Calendar Tax Year

Calendar Tax Year - 31 and includes taxes owed on earnings during. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. Generally, taxpayers filing a version of form 1040 use the calendar year. You must pay the full year's tax on all vehicles you have in use during the month of july. The choice is made easy but its intuitiveness and tends to line up. The tax period begins on july 1 and ends the following june 30. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. In the u.s., the tax year for individuals runs from jan.

The choice is made easy but its intuitiveness and tends to line up. 31 and includes taxes owed on earnings during. The tax period begins on july 1 and ends the following june 30. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. You must pay the full year's tax on all vehicles you have in use during the month of july. In the u.s., the tax year for individuals runs from jan. Generally, taxpayers filing a version of form 1040 use the calendar year.

You must pay the full year's tax on all vehicles you have in use during the month of july. Generally, taxpayers filing a version of form 1040 use the calendar year. The tax period begins on july 1 and ends the following june 30. The choice is made easy but its intuitiveness and tends to line up. 31 and includes taxes owed on earnings during. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. In the u.s., the tax year for individuals runs from jan.

Today is the Deadline for filing 990 Series Returns! Need an Extension

The tax period begins on july 1 and ends the following june 30. The choice is made easy but its intuitiveness and tends to line up. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. Generally, taxpayers filing a version of form 1040 use the.

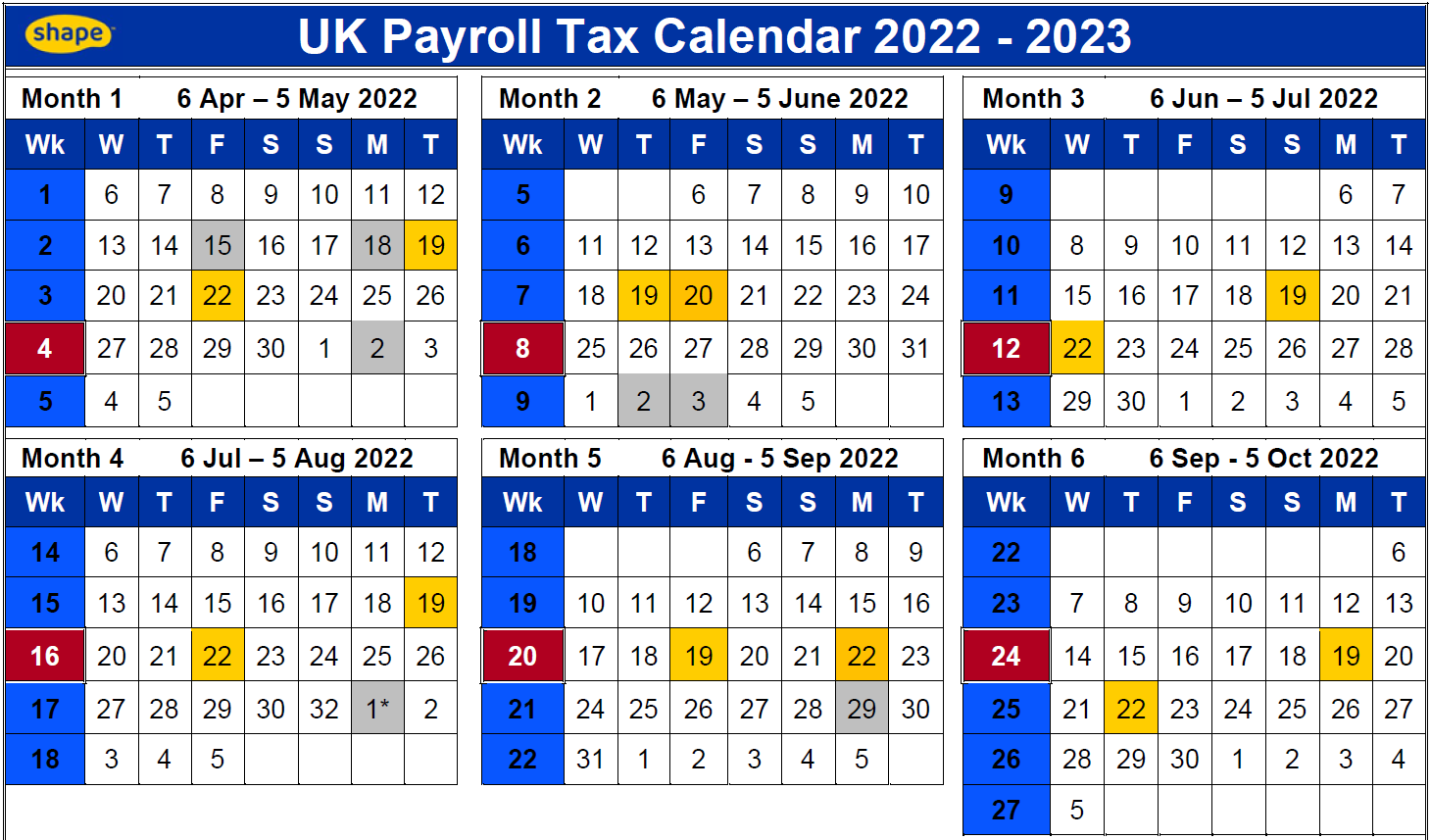

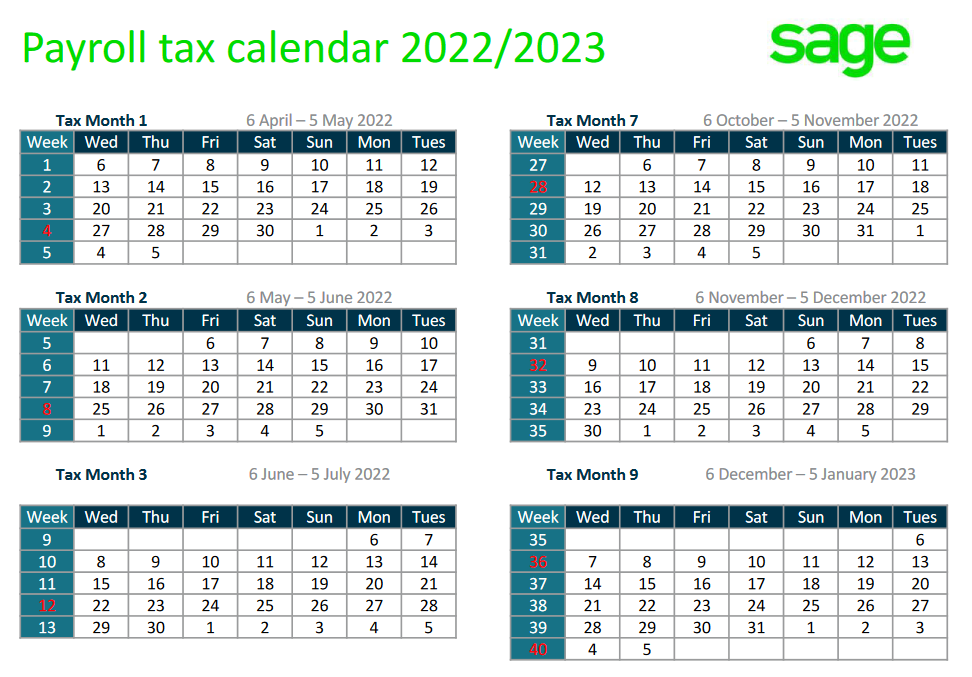

UK Payroll Tax Calendar 20222023 Shape Payroll

In the u.s., the tax year for individuals runs from jan. 31 and includes taxes owed on earnings during. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. You must pay the full year's tax on all vehicles you have in use during the month.

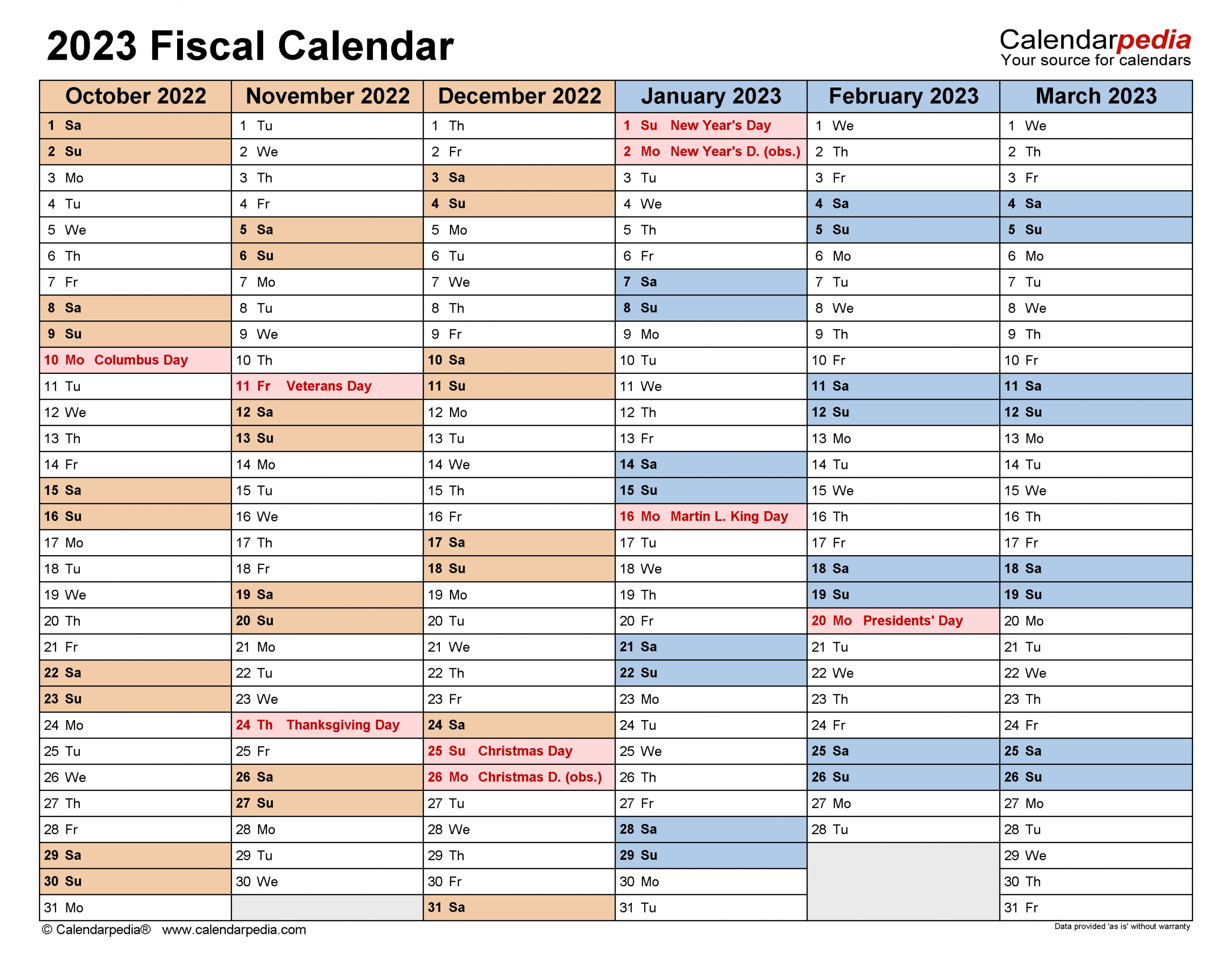

Tax Return 2023 Chart Printable Forms Free Online

An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. In the u.s., the tax year for individuals runs from jan. Generally, taxpayers.

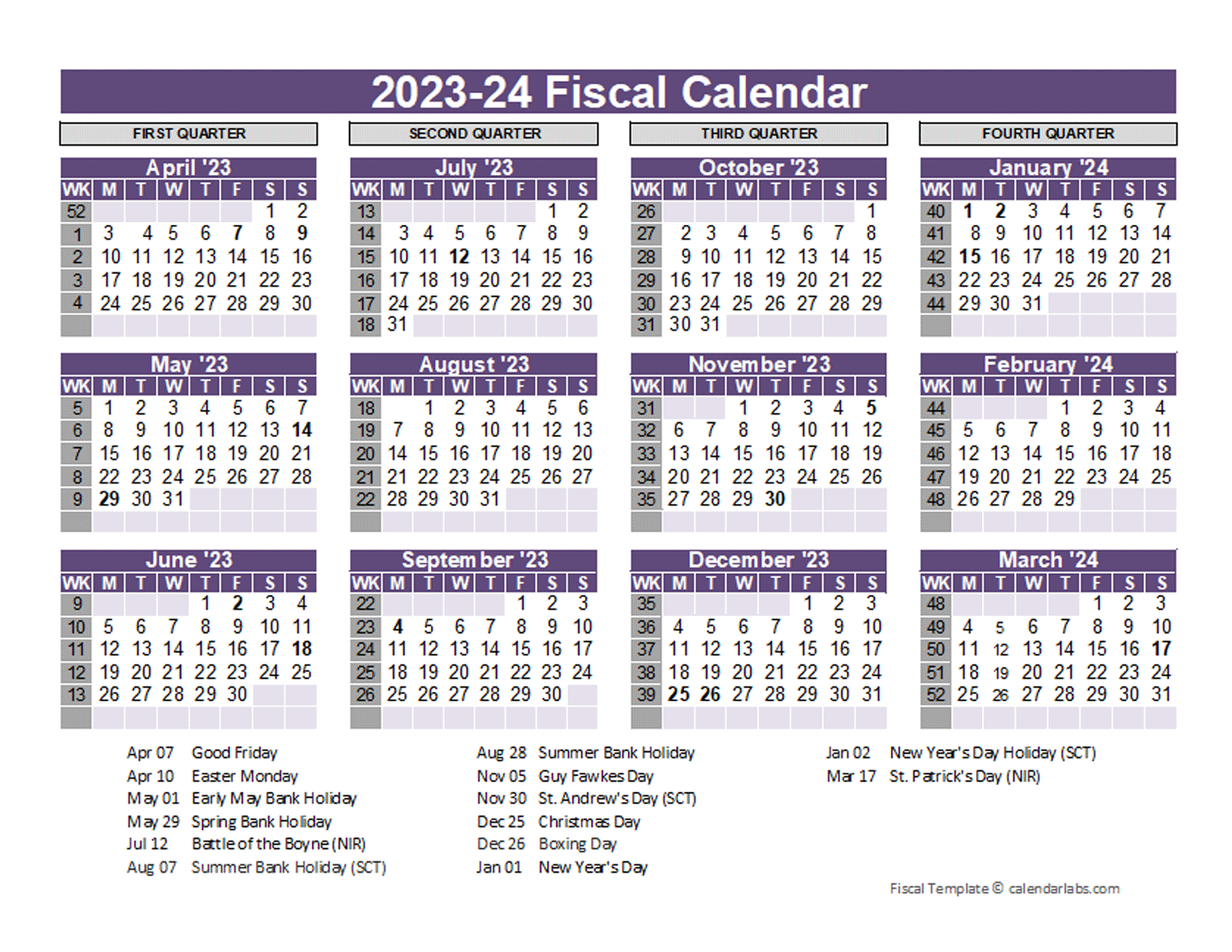

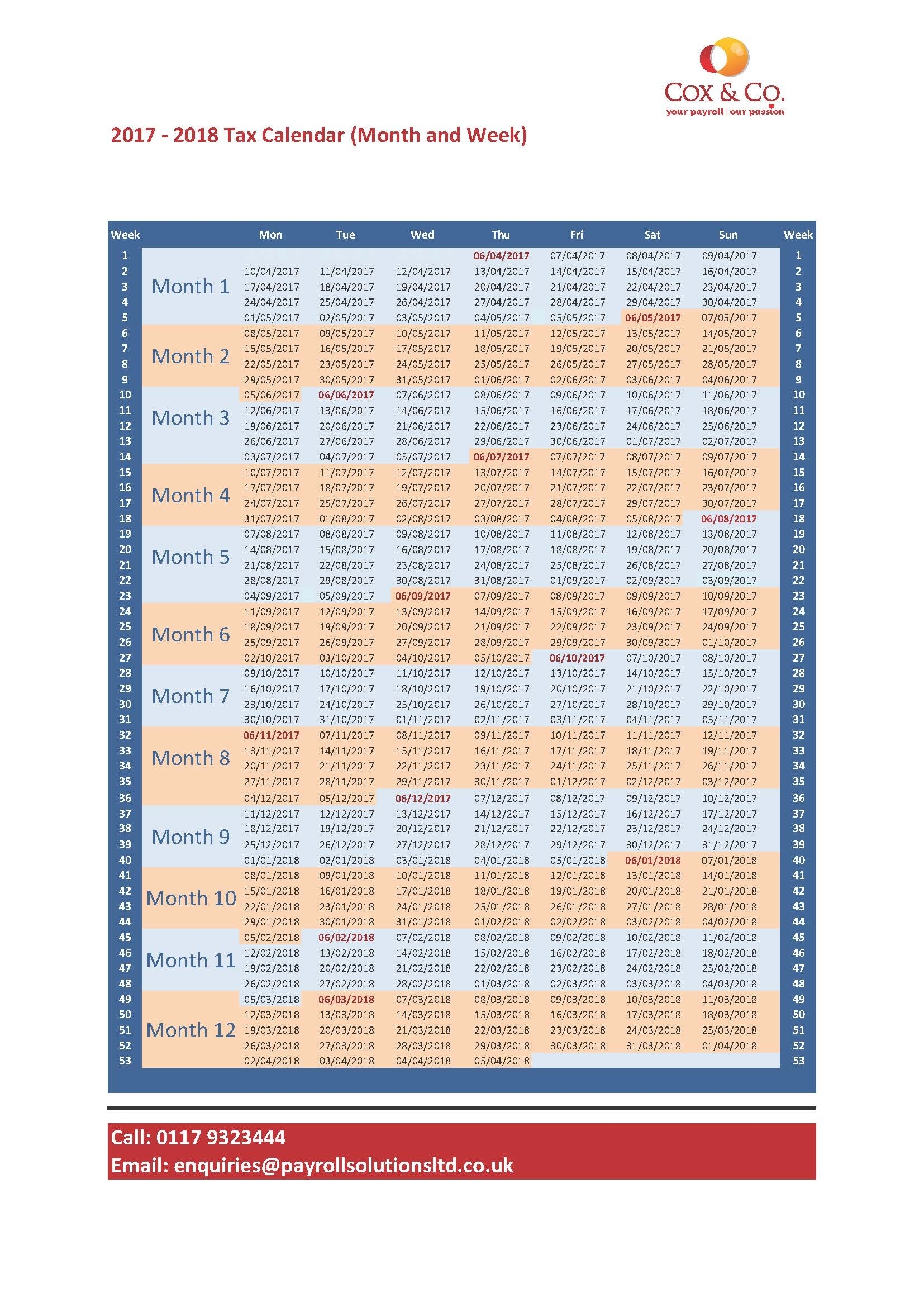

Tax Week Calendar 2024/24 Uk Printable 202425 Risa Raynell

In the u.s., the tax year for individuals runs from jan. The tax period begins on july 1 and ends the following june 30. The choice is made easy but its intuitiveness and tends to line up. You must pay the full year's tax on all vehicles you have in use during the month of july. An individual can adopt.

Choosing between a calendar tax year and a fiscal tax year Seiler

An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. The choice is made easy but its intuitiveness and tends to line up. 31 and includes taxes owed on earnings during. You must pay the full year's tax on all vehicles you have in use during the.

Comprehensive Tax Compliance Calendar for FY 202223 Covering Important

The tax period begins on july 1 and ends the following june 30. The choice is made easy but its intuitiveness and tends to line up. 31 and includes taxes owed on earnings during. In the u.s., the tax year for individuals runs from jan. It is common for organizations to use a calendar year, as opposed to a fiscal.

New Year Tax Planning Ideas McIntyreStuart

It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. 31 and includes taxes owed on earnings during. Generally, taxpayers filing a version.

Power Apps Guide Dates How to calculate UK tax weeks Power Apps

An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. 31 and includes taxes owed on earnings during. You must pay the full year's tax on all vehicles you have in use during the month of july. In the u.s., the tax year for individuals runs from.

Tax Calendar CM Advocates LLP

You must pay the full year's tax on all vehicles you have in use during the month of july. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. 31 and includes taxes owed on earnings during. It is common for organizations to use a calendar year,.

Take Hmrc Tax Year Calendar 2021 Best Calendar Example

The tax period begins on july 1 and ends the following june 30. You must pay the full year's tax on all vehicles you have in use during the month of july. 31 and includes taxes owed on earnings during. In the u.s., the tax year for individuals runs from jan. The choice is made easy but its intuitiveness and.

In The U.s., The Tax Year For Individuals Runs From Jan.

Generally, taxpayers filing a version of form 1040 use the calendar year. The choice is made easy but its intuitiveness and tends to line up. You must pay the full year's tax on all vehicles you have in use during the month of july. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted.

It Is Common For Organizations To Use A Calendar Year, As Opposed To A Fiscal Year, As The Tax Year Calendar For Their Company.

The tax period begins on july 1 and ends the following june 30. 31 and includes taxes owed on earnings during.