Ca Form 3514 Business Code

Ca Form 3514 Business Code - This form is used to claim the california eitc and other tax credits on your california tax return. It requires you to provide your personal and. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. California form 3514 want business code, etc. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if. How do we get rid of. Populated, but we don't have any of that and don't qualify for eic.

California form 3514 want business code, etc. This form is used to claim the california eitc and other tax credits on your california tax return. It requires you to provide your personal and. Populated, but we don't have any of that and don't qualify for eic. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if. How do we get rid of.

Populated, but we don't have any of that and don't qualify for eic. How do we get rid of. California form 3514 want business code, etc. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. This form is used to claim the california eitc and other tax credits on your california tax return. It requires you to provide your personal and. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if.

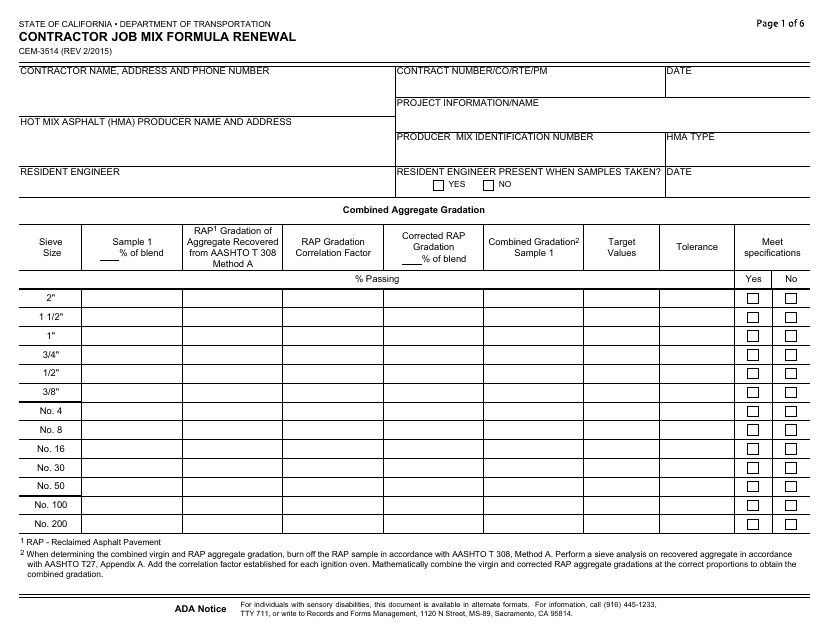

Form CEM3514 Download Fillable PDF or Fill Online Contractor Job Mix

California form 3514 want business code, etc. Populated, but we don't have any of that and don't qualify for eic. How do we get rid of. It requires you to provide your personal and. This form is used to claim the california eitc and other tax credits on your california tax return.

Announcing The Official Track For The Standard Chartered Hanoi Marathon

Populated, but we don't have any of that and don't qualify for eic. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. This form is used to claim the california eitc and other tax credits on your california tax return. California form 3514 want business code,.

2022 Personal Tax Booklet California Forms & Instructions 540

This form is used to claim the california eitc and other tax credits on your california tax return. California form 3514 want business code, etc. It requires you to provide your personal and. Populated, but we don't have any of that and don't qualify for eic. Use form ftb 3514 to determine whether you qualify to claim the eitc and.

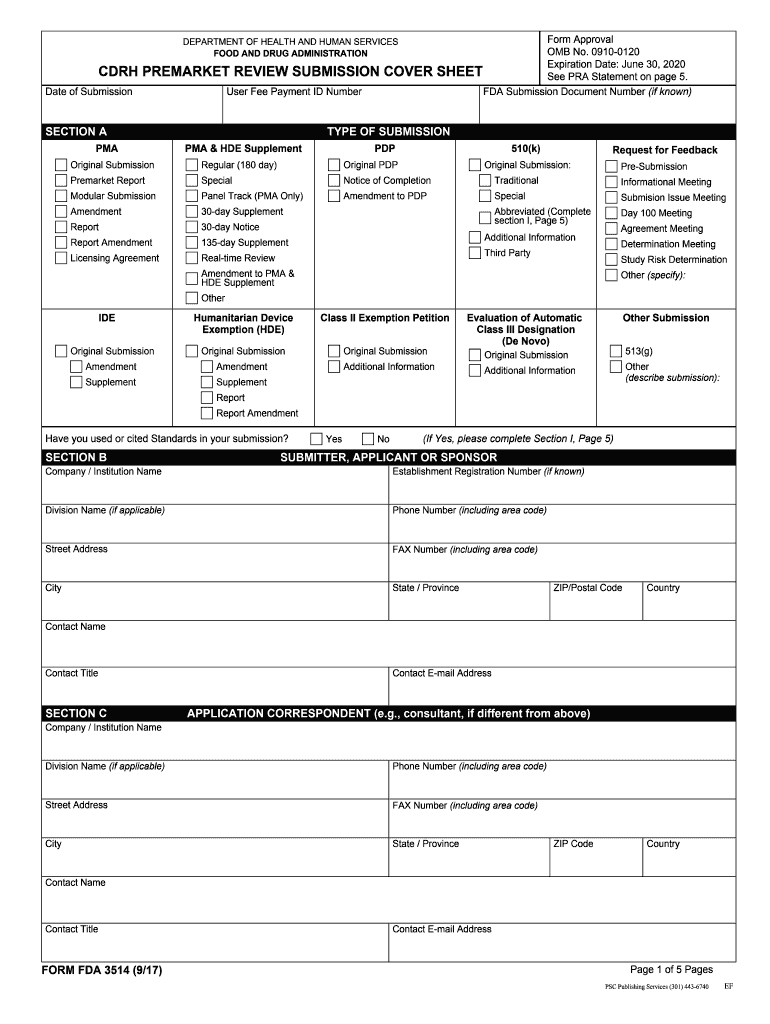

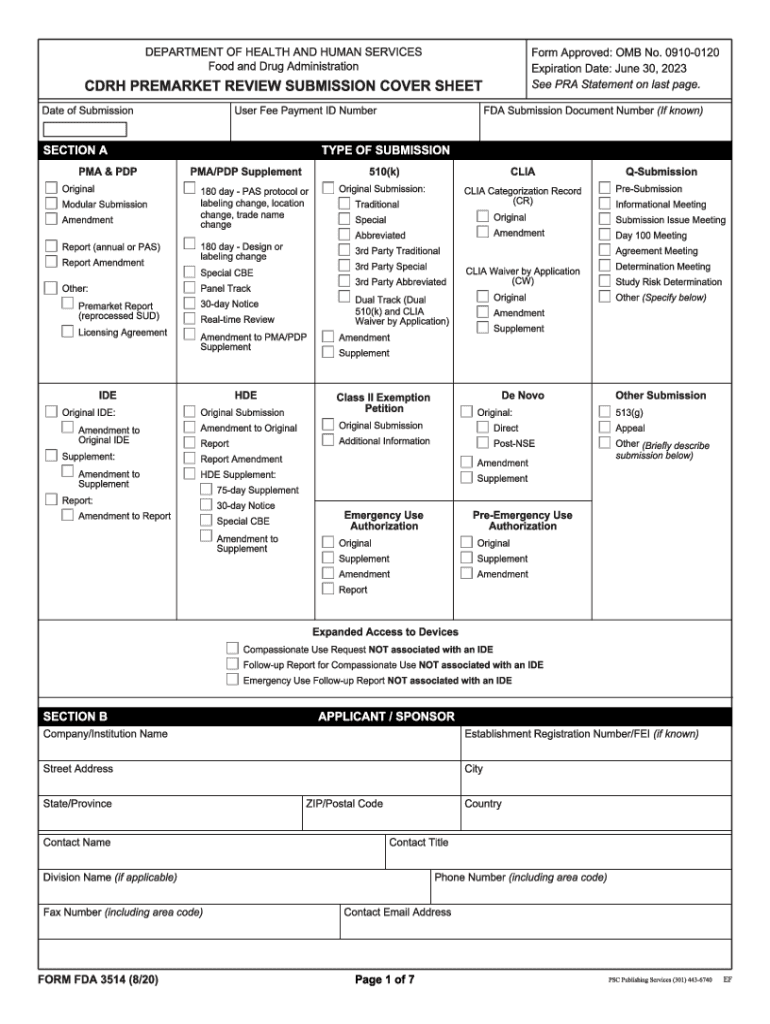

Fda form 3514 Fill out & sign online DocHub

California form 3514 want business code, etc. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. It requires you to provide your personal and. Populated, but we don't have any of that and don't qualify for eic. How do we get rid of.

What is Schedule B on a 990?

It requires you to provide your personal and. How do we get rid of. Populated, but we don't have any of that and don't qualify for eic. This form is used to claim the california eitc and other tax credits on your california tax return. California form 3514 want business code, etc.

Free earned credit eic worksheet, Download Free earned

Populated, but we don't have any of that and don't qualify for eic. This form is used to claim the california eitc and other tax credits on your california tax return. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. Use form ftb 3514 to determine.

FDA 3514 20202022 Fill and Sign Printable Template Online US Legal

Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. It requires you to provide your personal and. This form is used to claim the california eitc and other tax credits on your california tax return. California form 3514 want business code, etc. Use form ftb 3514.

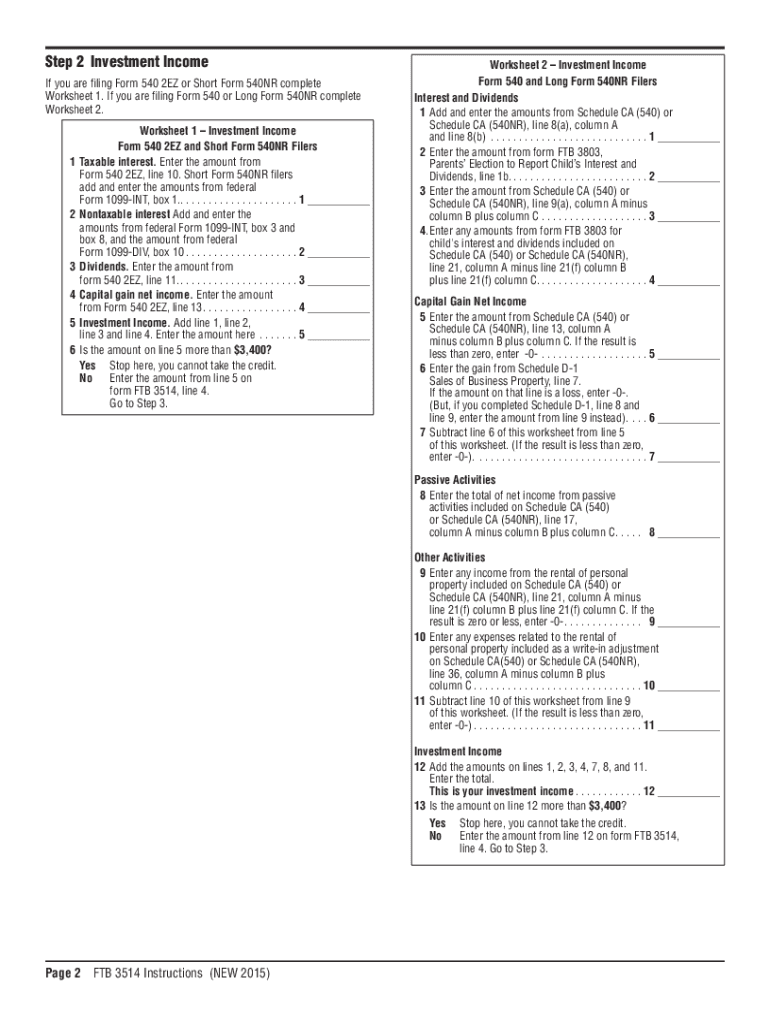

Ftb3514 20152024 Form Fill Out and Sign Printable PDF Template

It requires you to provide your personal and. How do we get rid of. Populated, but we don't have any of that and don't qualify for eic. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. California form 3514 want business code, etc.

20212024 Form CA FTB 3514 Instructions Fill Online, Printable

This form is used to claim the california eitc and other tax credits on your california tax return. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. How do we get rid of. Populated, but we don't have any of that and don't qualify for eic..

WIWU Alpha AntiTheft Clutch Bag Black Buy Online at Best Price in

Populated, but we don't have any of that and don't qualify for eic. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if. California form 3514 want business code, etc. How do we get rid of. Use form ftb 3514 to determine whether you qualify to claim.

It Requires You To Provide Your Personal And.

California form 3514 want business code, etc. Populated, but we don't have any of that and don't qualify for eic. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. How do we get rid of.

Use Form Ftb 3514 To Determine Whether You Qualify To Claim The Eitc, Yctc, And Fytc, Provide Information About Your Qualifying Children, If.

This form is used to claim the california eitc and other tax credits on your california tax return.