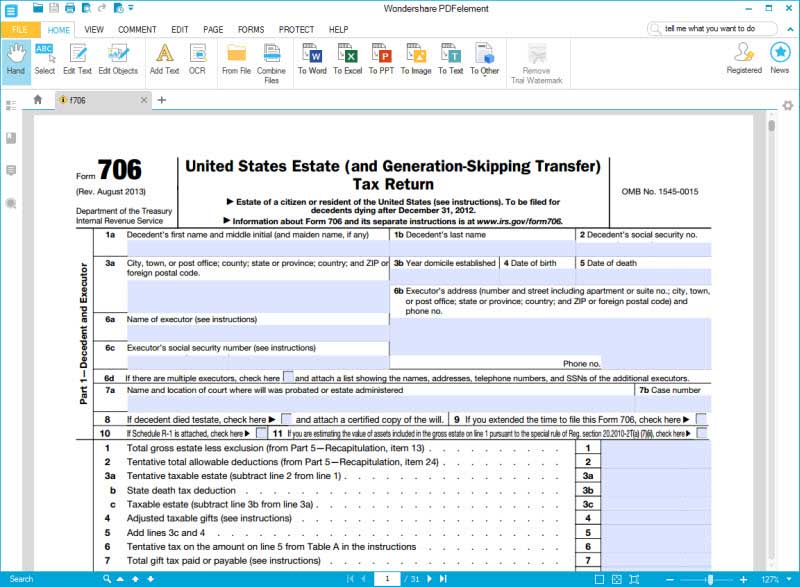

for How to Fill in IRS Form 706

Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue). Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Information about form 706, united states estate (and generation. Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the.

Fillable 706 2019 Complete with ease airSlate SignNow

You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If you are unable to file form 706 by the due date, you may receive. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Information about form 706,.

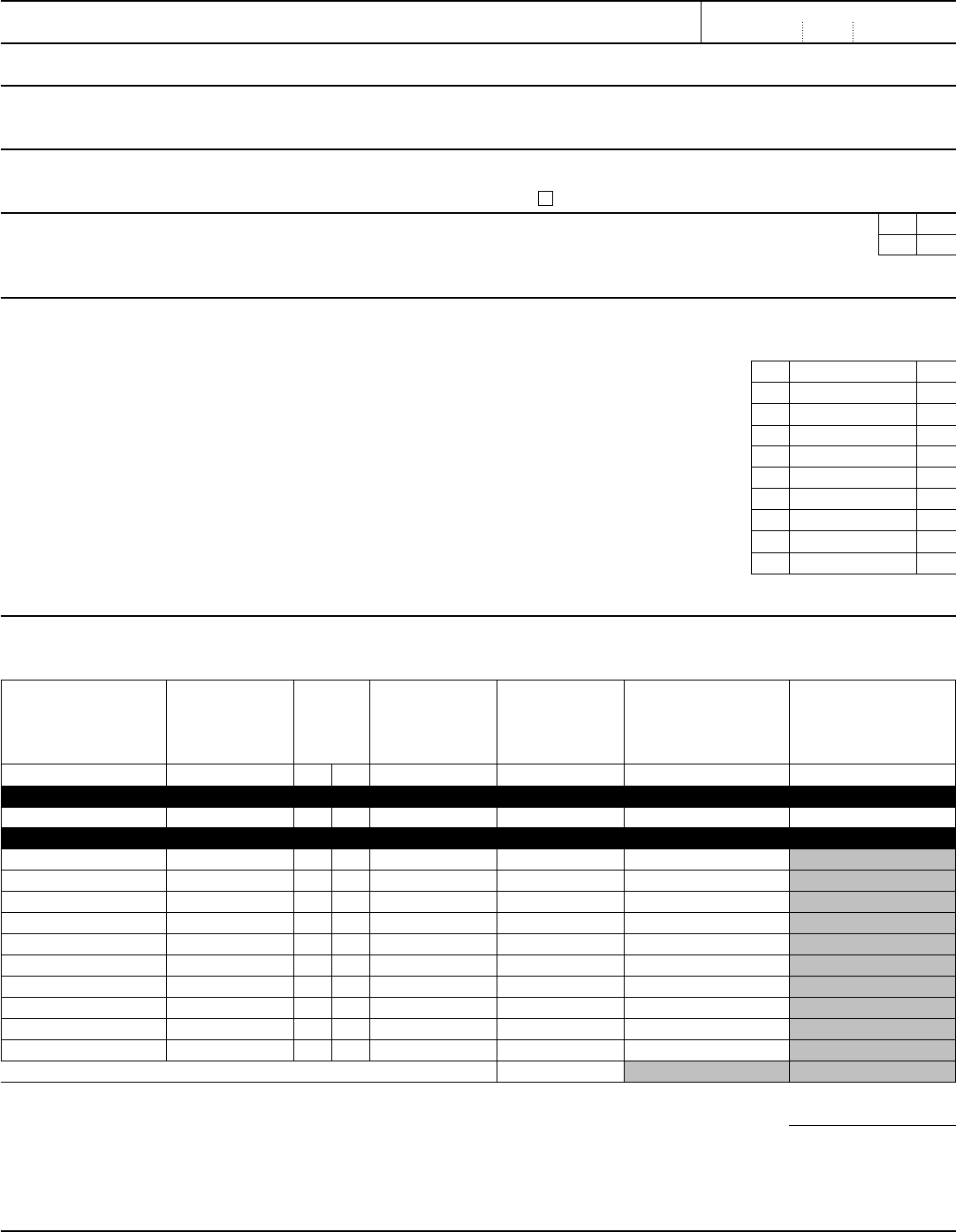

Form 706 Edit, Fill, Sign Online Handypdf

Information about form 706, united states estate (and generation. Tax form 706 is required for the decedent’s estate of u.s. If you are unable to file form 706 by the due date, you may receive. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizen or resident), increased by.

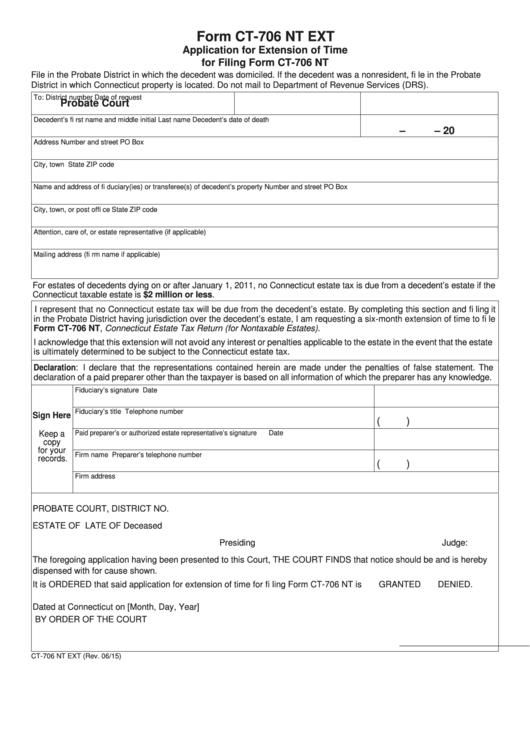

Form Ct706 Nt Ext Application For Extension Of Time For Filing Form

You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Form 706 must be filed by the executor of the estate of every u.s. Form 706 is used to.

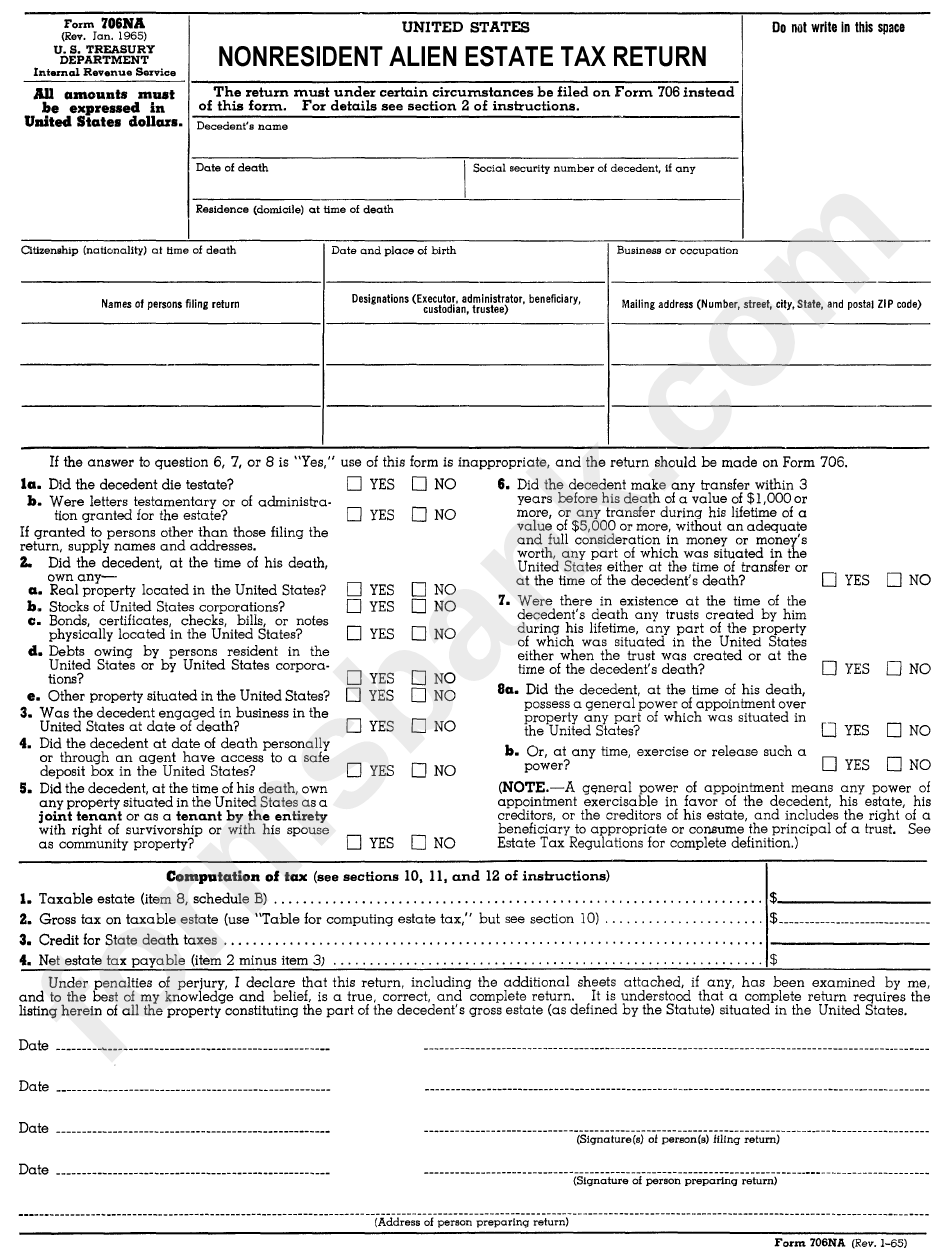

Form 706 Na (Rev. 011965) Nonresident Alien Estate Tax Return

Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Form 706 must be filed by the executor of the estate of every u.s. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. If you are unable to file form 706 by.

Fillable Online Form 706 Na Instructions Fax Email

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Tax form 706 is required for the decedent’s estate of u.s. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Whose executor elects to.

Plcb 706 Form ≡ Fill Out Printable PDF Forms Online

You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Tax form 706 is required for the decedent’s estate of u.s. Information about form 706, united states estate (and generation. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Form 706 is.

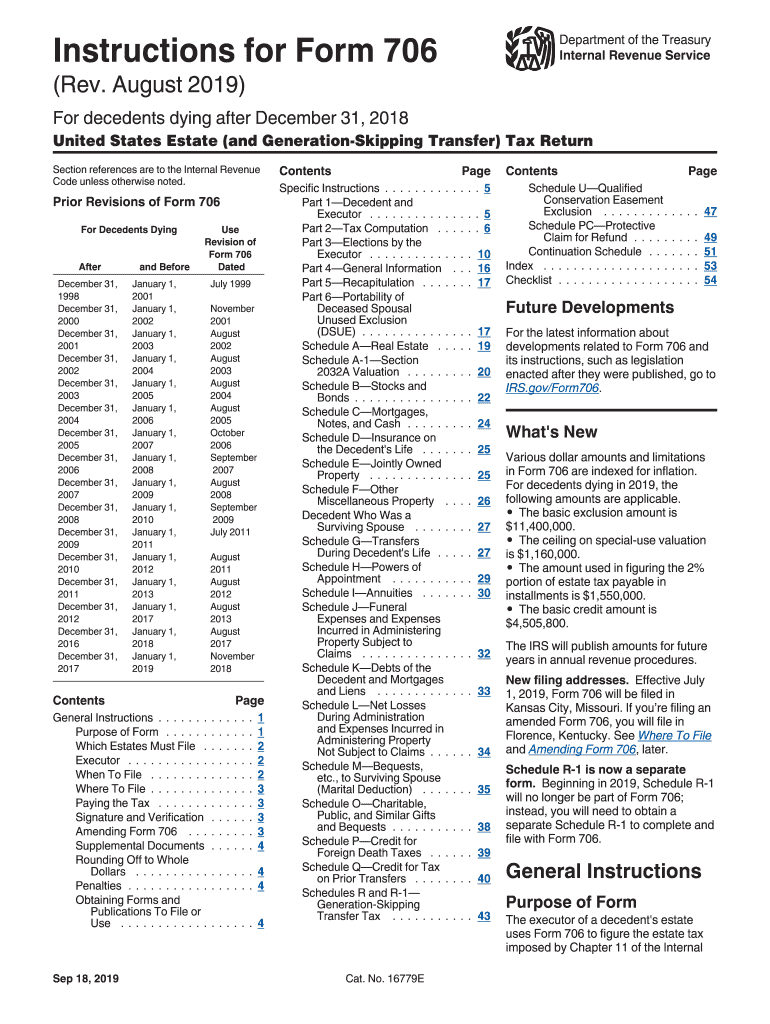

form 706 instructions 2020 Fill Online, Printable, Fillable Blank

You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Information about form 706, united states estate (and generation. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizens or residents whose gross estates, plus adjusted taxable gifts.

Instructions for How to Fill in IRS Form 706

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Information about form 706, united states estate (and generation. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Form 706 must be filed by the executor of the estate of every u.s. Tax.

Form 706 na Fill out & sign online DocHub

Tax form 706 is required for the decedent’s estate of u.s. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. If you are unable to file form 706 by the due date, you may receive. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax.

An Estate Tax Return (Form 706) Must Be Filed If The Gross Estate Of The Decedent (Who Is A U.s.

Form 706 must be filed by the executor of the estate of every u.s. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. If you are unable to file form 706 by the due date, you may receive.

Information About Form 706, United States Estate (And Generation.

Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue). Tax form 706 is required for the decedent’s estate of u.s. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is.