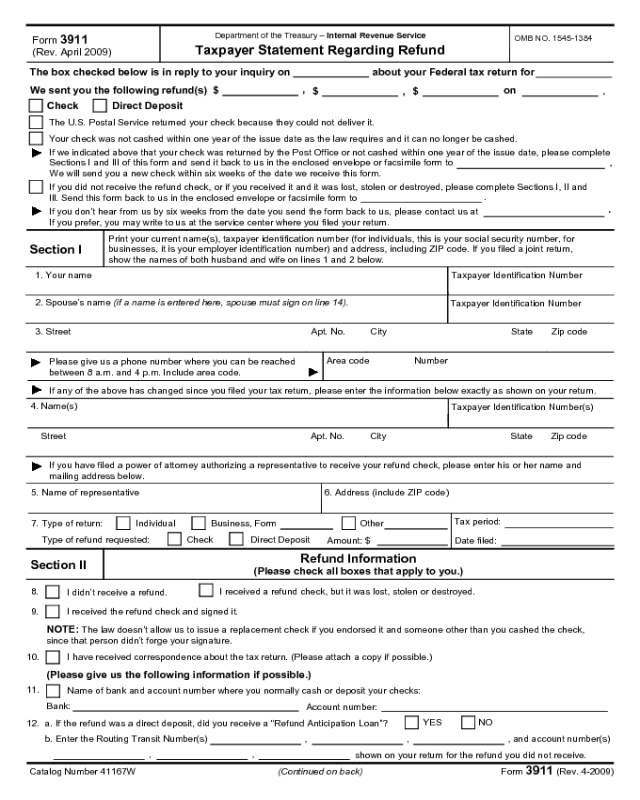

Form 3911 Instruction

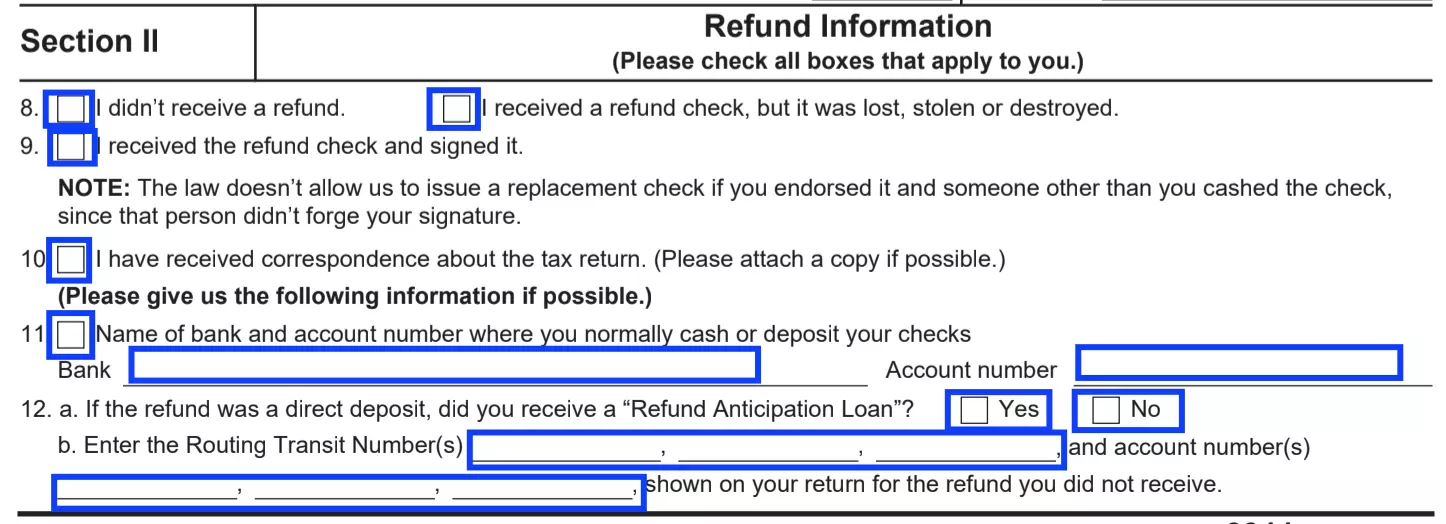

Form 3911 Instruction - It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund. Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. You can also file irs form 3911 to declare a lost refund check. In this article, we’ll cover what you need to know about irs form.

In this article, we’ll cover what you need to know about irs form. Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. You can also file irs form 3911 to declare a lost refund check. It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund.

Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund. You can also file irs form 3911 to declare a lost refund check. In this article, we’ll cover what you need to know about irs form.

Fill Free fillable Taxpayer Statement Regarding Refund (Spanish

You can also file irs form 3911 to declare a lost refund check. It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund. Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. In this article,.

IRS Form 3911 Instructions Replacing A Lost Tax Refund, 52 OFF

Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund. In this article, we’ll cover what you need to know about irs form. You can also.

FAQ Economic Impact Payments & Form 3911 [2021] US Expat Tax Service

It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund. In this article, we’ll cover what you need to know about irs form. Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. You can also.

Printable 3911 Tax Form Printable Forms Free Online

Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund. You can also file irs form 3911 to declare a lost refund check. In this article,.

IRS Form 3911 Download Fillable PDF or Fill Online Taxpayer Statement

It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund. You can also file irs form 3911 to declare a lost refund check. Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. In this article,.

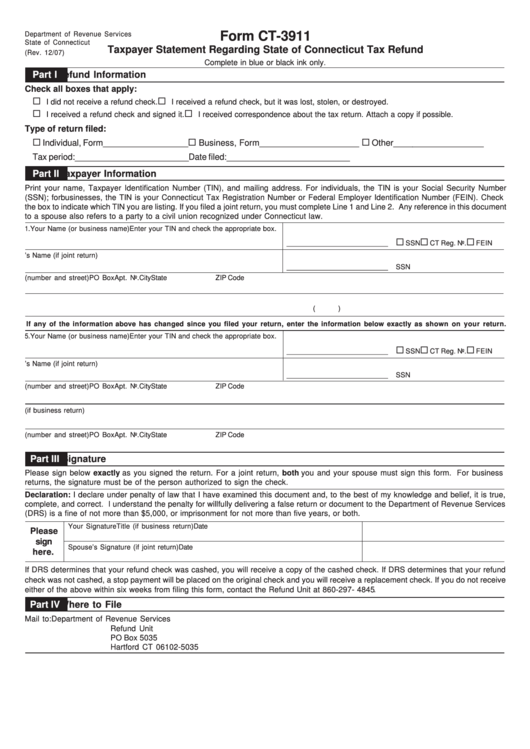

IRS Form 3911 Instructions Replacing A Lost Tax Refund Check

Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. You can also file irs form 3911 to declare a lost refund check. It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund. In this article,.

Fillable Online IRS Form 3911 Instructions Replacing A Lost Tax

Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. In this article, we’ll cover what you need to know about irs form. You can also file irs form 3911 to declare a lost refund check. It's a form that the irs sends to a taxpayer who.

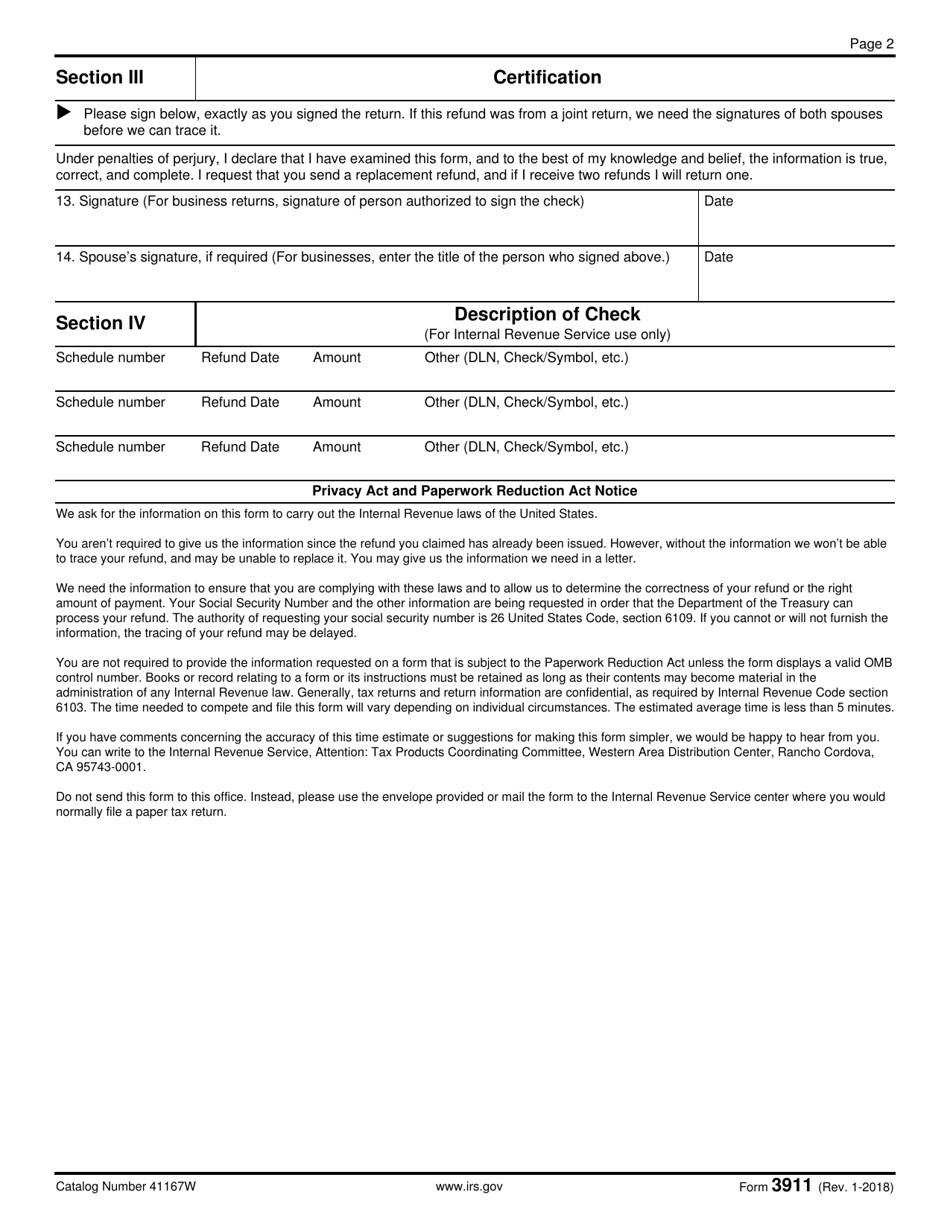

Form Ct3911 Taxpayer Statement Regarding State Of Connecticut Tax

Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. In this article, we’ll cover what you need to know about irs form. You can also file irs form 3911 to declare a lost refund check. It's a form that the irs sends to a taxpayer who.

IRS Form 3911 Instructions Replacing A Lost Tax Refund, 52 OFF

Download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the. You can also file irs form 3911 to declare a lost refund check. In this article, we’ll cover what you need to know about irs form. It's a form that the irs sends to a taxpayer who.

IRS Form 3911 Instructions Replacing A Lost Tax Refund, 52 OFF

In this article, we’ll cover what you need to know about irs form. It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund. You can also file irs form 3911 to declare a lost refund check. Download and complete the form 3911, taxpayer statement regarding refund pdf or the.

Download And Complete The Form 3911, Taxpayer Statement Regarding Refund Pdf Or The Irs Can Send You A Form 3911 To Get The.

You can also file irs form 3911 to declare a lost refund check. In this article, we’ll cover what you need to know about irs form. It's a form that the irs sends to a taxpayer who has contacted the irs because they haven't received their refund.

![FAQ Economic Impact Payments & Form 3911 [2021] US Expat Tax Service](https://tfxstorageimg.s3.amazonaws.com/tduchazek54xy5npzrh4ivterzqo)