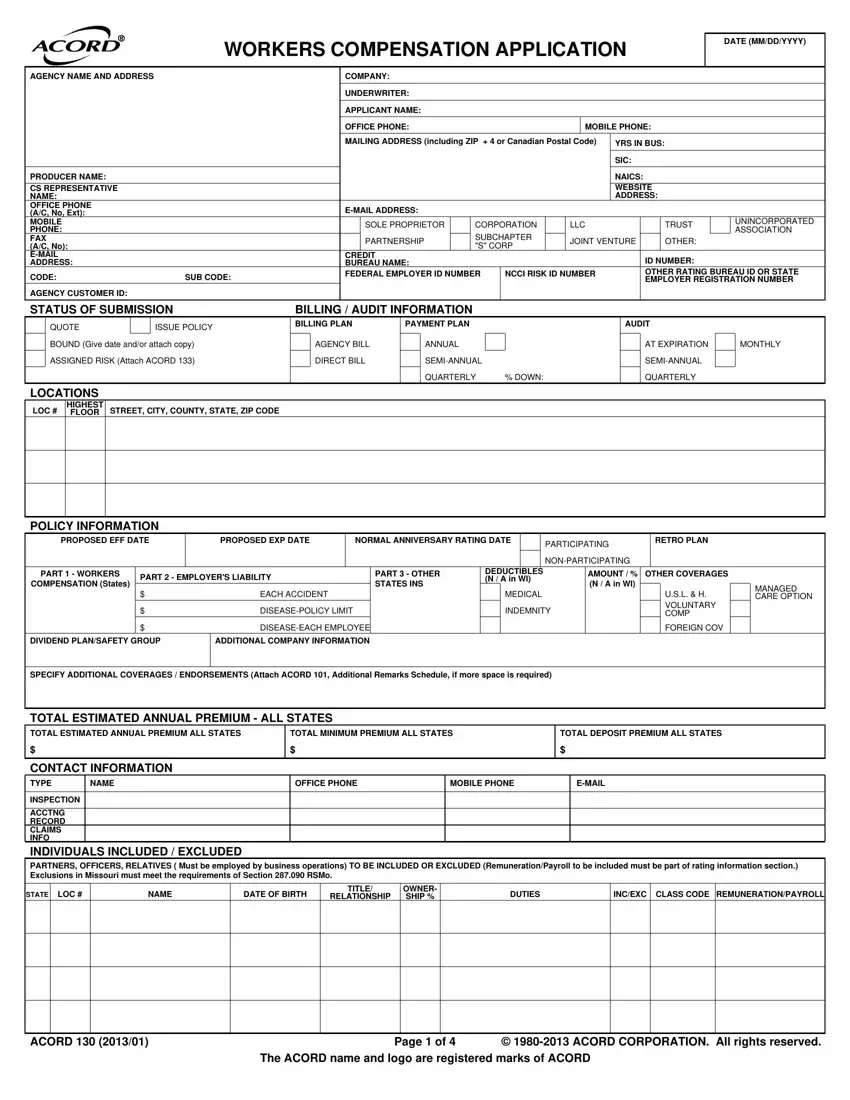

Acord 1035 Exchange Form

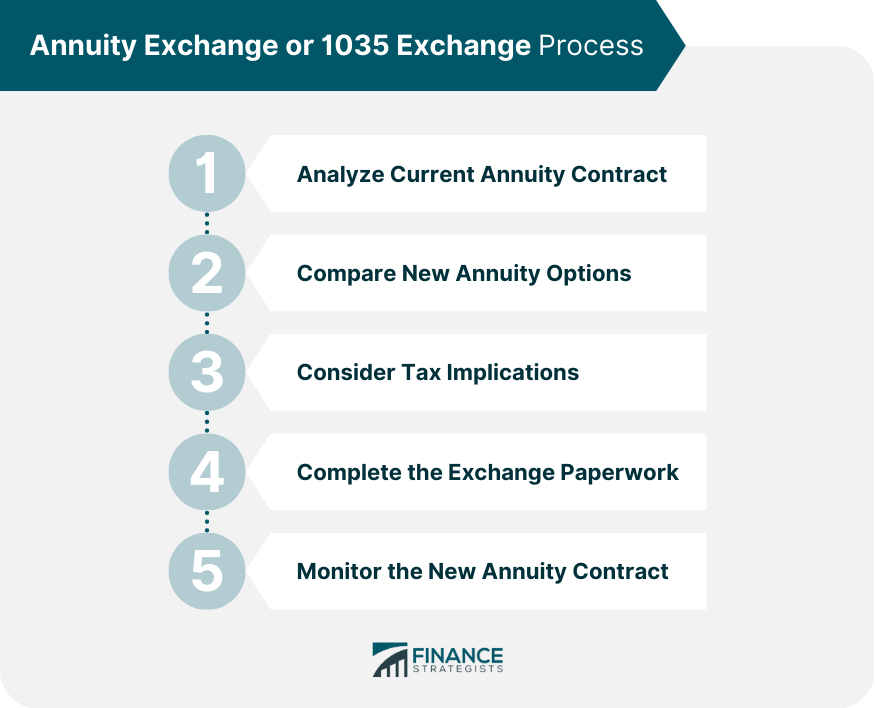

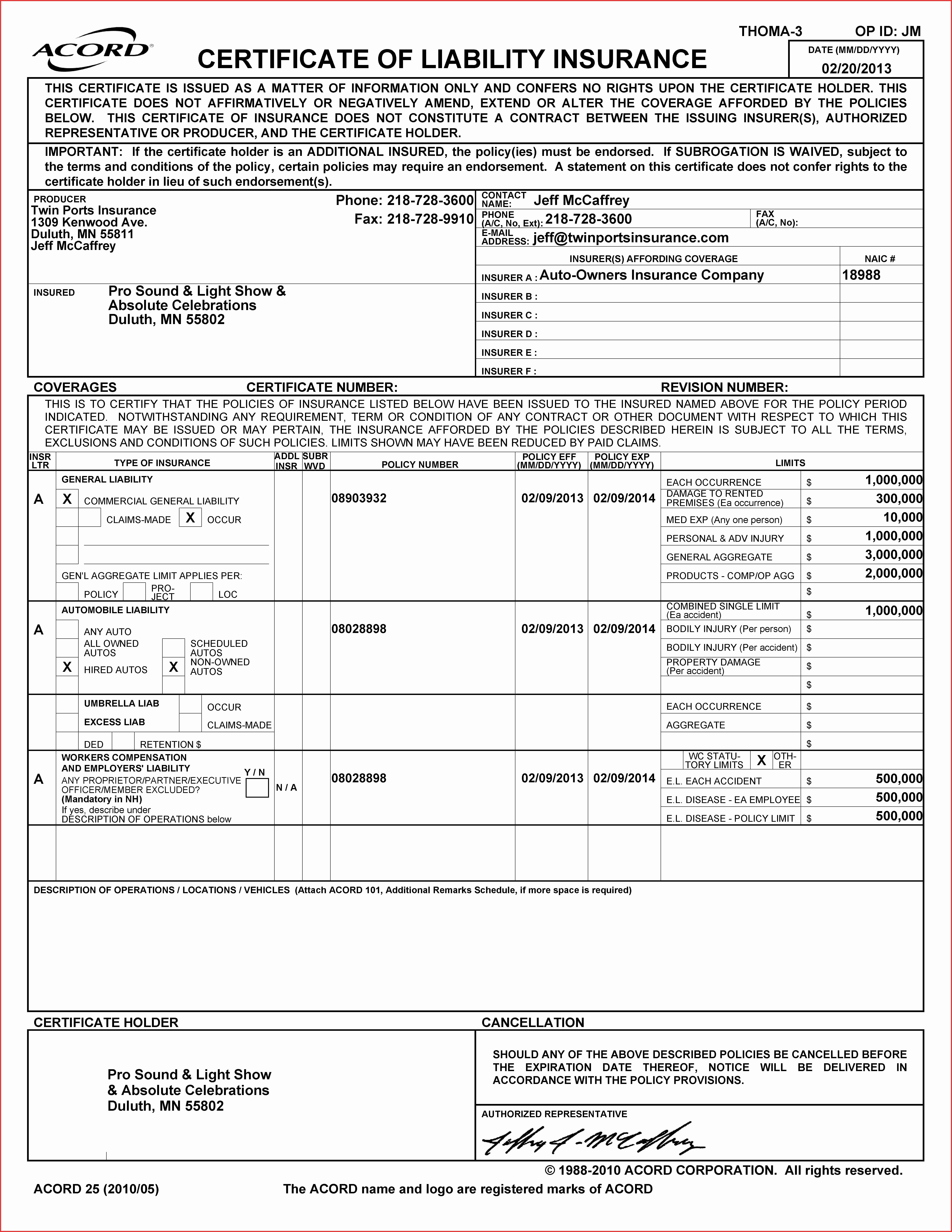

Acord 1035 Exchange Form - This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial. Acord has two forms for 1035 exchange/rollover/transfers: To help you with completing the form, we’ve put together the following guidelines. Acord 951 and acord 951e. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. Use this form to automatically transfer account values to maintain a specific percentage allocation among your current and future. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. A full or a partial exchange of.

This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial. Acord 951 and acord 951e. Acord has two forms for 1035 exchange/rollover/transfers: Use this form to automatically transfer account values to maintain a specific percentage allocation among your current and future. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. A full or a partial exchange of. To help you with completing the form, we’ve put together the following guidelines.

Acord 951 and acord 951e. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. Use this form to automatically transfer account values to maintain a specific percentage allocation among your current and future. A full or a partial exchange of. Acord has two forms for 1035 exchange/rollover/transfers: This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial. To help you with completing the form, we’ve put together the following guidelines.

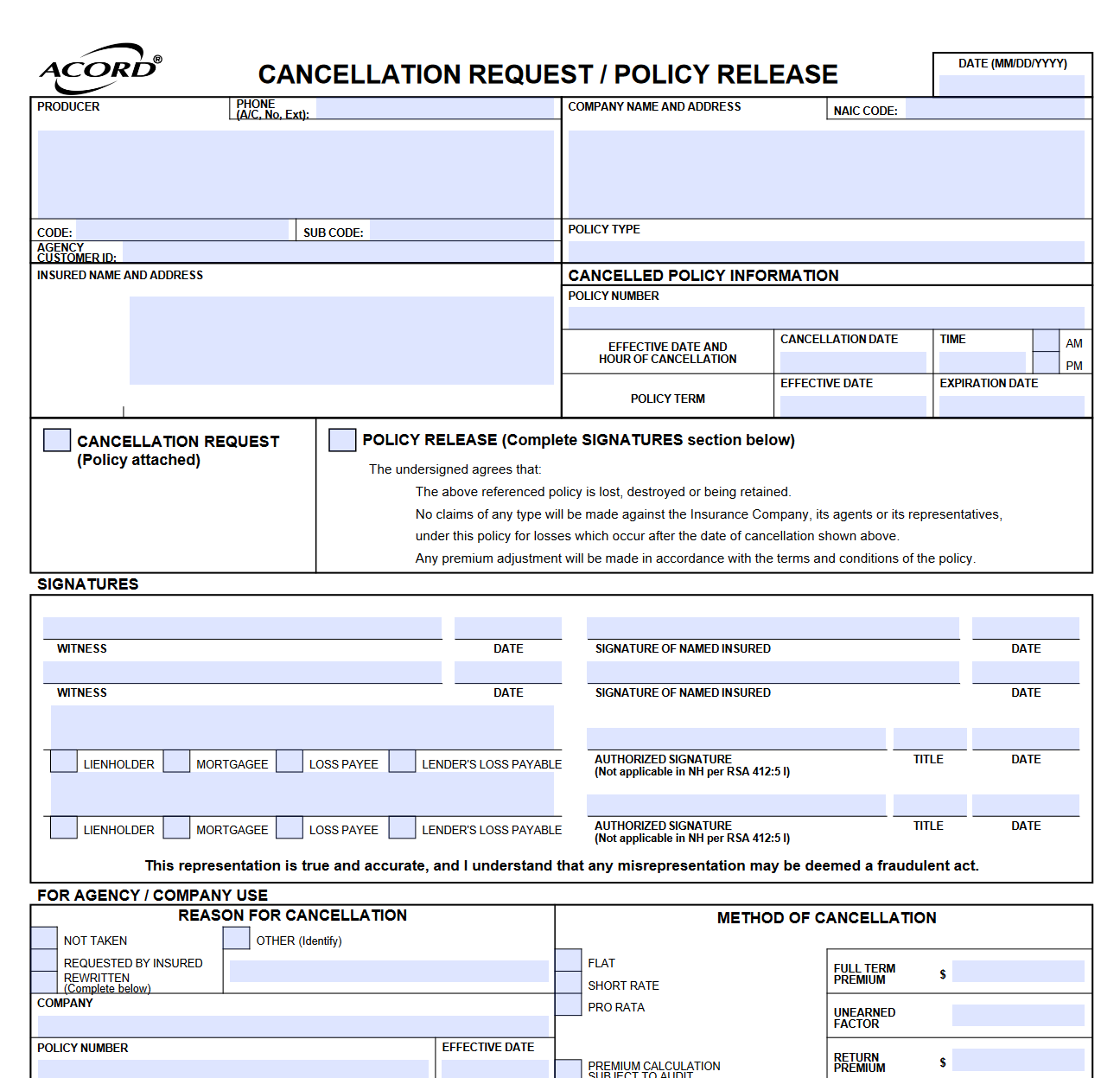

Accord Cancellation Form Fillable Printable Forms Free Online

This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. To help you with completing the form, we’ve put together the following guidelines. Use this form to automatically transfer account values to maintain a specific percentage allocation among your current and future. This form can be used.

Fillable Online Annuity 1035 Exchange and Transfer/Rollover Form Fax

To help you with completing the form, we’ve put together the following guidelines. Use this form to automatically transfer account values to maintain a specific percentage allocation among your current and future. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used.

Form 35 1 Fillable Printable Forms Free Online

This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. Use this form to automatically transfer account values to maintain a specific percentage allocation.

Form 1035 Exchange ≡ Fill Out Printable PDF Forms Online

This form can be used to accomplish a full or a partial. Acord 951 and acord 951e. Acord has two forms for 1035 exchange/rollover/transfers: To help you with completing the form, we’ve put together the following guidelines. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035.

When should you use a 1035 exchange with life insurance? YouTube

A full or a partial exchange of. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial. To help you with completing the form, we’ve put together the following guidelines. Acord 951 and acord 951e.

1035 Exchange For Annuities [Top 10 Pros and Cons] I&E Whole Life

Acord has two forms for 1035 exchange/rollover/transfers: This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. Acord 951 and acord 951e. This form.

Fillable Online NMAA Request for 1035 Exchange Form Fax Email Print

Acord has two forms for 1035 exchange/rollover/transfers: To help you with completing the form, we’ve put together the following guidelines. Use this form to automatically transfer account values to maintain a specific percentage allocation among your current and future. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc).

Acord 130 Fillable ≡ Fill Out Printable PDF Forms Online

A full or a partial exchange of. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal.

Fillable Online 1035 EXCHANGE / ROLLOVER / TRANSFER FORM Pages 1 4

To help you with completing the form, we’ve put together the following guidelines. Use this form to automatically transfer account values to maintain a specific percentage allocation among your current and future. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used.

Annuity Exchange (1035 Exchange) Options Meaning & Types

This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. To help you with completing the form, we’ve put together the following guidelines. This.

A Full Or A Partial Exchange Of.

Acord 951 and acord 951e. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial. Use this form to automatically transfer account values to maintain a specific percentage allocation among your current and future.

Acord Has Two Forms For 1035 Exchange/Rollover/Transfers:

To help you with completing the form, we’ve put together the following guidelines. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035. This form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section 1035.

![1035 Exchange For Annuities [Top 10 Pros and Cons] I&E Whole Life](https://www.insuranceandestates.com/wp-content/uploads/1035-Exchange-e1540997685940.jpg)