A Firm Should Accept Independent Projects If

A Firm Should Accept Independent Projects If - the npv (net present value) is >0.c. When the firm is considering. A firm should accept independent projects if?a. When the firm is considering. When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project. The npv is greater than the discounted payback. Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. The profitability index is greater than 1.0. When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport.

Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. The profitability index is greater than 1.0. When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. When the firm is considering. the npv (net present value) is >0.c. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the. A firm should accept independent projects if?a. The npv is greater than the discounted payback. The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project.

When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the. The profitability index is greater than 1.0. When the firm is considering. Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. When the firm is considering. The firm should accept independent projects if: When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project. The npv is greater than the discounted payback. the pi (profitability index) is <1.b.

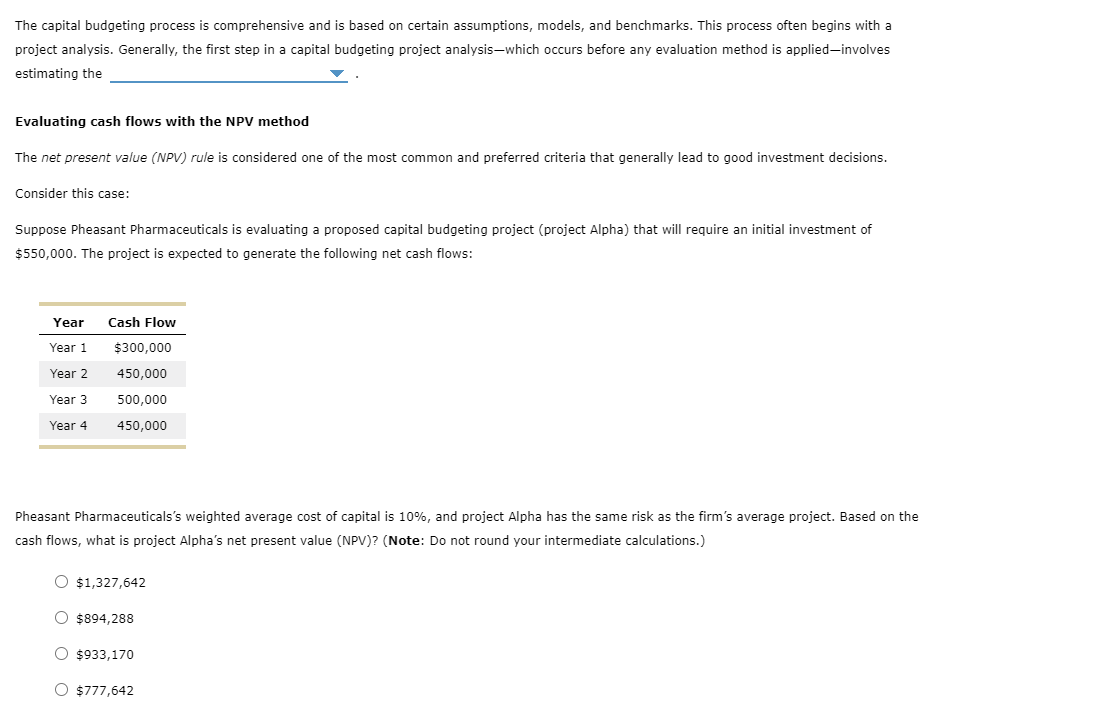

Solved A.) B.) Making the accept or reject decision Pheasant

The npv is greater than the discounted payback. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the. A firm should accept independent projects if?a. The firm should accept independent projects if: When the firm is considering.

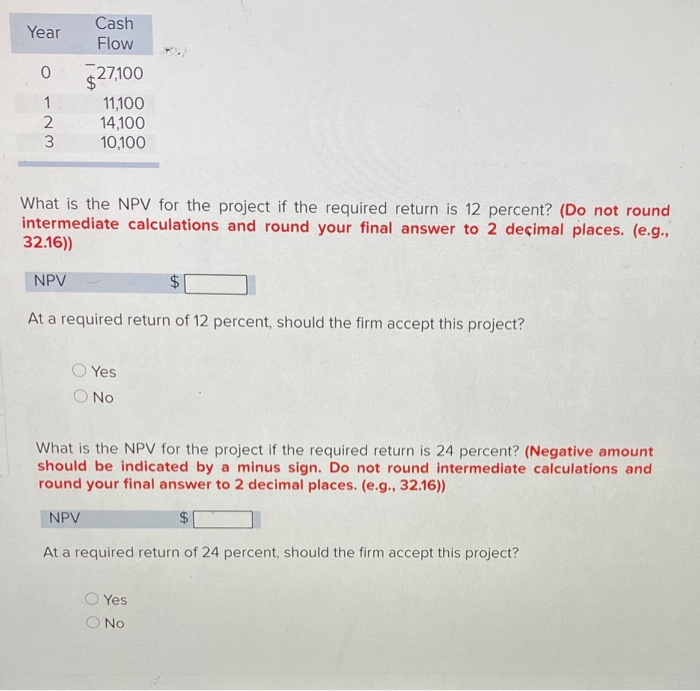

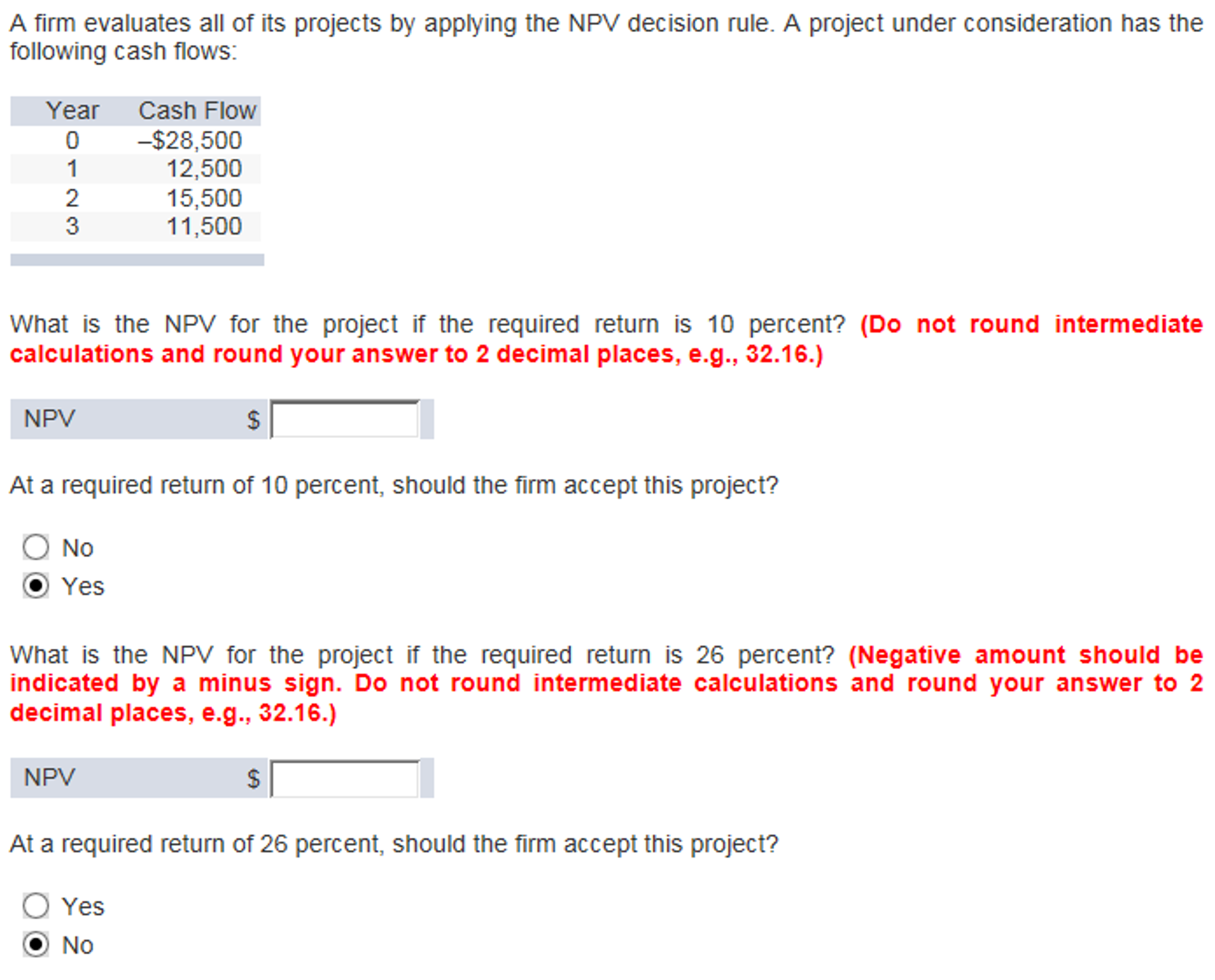

Solved A firm evaluates all of its projects by applying the

The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. the npv (net present value) is >0.c. When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project. When the firm is considering. When the firm is considering independent projects,.

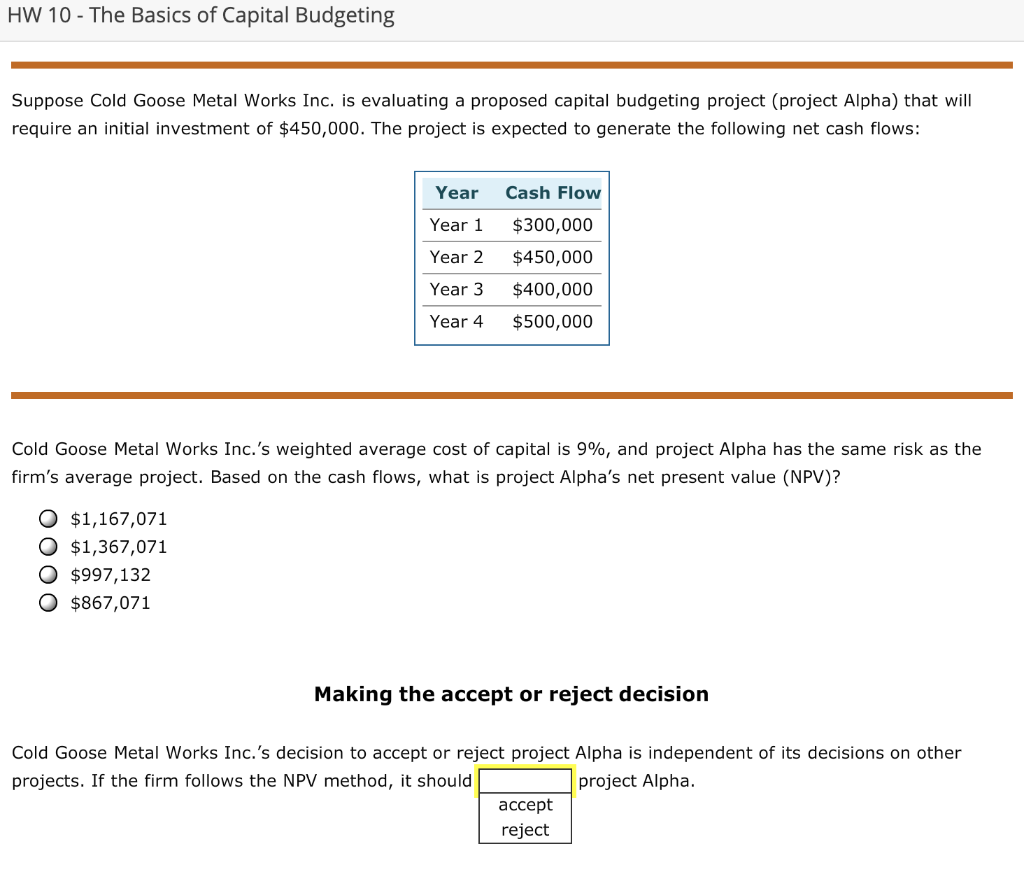

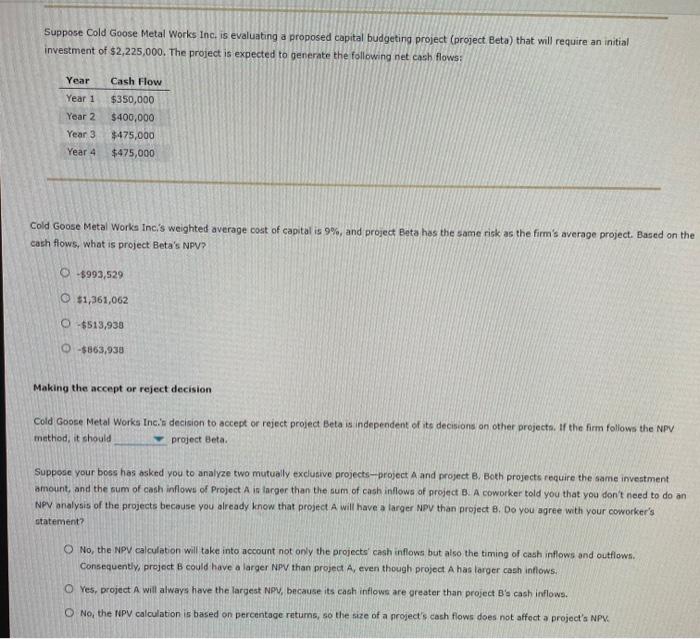

Solved HW 10 The Basics of Capital Budgeting Suppose Cold

When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project. the pi (profitability index) is <1.b. When the firm is considering. the npv (net present value) is >0.c.

Solved A firm evaluates all of its projects by applying the

When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project. the pi (profitability index) is <1.b. A firm should accept independent projects if?a. When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. A firm should accept independent projects if the profitability index (pi).

Solved Suppose Cold Goose Metal Works Inc. is evaluating a

When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. the npv (net present value) is >0.c. The npv is greater than the discounted payback. The firm should accept independent projects.

PAE IAM EN EL Adulto Mayor CENTRO DE ESTUDIOS UNIVERSITARIOS GRUPO

the npv (net present value) is >0.c. The npv is greater than the discounted payback. When the firm is considering. Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. A firm should accept independent projects if the profitability index (pi) is greater than 1 or.

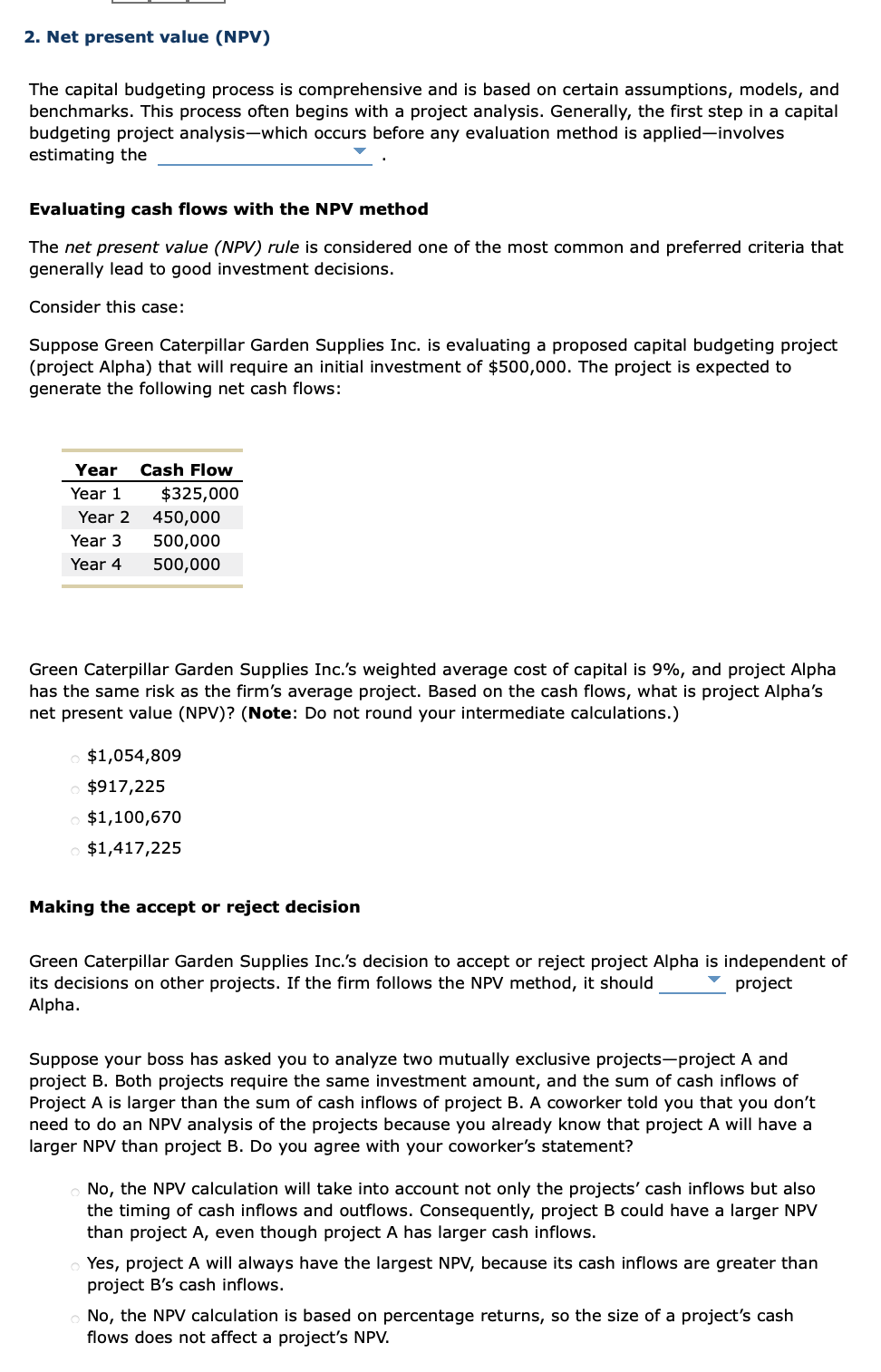

Solved 2. Net present value (NPV) The capital budgeting

A firm should accept independent projects if?a. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the. When the firm is considering. The npv is greater than the discounted payback. The firm should accept independent projects if:

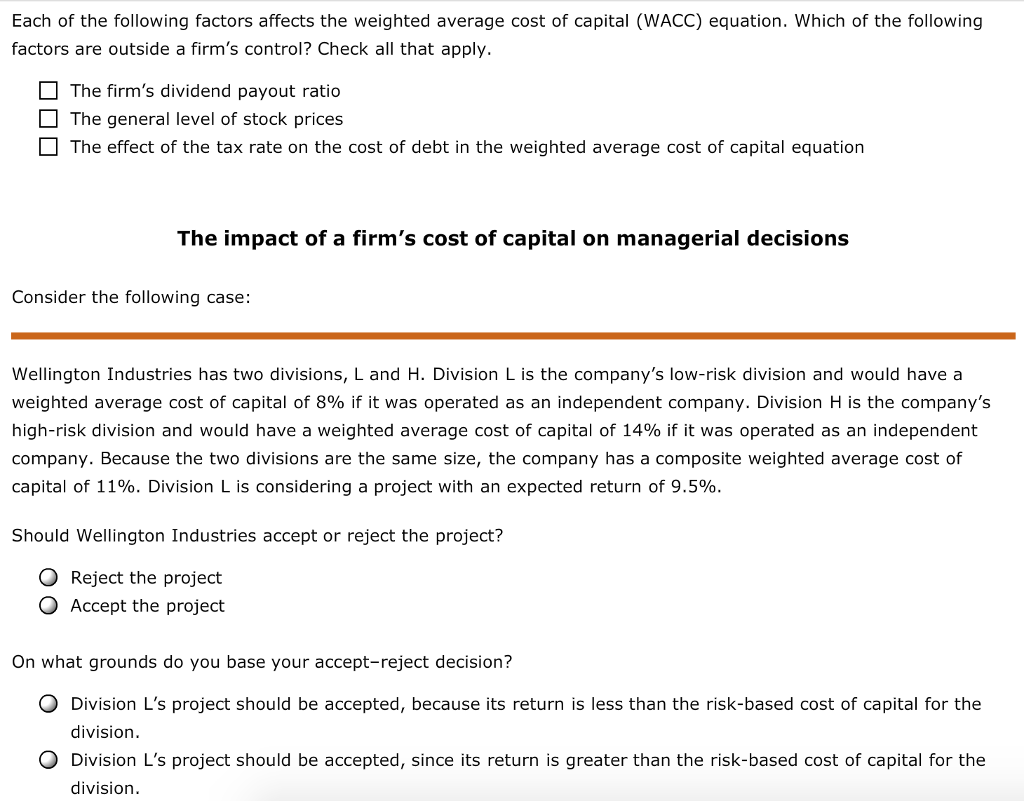

Solved Each of the following factors affects the weighted

Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. the pi (profitability index) is <1.b. The profitability index is greater than 1.0. When the firm is considering. A firm should accept independent projects if?a.

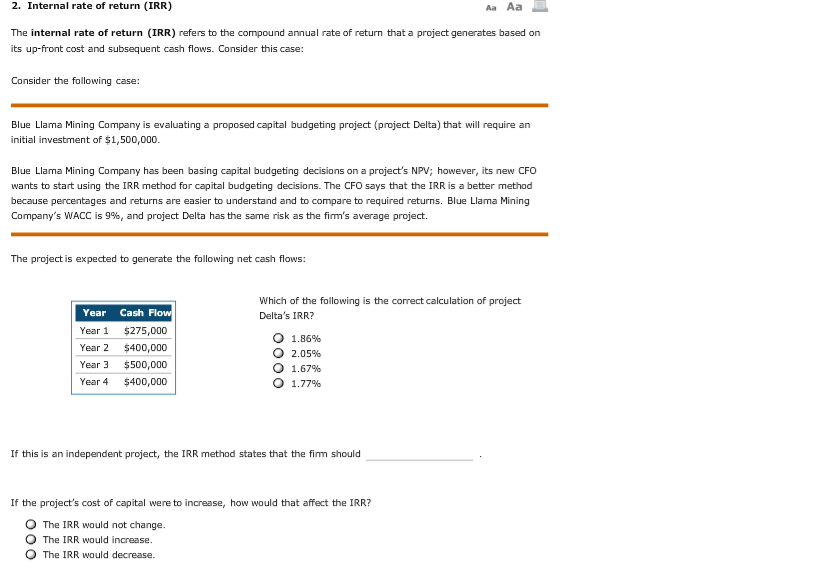

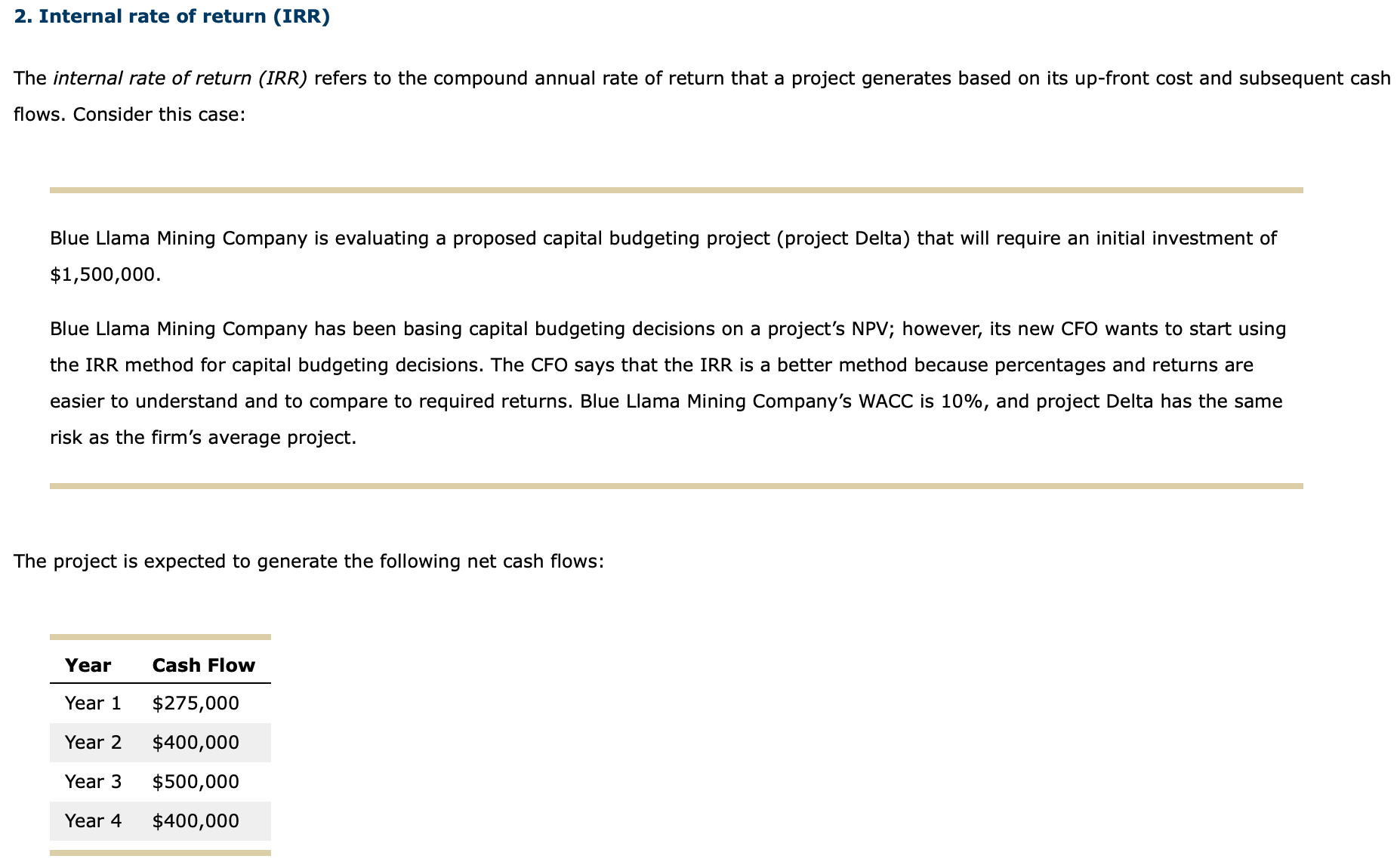

Solved 2. Internal rate of return (IRR) The internal rate of

When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project. The profitability index is greater than 1.0. A firm should accept independent projects if?a. Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. the pi (profitability.

Solved The internal rate of return (IRR) refers to the

Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. A firm should accept independent projects if?a. The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. the npv (net present value) is >0.c..

The Second Project Is To Build A Parking Garage On A Piece Of Land That The Firm Owns Adjacent To The Airport.

When the firm is considering. The firm should accept independent projects if: When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the.

A Firm Should Accept Independent Projects If?A.

When the firm is considering. the pi (profitability index) is <1.b. When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. The npv is greater than the discounted payback.

The Profitability Index Is Greater Than 1.0.

the npv (net present value) is >0.c. Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer.