Commodities Futures Trading

Commodities Futures Trading - Investors can speculate or hedge on the price direction of. There are two types of commodity prices you’ll need to understand before you begin: With the buying or selling of these. Spot prices and futures prices. Futures are contracts to buy or sell a specific underlying asset at a future date. Commodity trading is the exchange of different assets, typically futures contracts, that are based on the price of an underlying physical commodity. Futures trading is the buying and selling of a particular type of derivatives contract. The underlying asset can be a commodity, a security, or other financial instrument. These contracts entitle one you to buy or sell a particular asset, such as a stock or commodity, at. The price at which a commodity is selling right now.

With the buying or selling of these. These contracts entitle one you to buy or sell a particular asset, such as a stock or commodity, at. Futures trading is the buying and selling of a particular type of derivatives contract. There are two types of commodity prices you’ll need to understand before you begin: Commodity trading is the exchange of different assets, typically futures contracts, that are based on the price of an underlying physical commodity. Futures are contracts to buy or sell a specific underlying asset at a future date. Spot prices and futures prices. The underlying asset can be a commodity, a security, or other financial instrument. Investors can speculate or hedge on the price direction of. The price at which a commodity is selling right now.

Commodity trading is the exchange of different assets, typically futures contracts, that are based on the price of an underlying physical commodity. The price at which a commodity is selling right now. The underlying asset can be a commodity, a security, or other financial instrument. These contracts entitle one you to buy or sell a particular asset, such as a stock or commodity, at. Futures are contracts to buy or sell a specific underlying asset at a future date. Spot prices and futures prices. Futures trading is the buying and selling of a particular type of derivatives contract. With the buying or selling of these. There are two types of commodity prices you’ll need to understand before you begin: Investors can speculate or hedge on the price direction of.

Commodity Market Definition, Types, Example, and How It Works (2024)

There are two types of commodity prices you’ll need to understand before you begin: With the buying or selling of these. Futures trading is the buying and selling of a particular type of derivatives contract. Commodity trading is the exchange of different assets, typically futures contracts, that are based on the price of an underlying physical commodity. The price at.

Commodities ETF (GSG) Posts New LongTerm Trend Model BUY Signal

With the buying or selling of these. The price at which a commodity is selling right now. These contracts entitle one you to buy or sell a particular asset, such as a stock or commodity, at. Investors can speculate or hedge on the price direction of. Commodity trading is the exchange of different assets, typically futures contracts, that are based.

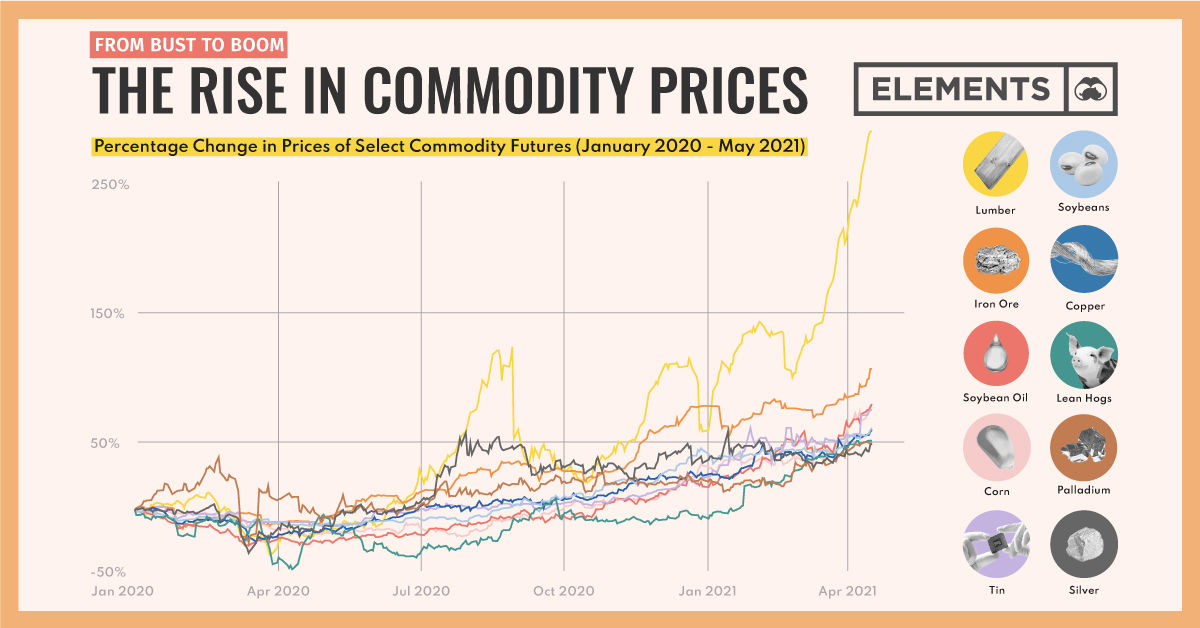

From Bust to Boom Visualizing the Rise in Commodity Prices

Investors can speculate or hedge on the price direction of. These contracts entitle one you to buy or sell a particular asset, such as a stock or commodity, at. The price at which a commodity is selling right now. There are two types of commodity prices you’ll need to understand before you begin: With the buying or selling of these.

Commodity Trading Best Practices How To Trade

With the buying or selling of these. The underlying asset can be a commodity, a security, or other financial instrument. Futures are contracts to buy or sell a specific underlying asset at a future date. These contracts entitle one you to buy or sell a particular asset, such as a stock or commodity, at. Commodity trading is the exchange of.

Commodity Futures And Importance Of Liquidity In Commodities, 5 Reasons

Futures are contracts to buy or sell a specific underlying asset at a future date. These contracts entitle one you to buy or sell a particular asset, such as a stock or commodity, at. The underlying asset can be a commodity, a security, or other financial instrument. Spot prices and futures prices. Investors can speculate or hedge on the price.

Intro to Commodities StreetFins®

The underlying asset can be a commodity, a security, or other financial instrument. Spot prices and futures prices. Futures are contracts to buy or sell a specific underlying asset at a future date. Futures trading is the buying and selling of a particular type of derivatives contract. The price at which a commodity is selling right now.

Futures Trading Strategies Explained With Free PDF

Commodity trading is the exchange of different assets, typically futures contracts, that are based on the price of an underlying physical commodity. With the buying or selling of these. These contracts entitle one you to buy or sell a particular asset, such as a stock or commodity, at. Futures are contracts to buy or sell a specific underlying asset at.

Futures Options Trading can provide an Effective Strategy for

With the buying or selling of these. These contracts entitle one you to buy or sell a particular asset, such as a stock or commodity, at. There are two types of commodity prices you’ll need to understand before you begin: Investors can speculate or hedge on the price direction of. Futures trading is the buying and selling of a particular.

Futures & Commodities Trading True Trading Group

The underlying asset can be a commodity, a security, or other financial instrument. With the buying or selling of these. Futures trading is the buying and selling of a particular type of derivatives contract. Investors can speculate or hedge on the price direction of. The price at which a commodity is selling right now.

What is Commodity Futures Trading Commission? Forex Glossary

Futures are contracts to buy or sell a specific underlying asset at a future date. These contracts entitle one you to buy or sell a particular asset, such as a stock or commodity, at. Investors can speculate or hedge on the price direction of. Futures trading is the buying and selling of a particular type of derivatives contract. There are.

There Are Two Types Of Commodity Prices You’ll Need To Understand Before You Begin:

Investors can speculate or hedge on the price direction of. The underlying asset can be a commodity, a security, or other financial instrument. With the buying or selling of these. The price at which a commodity is selling right now.

These Contracts Entitle One You To Buy Or Sell A Particular Asset, Such As A Stock Or Commodity, At.

Commodity trading is the exchange of different assets, typically futures contracts, that are based on the price of an underlying physical commodity. Futures are contracts to buy or sell a specific underlying asset at a future date. Futures trading is the buying and selling of a particular type of derivatives contract. Spot prices and futures prices.

:max_bytes(150000):strip_icc()/commodity-market-c13b0044c1da45dea230710a5c993bc6.jpg)